Hong Kong Business Tax Id

Tax Identification Number TIN Hong Kong Inland Revenue Department the IRD does not issue TIN for communication with the taxpayer. For certain types of taxpayers notably financial institutions there are specific rules with respect to determining the source of interest income in Hong Kong.

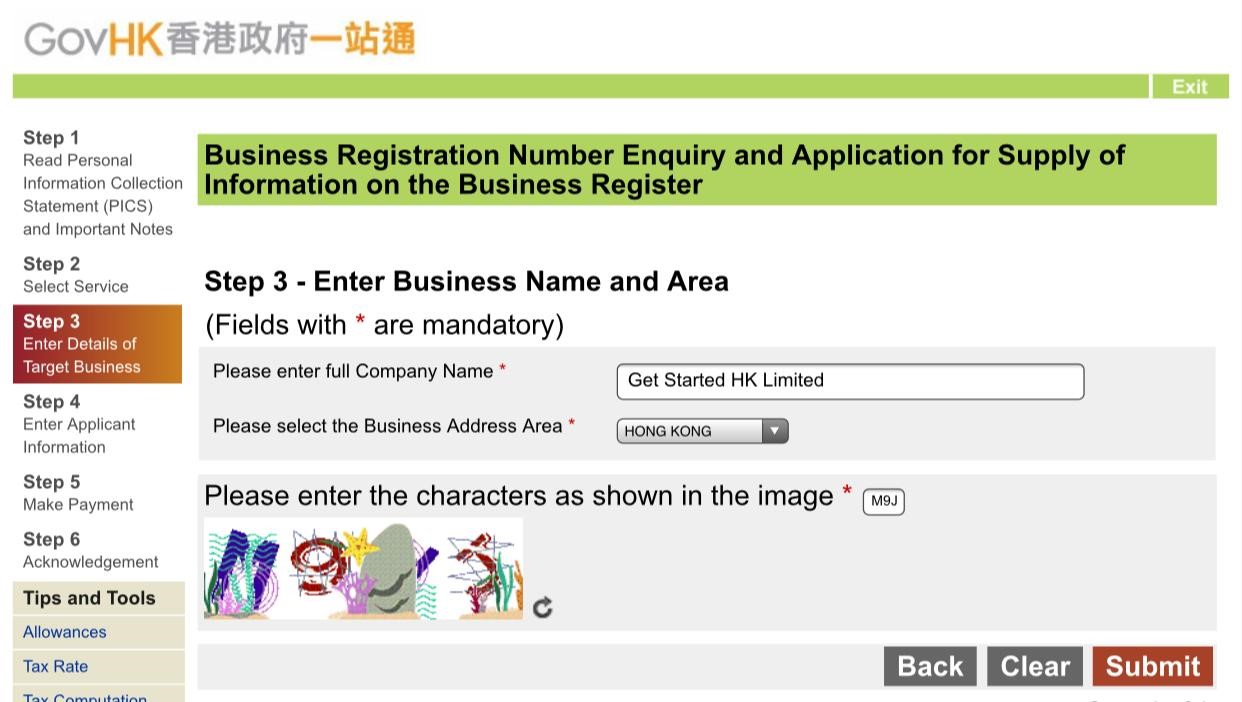

Business Registration Br Number Vs Company Registration Cr Number Get Started Hk

Thank you very much for your prompt answer.

Hong kong business tax id. You may not be able to view some of the documents here during this period. Please note that system update has been scheduled to take place daily from 300am. This number is issued by the Inland Revenue Department IRD before a work location can be set up.

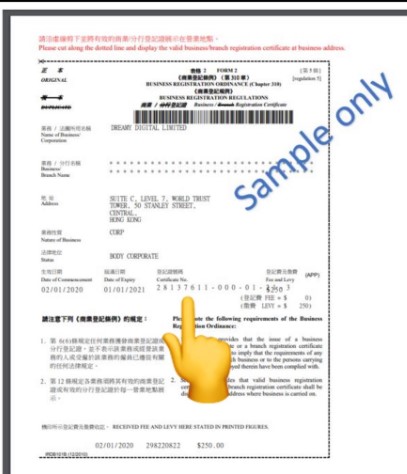

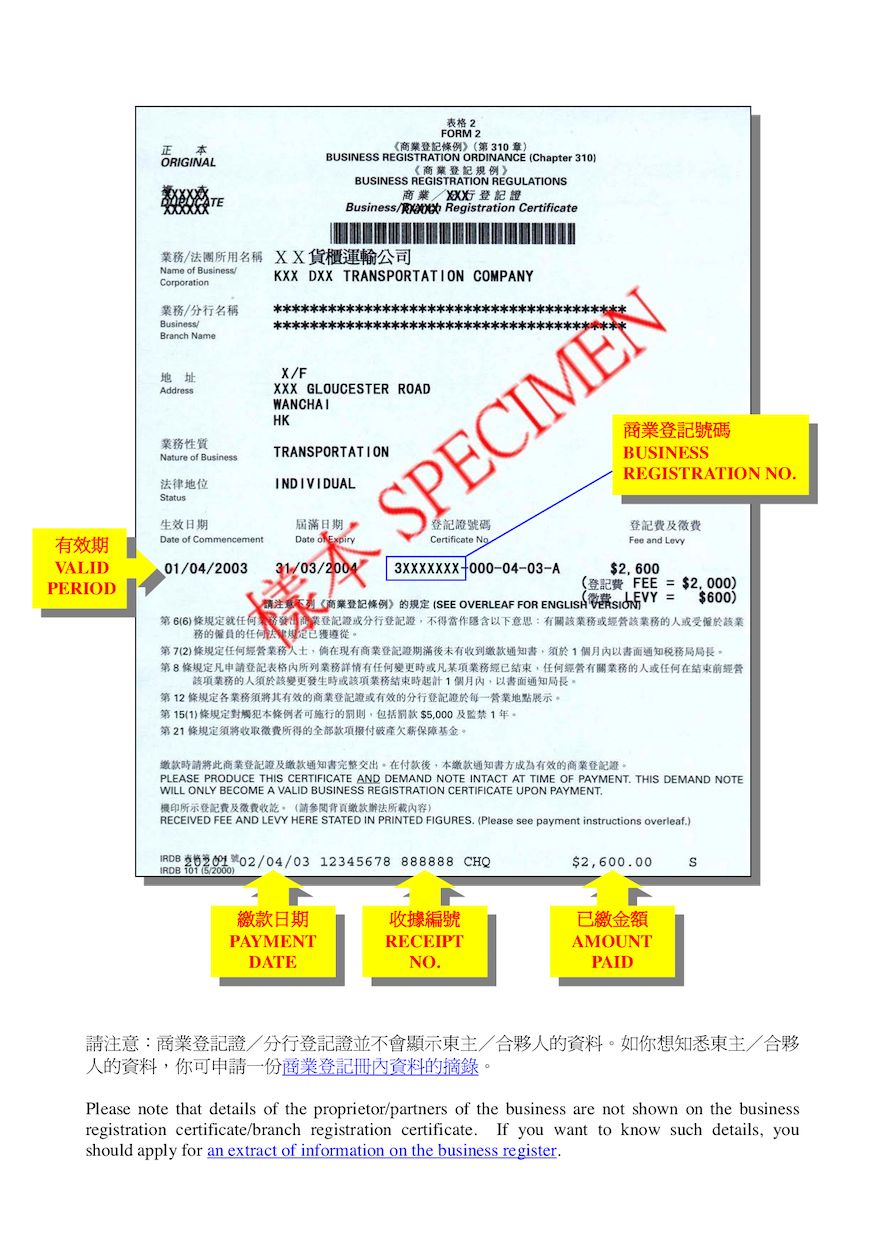

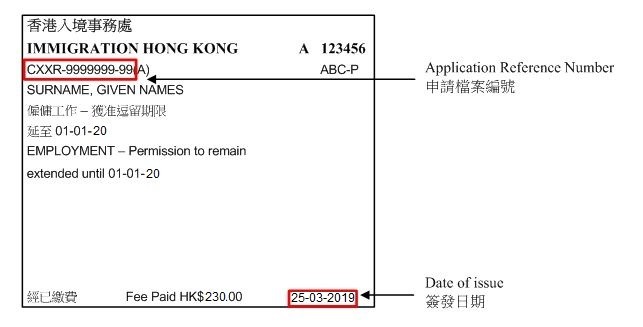

Interest income derived from financial institutions is specifically exempt from tax in Hong Kong. Once the business registration fee and the levy specified on the business registration renewal demand note are paid the demand note will become a valid business registration certificate branch registration certificate which bears a machine-printed line showing the date of payment the receipt number and the amount paid. Hong Kong does not issue TIN for taxpayers.

It is important to note that all the numerals of the BR number are used as an identifier equivalent to the tax identification number. We apologise for any inconvenience caused. Tax Exemptions in respect of Relief Measures under the Anti-epidemic Fund Relief Measure.

Profits tax is payable by every person defined to include corporation partnership and sole proprietorship carrying on a trade profession or business in Hong Kong SAR on profits arising in or derived from Hong Kong SAR from that trade profession or business. Hong Kong Identity Card HKID number issued by the Immigration Department under the. Conditional waiver of surcharges for instalment settlement of demand notes.

In Guernsey the social security number serves as a TIN for individuals. The 165 rate only applies to the earnings above HK2 million. Hong Kong SAR adopts a territorial basis of taxation.

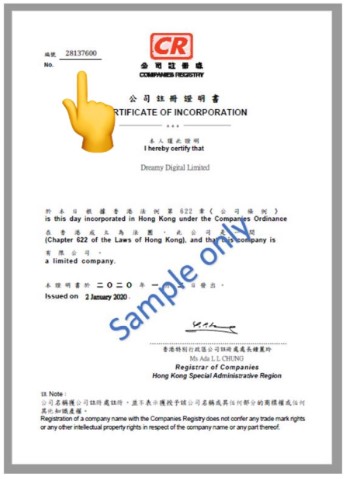

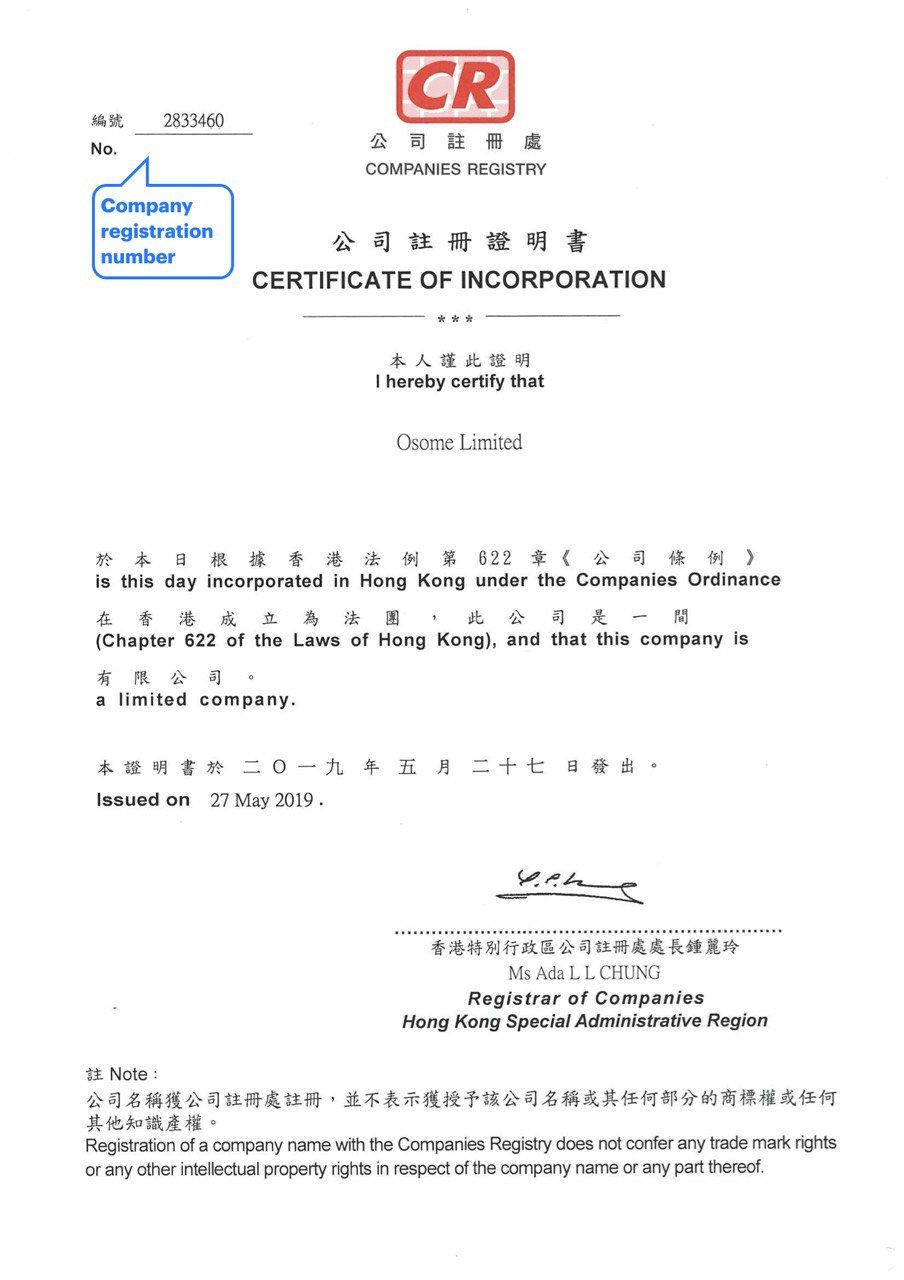

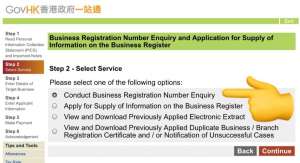

In Hong Kong the Hong Kong Identity Card HKID Number serves as a TIN for individuals. Every business operating in Hong Kong requires a Hong Kong business registration number BRN. This means that a BRN is necessary for all legal business operations and tax payments in Hong Kong.

70569713 - which is issued and assigned by the Inland Revenue Department IRD at the date of incorporation. The fact is I used to ship merchandise from HK to States and my staff will received and acknowleged the parcel with Hong Kong passort. In Pakistan the Computerised National Identity Card CNIC serves as a TIN for individuals.

The most relevant identification that equivalent to TIN is the Business Registration Certificate number. If you are the majority shareholder in more than one Hong Kong business the entities are considered connected through you. Filing of Tax Return - Individuals.

A Business Registration Number BRN is a unique number assigned to a business by the Inland Revenue Department IRD of Hong Kong upon registration. The Business Registration number comprises 8 numerals at the front of business registration certificate number eg. Business registration number is the Tax Identification Number TIN Business Registration number is a unique number assigned to a business by the Inland Revenue.

It is an 8-digit sequence at the front of your BR certificate number eg. Profits tax rate in Hong Kong of first 2 million HKD is 825 percent for corporates and 75 percent for unincorporated businesses ie sole proprietorships or partnerships. But suddenly the agent need us to get a Business tax ID so that we can released the parcel.

The remainder profit is payable of 165 percent and 15 percent for corporations and unincorporated businesses respectively. A Hong Kong business registration number BRN follows an 8-digit sequence. Its not that the rate changes once you pass the HK2 million threshold.

The above examples are neither meant to be exhaustive nor to constitute tax advice. The certificate shall be valid until the Date of Expiry printed thereon. In respect of individuals.

The BR number follows an unique 8-digit sequence ie. The first HK2 million are still taxed at 825. A company in Hong Kong must have a BRN before a.

The Inland Revenue Department IRD of Hong Kong issues this number. It is used as a Tax Identification Number TIN for businesses. Each business in Hong Kong must secure one when conducting operations.

Hong Kong company registry Offshore company in Hong Kong HK - A gateway to explore business opportunities in Mainland China and Asia - Business-friendly tax system that allows maximizing profits - Non-HK source tax exemption - No VAT Import Property tax and no tax on Dividends Interest - Easy business set-up and transparency ongoing. Interest income is subject to Hong Kong profits tax only where it is sourced in Hong Kong. Corporate tax is fixed at 165 of assessable profits for companies and 15 for unincorporated business.

Tax When considering starting a business in Hong Kong limited taxes on corporations are a major selling point. There is neither capital gains tax nor any withholding tax on dividends and interest or collection of social security benefits. 10 rows The HKID is an official identity document issued by the Immigration Department of Hong Kong.

To align with international practices the IRD uses Hong Kong Identity HKID numbers and business registration numbers for that purposes.

Hong Kong Tax Tin China Tax Investment Consultants Ltd

Https Www Oecd Org Tax Automatic Exchange Crs Implementation And Assistance Tax Identification Numbers China Tin Pdf

Hong Kong Offshore Tax Exemption How To Take Its Advantages

Business Registration Br Number Vs Company Registration Cr Number Get Started Hk

Business Registration Number In Hong Kong Definition Examples

Business Registration Number In Hong Kong Definition Examples

Https Www Oecd Org Tax Automatic Exchange Crs Implementation And Assistance Tax Identification Numbers China Tin Pdf

Business Registration Br Number Vs Company Registration Cr Number Get Started Hk

.jpg)

Govhk Starting A Business Licensing Registration Regulations

Business Registration Br Number Vs Company Registration Cr Number Get Started Hk

Https Www Esunbank Com Tw Bank Media Esunbank Files About Announcement Overseas Hong Kong Crs Tin Pdf La En

Business Registration Number In Hong Kong Definition Examples

Business Registration Br Number Vs Company Registration Cr Number Get Started Hk

Govhk Faqs About Filing Of Profits Tax Return Through The Internet

Govhk Application Reference Number And Transaction Reference Number

Https Www Oecd Org Tax Automatic Exchange Crs Implementation And Assistance Tax Identification Numbers China Tin Pdf

Https Www Oecd Org Tax Automatic Exchange Crs Implementation And Assistance Tax Identification Numbers China Tin Pdf

Account Tax Identification Numbers

Business Registration Br Number Vs Company Registration Cr Number Get Started Hk

Post a Comment for "Hong Kong Business Tax Id"