Government Business Mileage Rate 2020

59 per kilometre for the first 5000 kilometres driven. The Internal Revenue Service IRS released Notice 2020-05 providing the 2020 standard mileage rates.

Volkswagen S Retail First Store Opens In Birmingham S Bullring Shopping Centre He Store Features Volkswagen Showroom Car Showroom Design Car Showroom Interior

The rates apply for any business journeys you make between 6 April 2020 and 5 April 2021.

Government business mileage rate 2020. Rate per mile. Kilometre rates for the 2018-2019 income year Use these rates to work out your vehicle expenses for the 2018-2019 income year. Per-diems are fixed amounts to be used for lodging meals and incidental expenses when traveling on official business.

1 Understanding the Standard. Beginning January 1 2020 the standard mileage rates for the use of a car van pickup or panel truck will be. For the 2020 tax year the standard mileage rate for business use is set at 575 cents per mile.

The advisory fuel rates from 1 June 2021 have been added. 56 cents per mile for business miles this is a decrease of 15 cents from 2020 16 cents per mile for medical or moving expenses this is a decrease of 1 cent from 2020 14 cents per mile driven in service of charitable organizationsthis rate is set by law and hasnt changed from previous years 4. As a result the current AMAP rates are 45p per mile for the first 10000 miles and 25p.

14 rows The following table summarizes the optional standard mileage rates for employees self. Rates are set by fiscal year effective October 1 each year. 575 cents per mile driven for business use down from 58 cents in 2019.

Find current rates in the continental United States CONUS Rates by searching below with city and state or ZIP code or by clicking on the map or use the new Per Diem tool to calculate trip allowances. For prior-year rates see Automobile allowance rates. 16 cents per mile was 17 cents in 2020.

First 10000 business miles in the tax year Each business mile over 10000 in the tax year. Kilometre rates for the 2019-2020 income year Use these rates to work out your vehicle expenses for the 2019-2020 income year. 59 per kilometre for the first 5000 kilometres driven 53 per kilometre driven after that In the Northwest Territories Yukon and Nunavut there is an additional 4 per kilometre allowed for travel.

56 cents per mile was 575 cents in 2020 Medical Moving. 575 cents per mile for business miles driven down from 58 cents in 2019. Use the rates listed below to calculate the allowable expense for using your vehicle for business purposes for the 2019-2020 income year.

For 2021 they are. If Government-furnished automobile is available. The standard mileage rates for 2021 are as follows.

Kilometre rates for the 2017-2018 income year. 53 per kilometre driven after that. Beginning on January 1 2020 the standard mileage rates for the use of a car also vans pickups or panel trucks will be.

In the Northwest Territories Yukon and Nunavut there is an additional 4 per kilometre for travel. FY 2020 Per Diem Rates apply from October 2019 - September 2020. The advisory fuel rates from 1 March 2020 have been added.

In fact the last time AMAP rates changed was in April 2012 when the AMAP rate for the first 10000 car and van miles rose from 40p per mile to 45p per mile. 575 cents per mile driven for business use down one half of a cent from the rate for 2019 17 cents per mile driven for medical or moving purposes down three cents from the rate for 2019 and. Federal per diem rates are set by the General Services Administration GSA and are used by all government employees as well as many private-sector employees.

For tax year 2021 the business use rate is 56 cents per mile. Per Diem Rates Look-Up. Theyre identical to the rates that applied during 2019-20.

Starting January 1 2020 the IRS Standard mileage rate for transportation and travel expenses has declined to 575 cents per mile from 58 cents per mile in 2019. 26 May 2021. For 2020 standard mileage rates for the use of cars vans pickups or panel trucks will be.

The automobile allowance rates for 2020 are. If use of privately owned automobile is authorized or if no Government-furnished automobile is available. As you can see the standard business mileage rate has stayed in the 50s cent range for the past decade.

As we rely on third-party information that was delayed due to COVID-19 we were previously unable to provide these rates and advised businesses to use the kilometre rates for the 2018-2019 income year instead. Airplane January 1 2021.

![]()

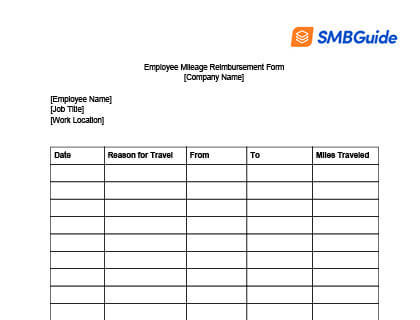

Free Mileage Tracking Log And Mileage Reimbursement Form

Los Angeles County Tax Sale Https Losangelescountytaxsale Freetaxfree Com Tax Refund Freetax Irs Irstax Wheresmyr Irs Taxes Tax Free Los Angeles County

How Much Do Car Maintenance Costs Increase With Mileage Yourmechanic Advice Car Maintenance Costs Car Maintenance Car Cost

Free Mileage Log Templates Smartsheet

Mileage Reimbursement For Employees Info Free Download

Get Japanese New Or Used Cars As Per Your Demand In Reasonable Rates We Deliver All Over The Pakistan Lowest Rate Gua Japanese Used Cars Used Cars Pakistan

Https Mn Gov Mmb Assets 20200102 Tcm1059 414823 Pdf

Free Mileage Reimbursement Form 2021 Irs Rates Word Pdf Eforms

Mileage Log Mileage Tracker For Tax Purposes Printable Etsy In 2021 Work Planner Weekly Work Planner Mileage Tracker

What Determines The Cost Of Your Auto Insurance Auto Insurance Companies Cheap Car Insurance Car Insurance

![]()

25 Printable Irs Mileage Tracking Templates Gofar

New Mileage Rate For 2020 Mileage Expenses

Claiming For Your Home Office Against Your Taxes Home Office Expenses Business Tax Deductions Small Business Tax

What Do Most Companies Pay For Mileage Reimbursement

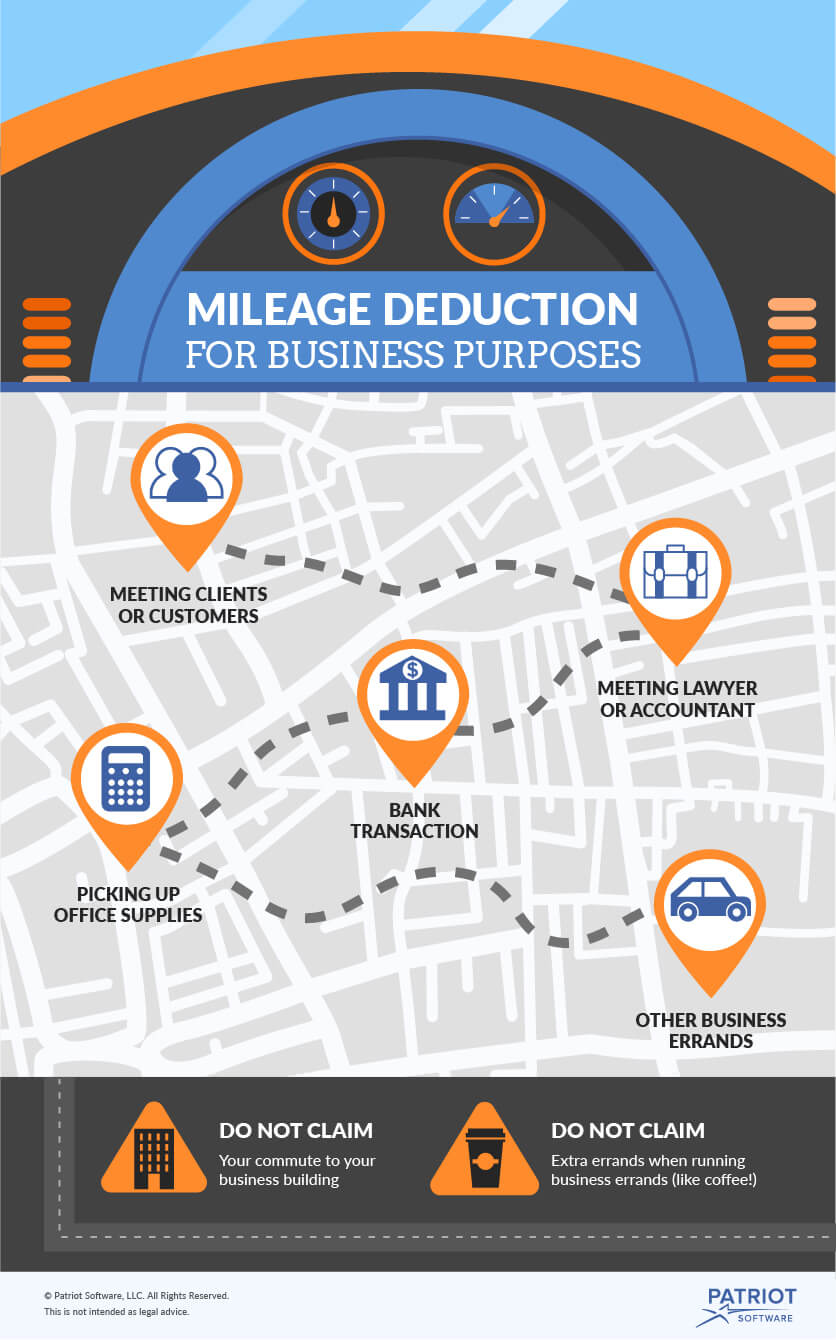

Business Mileage Deduction 101 How To Calculate Mileage For Taxes

![]()

25 Printable Irs Mileage Tracking Templates Gofar

Planner Fun Blog Business Plan Template Mileage Tracker Printable Mileage Tracker

Post a Comment for "Government Business Mileage Rate 2020"