Zelle Business Processing Fee

What happens if a Zelle payment doesnt go through. Refer to your Schedule of Fees and Charges for details.

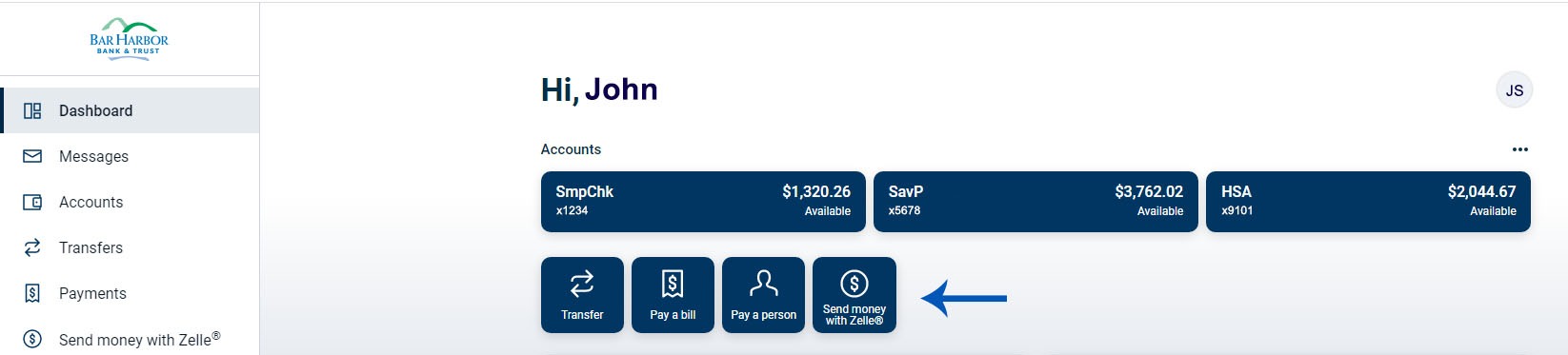

Enrolling With And Using Zelle Bar Harbor Bank Trust

Read the updated terms and conditions provided by your financial institution and accept them to use Zelle.

Zelle business processing fee. Zelle does not charge any fees. However there is a fee for the business account to receive money. Bank Mobile App with your business banking user ID select Zelle from the quick-action menu and choose Update my enrollment.

You can find Zelle in the banking app of hundreds of banks and credit unions nationwide. The fee is 250 of transaction amount with a 15 maximum fee or a 025 minimum fee. 1 To send or receive money with a small business a consumer must be enrolled with Zelle with a linked domestic deposit account at a US.

Enrolled with Zelle through their financial institution. There is also no fee to request money with Zelle at US. Small businesses are not able to enroll in the Zelle app and cannot receive payments from consumers enrolled in the Zelle app.

That being said they do recommend that you check with your bank in case they charge additional fees⁶. Zelle z ɛ l is a United Statesbased digital payments network owned by Early Warning Services a private financial services company owned by the banks Bank of America BBT Capital One JPMorgan Chase PNC Bank US. However your bank may charge a fee so double-check the terms of service on your account or call your bank before using Zelle.

Check with your financial institution to see what fees may apply. Mobile number enter a. The company does however recommend checking with.

Send money straight from your banking app for all sorts of things even if your recipient has a. Zelle is a fast and free 1 way to send and receive money with the people you know and trust. Zelle allows people to send and receive money through your banks app or through the Zelle app if your bank does not have its own.

However Zelle payments to your business account will be charged a 10 fee by BBT. Youll be happy to know that Zelle doesnt charge any fees for receiving or sending money. There is no fee to send money with Zelle and no fee to request money with Zelle at US.

To send money to or receive money from an eligible small business a consumer must be enrolled with Zelle through their financial institution. Only one needs an eligible Chase account. Is there a fee to use Zelle as a small business.

So as Zelles transaction volume increases so will each banks costs. Other Bank of the West fees such as stop payment and overdraft fees may apply. Zelle gives you a fast easy and convenient way to send money to and receive money from customers and eligible businesses with just your email address or US.

What banks use Zelle. Additionally fees are applied to receive money with Zelle to a US. There is not a fee to send money with Zelle from your enrolled BBT business account.

The Zelle service enables individuals to electronically transfer money from their bank account to another registered users bank account within. The fee is 250 of transaction amount 15 maximum fee or a 025 minimum fee There is no fee to send money. Small businesses are not able to enroll in the Zelle app and cannot send or receive payments from consumers enrolled in the Zelle app.

You heard right - you wont pay a dime in Zelle fees. If you choose to use a credit card to send money to friends and family on PayPal the sender will pay a. To enroll your eligible business account with Zelle log into the US.

Bank but there is a fee for the business account to receive that money. For more information view the Zelle Transfer Service Addendum to the Wells. PayPal charges a 025 fee for instant deposits but standard ACH deposits next business day if initiated before 7 pm.

Financial institution that offers Zelle. Both parties need an eligible bank account in the US. Zelle doesnt charge to send and receive money.

Similarly Zelle is free to download and use. I use Zelle for free as a consumer. Zelle doesnt charge to send and receive money.

Bank and Wells Fargo. While Zelle is both free to the user and instantaneous it costs the participating bank between 050 to 075 per transaction. Zelle doesnt charge any fees to send or receive money and its unlikely that your bank will charge you a fee to use the service.

Select your email or US. No Zelle does not charge any fees for its service. Yes there is a fee to receive money to a business account at US.

While Zelle is a weapon that banks can use to beat back Venmo and Square Cash the third-most frequently used P2P app it does have its drawbacks. There is no fee for enrolling with or sending money using Zelle in Bank of the West Online or Mobile Banking.

Zelle For Business Guide Fees Which Banks Use Zelle More

How Does Zelle Make Money Fourweekmba

Consumers And Small Businesses Significantly Increase Use Of Zelle In 1st Half Of 2020

How To Send Money With Zelle Chase Mobile App Youtube

Zelle Renasant Bank Mobile Banking

Zelle For Business Guide Fees Which Banks Use Zelle More

Zelle For Your Business Business Banking U S Bank

Sending Money With Zelle Its Easy At Fidelity Bank

Zelle For Your Business From Bank Of America

Zelle For Your Business From Bank Of America

What Is The Zelle Transfer Limit Averagecash

Bank Of America Zelle Limit Seven Reasons Why People Love Bank Of America Zelle Limit Bank Of America Money Transfer Financial Institutions

Zelle For Your Business From Bank Of America

Zelle Closes 2020 With Record 307 Billion Sent On 1 2 Billion Transactions Zelle

Disbursements Via Zelle Developer Portal

Zelle For Your Business Business Banking U S Bank

Zelle For Business Guide Fees Which Banks Use Zelle More Small Business Apps Business Money Business

Post a Comment for "Zelle Business Processing Fee"