Small Business Taxes Kenya

The tax payment is due every month before or on 20th. 8 hours agoThe Risk Posed to Small Business By coming under the purview of these new tax rules local enterprises especially SMEs face additional hurdles and costs of doing business.

Small Business Tax Write Off Checklist Tax Queen Small Business Tax Business Tax Deductions Business Tax

The tax will be payable on or before the 20th of the following month.

Small business taxes kenya. Box 48240 - 00100 Tel 254 20 281 0000 Email. Small business corporations known as small S corporations pay an average of 269 percent according to the Small Business Administration. Every taxpayer whether an individual or a corporate organization has one personal identification number PIN for taxation purposes.

Turnover is the measure of how fast a company collects cash. Non-resident companies are subject to Kenya corporate income tax CIT only on the trading profits attributable to a Kenyan PE. In a notice to the public Kenya Revenue Authority says it is targeting businesses with turnover less that Ksh5 million per year with the presumptive tax.

Every day week month and year Kenyans are partying. For purposes of this study the emphasis is put on how the tax rates tax policies and various types of taxes affected growth of small and medium sized enterprises ROK 2007. A small business is defined as an independently owned venture thats characterised by a few employees usually between one and 19.

The taxman has asked millions of small traders to immediately pay a newly introduced tax that kicks in from January or risk not getting their business permits renewed. Tax rate is 3 of turnover. Currently one requires a National Identification ID card or an Alien card to register any business in Kenya.

It is applicable to your business if turnover does not exceed Sh5 million but is above Sh500000. This is known as tax evasion and its illegal in Kenya. Times Tower Building Haile Selassie Avenue P.

Deducted from the business income. Event and Party Planning. According to the VAT Order issued by the CS National Treasury and Planning VAT was reduced from 16 to 14.

The Kenya Revenue Authority has provided for training to educate the business community on taxes through seminars. ToT is a 3 tax on gross sales for business entities that post less than Ksh5 million revenue every year. The government has announced new taxes for small businesses with an annual turnover of below Ksh5 million.

Small businesses with one owner pay a 133 percent tax rate on average and ones with more than one owner pay an average of 236 percent. Income tax is a tax charged for each year of income upon all the income of a person whether resident or non-resident which is accrued. This business idea in Kenya will best work with items sold in small compact forms.

The rate charged is 10 of the total monthly gross rent. Small businesses pay an average of 198 percent in taxes depending on the type of small business. The Finance Act of 2015 defines the residential rental income tax as the amount payable from accrued incomes from the residential property within Kenya and is not above Kshs 10 million per income year.

Traders operating small and mid-sized businesses will from today start paying a three percent tax on their sales to the Kenya Revenue Authority KRA following the re-introduction of. The taxman also underscored that businesses with an obligation to pay ToT are also liable to pay Presumptive Tax at a rate of 15 of the business permit fee or license payable. Shop around for the appropriate vending machine and locate it in a strategic position such as a busy residential area near busy bus terminus near a college or school etc.

Currently the cost of registering the sole proprietorship business is kshs 1000. Value Added Tax VAT 4. The rate of CIT for resident companies including subsidiary companies of foreign parent companies is 30.

The tax is 30 for resident companies and 375 for non-resident companies. Resident companies with business activities outside Kenya are also taxed on income derived from business activities outside of Kenya. Nonetheless these undertakings like the rest of businesses in Kenya are obligated to various types of taxes paid at various phases of the business.

Capital Gains Tax CGT. As a small business owner you may delegate this responsibility but it is important to keep proper tabs on whether taxes have been filed or not and possibly have these filed returns in a safe place. According to The Standard traders in this bracket will now be required to remit a new presumptive tax computed at the rate of 15 percent of their annual permit fee.

Small enterprises in all counties will start paying 15 per cent of the business permit fee or license from 1 January 2019 the tax Czar has proclaimed. The Government of Kenya in a bid to cushion citizens from the adverse impact of the economy nose-dive caused by the pandemic introduced various tax measures in April 2020.

How Much Tax Do Small Businesses Pay A Simple Guide Freshbooks Resource Hub

Plan With Me How To Create A Tax Prep Binder Tax Prep Tax Prep Checklist Bookkeeping Business

The Ultimate Guide To Pinterest For Business Pinterest For Business Network Marketing Tips Pinterest Marketing Strategy

Super Helpful List Of Business Expense Categories For Small Businesses Based On The Schedul Small Business Bookkeeping Business Expense Small Business Planner

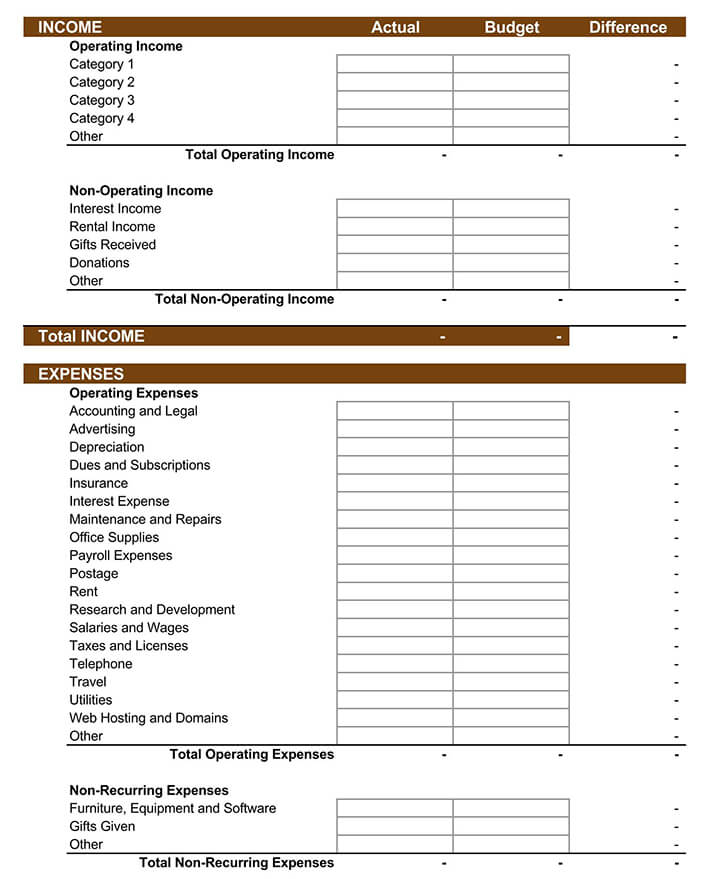

15 Free Small Business Budget Planner Templates Excel Worksheets

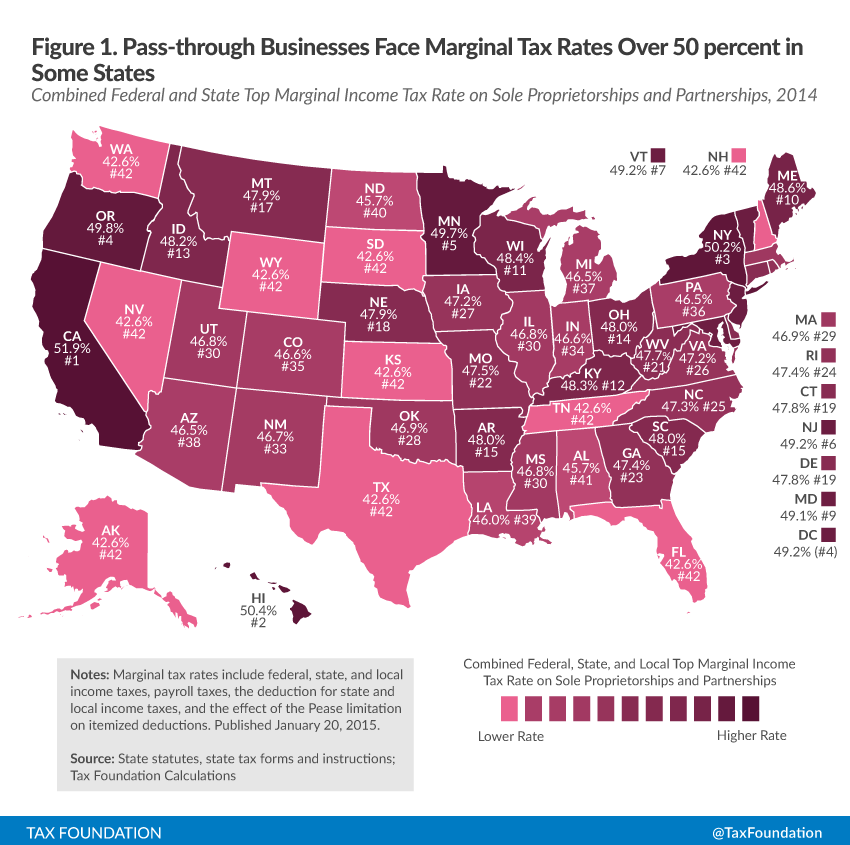

Corporations Make Up 5 Percent Of Businesses But Earn 62 Percent Of Revenues Tax Foundation

7 Insanely Awesome Write Offs That Solopreneurs Need To Know Business Tax Tax Write Offs Small Business Organization

Check Out How Income Tax Is Calculated On Business Income Abc Of Money

Doing Business In The United States Federal Tax Issues Pwc

Small Businesses And Their Income Tax Burden Tax Foundation

Organize Small Business Taxes Plus Free Printables Small Business Tax Business Tax Business Organization

Property Tax Map Tax Foundation

Owning A Small Business Is Challenging On So Many Levels But Taxes Seem To Be A Big Stressor On The Minds Of Most Creatives While Ta Small Business Accounting Small Business

Small Business Tax Spreadsheet Business Tax Deductions Business Worksheet Business Budget Template

How Do Taxes Affect The Economy In The Short Run Tax Policy Center

Pdf Influence Of Online Tax Filing On Tax Compliance Among Small And Medium Enterprises In Nakuru Town Kenya

The Ultimate Self Employed Deduction Cheat Sheet Exceptional Tax Services Business Tax Deductions Business Tax Small Business Bookkeeping

Post a Comment for "Small Business Taxes Kenya"