Are Quarterly Taxes Delayed 2020

The IRS urges taxpayers who are owed a refund to file as quickly as possible. What You Need to Know About Your 2020 Taxes.

Of the Acts of 2020.

Are quarterly taxes delayed 2020. Delayed payroll taxes in some states case-by-case deferrals for GST. Tax year 2020 quarterly estimated tax payment due on or after April 1 2020 and before July 15 2020 could be delayed until July 15 without. Taxes and fees are reported by calendar years quarters or months except for.

Whereas The deferred operation of this act would tend to defeat its purpose which is. BREZ the Company announced today that on May 28 2021 it received a notice Notice from. If so then 50 of the deferred amount must be deposited no later than December 31 2021 and the other.

What to know Some benefits are taxed but others are not. Previously scheduled appointments will be cancelled and rescheduled if possible. The GOP was founded in 1854 by opponents of the KansasNebraska Act which allowed for the potential expansion of chattel slavery into the western territories.

All Utah sales and use tax returns and other sales-related tax returns must be filed electronically beginning with returns due Nov. Due to the COVID-19 pandemic employers can elect to defer the deposit and payment of the employers share of Social Security taxes that would otherwise be made during the period beginning on March 27 2020 through December 31 2020. Third quarter July-Sept 2020 quarterly filers September 2020 monthly filers Jan Dec 2020 annual filers.

The filing deadline for tax returns has been extended from April 15 to July 15 2020. The Republican Party also referred to as the GOP Grand Old Party is one of the two major contemporary political parties in the United States along with its main historic rival the Democratic Party. DOR representatives are available by phone or email.

File electronically using Taxpayer Access Point at taputahgov. July-Sept 2020 quarterly filers September 2020 monthly filers Jan Dec 2020 annual filers. March 21 2020 The Treasury Department and the Internal Revenue Service are providing special tax filing and payment relief to individuals and businesses in response to the COVID-19 Outbreak.

AN ACT making appropriations for the fiscal year 2021 for the maintenance of the departments boards commissions institutions and certain activities of the commonwealth for interest sinking fund and serial bond requirements and for certain permanent improvements. Quotes delayed at least 15 minutes. March 16 2020 Effective immediately the Kentucky Department of Revenue DOR will not receive walk-in customers for tax filing assistance collections cases or other tax-related issues due to concerns surrounding the 2019 novel coronavirus COVID-19.

IR-2020-256 November 17 2020 WASHINGTON The Internal Revenue Service today encouraged taxpayers to take necessary actions this fall to help them file their federal tax returns timely and accurately in 2021 including special steps related to Economic Impact Payments EIP. Virgin Galactic Holdings Inc has delayed its quarterly results by about a week to May 10 following the accounting guidance issued for blank check companies by the US. Securities regulator the.

You may have to make quarterly estimated payments to the. The deadline to file a 2020 individual federal return and pay any tax owed has been extended to May 17 about a month later than the typical April. Luxembourg is allowing businesses to file requests for cancellation of the first two quarterly tax payments for 2020 for corporate income and municipal business taxes and there is a four-month deadline extension for corporate income.

To save time and ensure all needed schedules are included. Your business registration will be delayed. Breeze Holdings Acquisition Corp.

Stimulus benefits and your 2020 taxes.

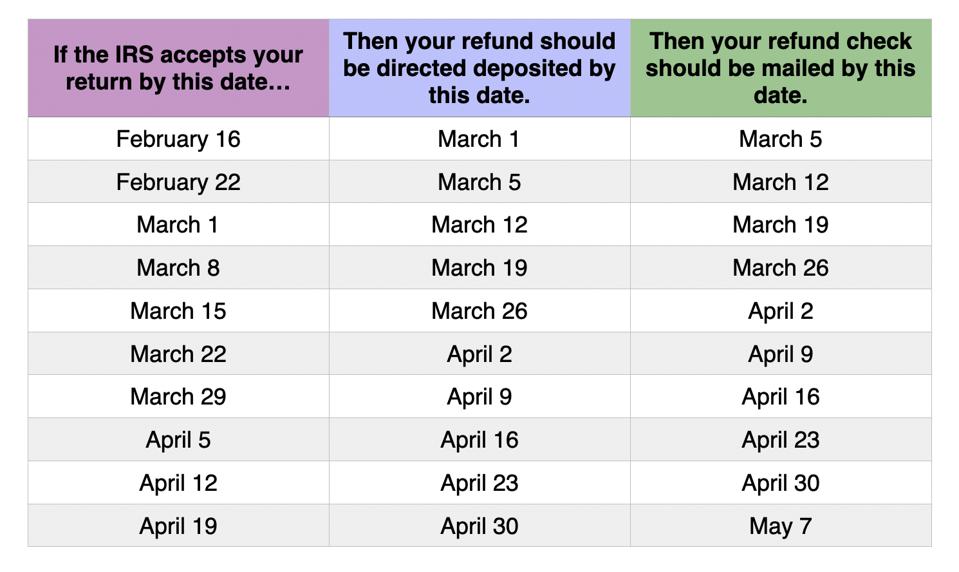

Tax Refund Chart Can Help You Guess When You Ll Receive Your Money In 2021

Tax Extension Deadline Is Today What To Know About Filing Late Irs Penalties Cnet

2021 Taxes A Comprehensive Guide To Filing Money

Tax Deadline Monday 4 Reasons Why You Should File Your Income Tax Return Now Cnet

Tiny Tip Tuesday Top 5 Celiac Expense Tax Tips Tax Time Estimated Tax Payments Tax Prep

State Conformity To Irs Income Tax Deadline Extension Wipfli

Irs Makes It Official Tax Deadline Delayed To May 17 2021 Cpa Practice Advisor

Tax Day 2021 Deadline The Last Day You Can File And How To Get An Extension Cnet

2020 Tax Deadline Extension What You Need To Know Taxact

When To Expect My Tax Refund Irs Tax Refund Calendar 2021

Faqs On Tax Returns And The Coronavirus

In All The Chaos Of All Of This Gestures At World I Completely Forgot To Do My Quarterly Sales Taxes I Know A Few Other Thin Tax Time Sales Tax Sale

Irs Announced Federal Tax Filing And Payment Deadline Extension The Turbotax Blog

How To Defer Your 2020 Tax Payments Bench Accounting

2021 Irs Tax Refund Schedule Direct Deposit Dates 2020 Tax Year

Why Is My Tax Return So Low 2020 Tax Year Edition Picnic S Blog

Taxes 2021 Everything New Including Deadline Stimulus Payments And Unemployment Cnet

When To Expect My Tax Refund Irs Tax Refund Calendar 2021

Coronavirus Covid 19 Tax Relief Taxpayer Advocate Service

Post a Comment for "Are Quarterly Taxes Delayed 2020"