Small Business Administration Loans Uk

Allows for payment deferral for at least six months. Achieve financial stability and long-term success.

The 10 Best Sba Lenders For Small Businesses In 2021

Instead it sets guidelines for loans made by its partnering lenders community development organizations and micro-lending institutions.

Small business administration loans uk. The loans may be issued for any amount up to a total of 1125 million. Note that an arrangement fee of 100 is payable at the start of the loan. In the latest round businesses that received loans last year will be able to borrow up to 2 million as long as they have no more than 300 employees and suffered at least a.

Qualifying businesses enjoy low rates and exclusive terms for working capital commercial real estate and other business expenses. You dont need an HSBC current account to apply for a small business loan. The SBA allows online applications on all of its disaster loans the fastest method although you may also submit a paper application by.

OnDeck loans are easy to obtain and available for small-business owners with fair to good personal credit. The agency doesnt lend money directly to small business owners. The Small Business Administration also known as the SBA is most famous for its popular 7 a loan program.

Start or expand your business with loans guaranteed by the Small Business Administration SBA. Kabbage provides fast though potentially expensive business loans and is an. A small business can qualify for a 504 Loan from a certified development company CDC to partially finance long-term fixed assets if the small business seems likely to create or.

There are no charges for additional repayments to your loan but you do have the option to defer your first repayment for three months. Maximum loan amounts of 5000 5000000. Apply for a loan.

Small Business Administration 409 3rd St SW. Apply for a low-interest disaster loan to help recover from declared disasters. Small Business Administration has developed loan programs designed to help community establishments compete.

It hit a milestone announcing it has provided more than 10 billion in loans to more than 225000 small businesses around the globe. Beginning April 6 small businesses and non-profits can apply for up to 24 months of relief with a maximum loan amount of 500000 the Small Business Administration announced Wednesday. Find an SBA lender near you to help fund your business.

Unlike a business loan this is an unsecured personal. Interest rates begin at. 695 to 697f.

Small Business Administration Loans have no balloon payments associated with them. The terms associated with Small Business Administration Loans may go up to a period of â but not exceeding 25 years. Keep your business afloat with a straightforward cash flow solution that a small business administration loan can provide.

Apply for a Start Up Loan for your business Apply for a government-backed Start Up Loan of 500 to 25000 to start or grow your business. The SBA works with lenders to provide loans to small businesses. A lender may require you to offer assets as security against the loan depending on the amount you need.

Benefits of SBA-Guaranteed Loans. Small Business Administration Loan. To find out if an SBA loan would be right for your business contact one of our lenders today at 800-564-3195.

Defined small business less than 500 employees and gross receipts limits in certain industries 2. SBA loans offer a wide variety of financing options. Maximum loan is 10 million with a rate no higher than 4 and no prepayment fees.

SBA guaranteed business loans. Loans do not require a personal guarantee. The SBA reduces risk for lenders and makes it easier for them to access capital.

Loan balances will have a maturity of not more than ten years. Home business disaster loans. That makes it easier for small businesses to get loans.

With a small business loan you could qualify for a quick short-term loan from as little as 1000 to 500000 from one of our trusted direct lenders. The 10 billion mark comes a. The 7 a loan is a government-backed loan that allows small businesses to obtain.

A Practice Note describing loans 504 Loans under a loan program from the US Small Business Administration SBA which is authorized by Title V of the Small Business Investment Act 15 USC.

Business Loan Application Checklist The U S Small Business Administration Sba Go Small Business Administration Small Business Resources Sell Your Business

The Fed Availability Of Credit To Small Businesses September 2017

/cloudfront-us-east-2.images.arcpublishing.com/reuters/YA7E2SYBJJI3BDC2QKVSJQYKUI.jpg)

Over 5 Billion In U S Small Business Relief Loans Approved In First Week Sba Reuters

The Fed Availability Of Credit To Small Businesses September 2017

Small Business Relief Tracker Funding Grants And Resources For Business Owners Grappling With Coronavirus

The Fed Availability Of Credit To Small Businesses September 2017

Sba On Twitter Heads Up The Deadline To Apply For A Paycheck Protection Program Loan Is August 8 Learn More And Apply

The Fed Availability Of Credit To Small Businesses September 2017

The Fed Availability Of Credit To Small Businesses September 2017

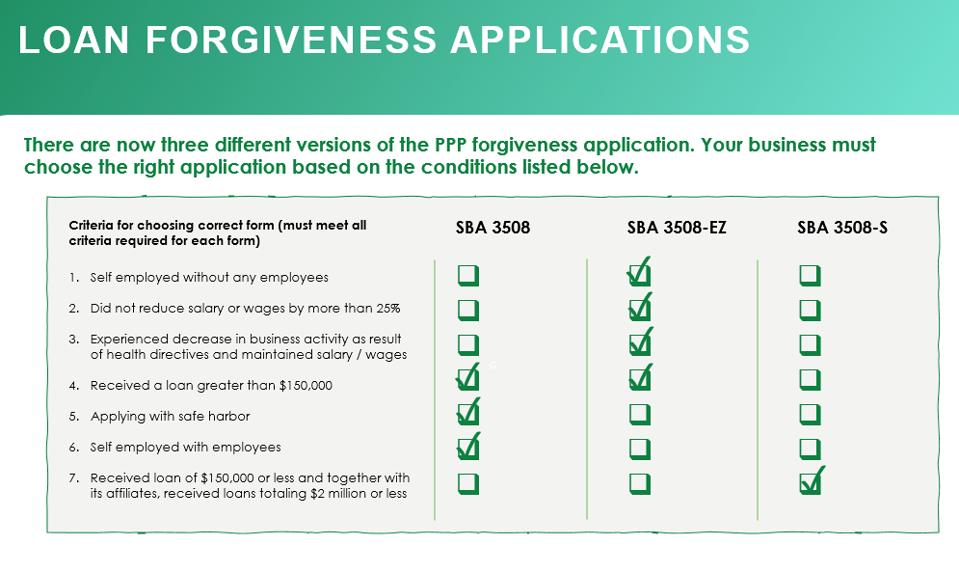

A Guide To Applying For Ppp Loan Forgiveness

Biz2credit In The News Biz2credit

Why Minorities Have So Much Trouble Accessing Small Business Loans

Sba Eidl Loan For Small Business Application Up To 500k Youtube

Covid 19 Small Business Loans Are About To Get Much Bigger Forbes Advisor

Apply For An Sba Loan In 6 Steps 7 A Covid Relief And More Finder Com

Apply For An Sba Loan In 6 Steps 7 A Covid Relief And More Finder Com

Types Of Sba Loans 6 Sba Loan Programs In Detail Sba Loans Loan Business Loans

Post a Comment for "Small Business Administration Loans Uk"