Current Business Mileage Rate 2020

IRS has been publishing IRS tax laws since 2011. 17 cents per mile to.

Free Mileage Log Templates Smartsheet

14 cents per mile was 14 cents in 2020 You may also be interested in our free Lease Mileage Calculator.

Current business mileage rate 2020. The rates apply for any business journeys you make between 6 April 2020 and 5 April 2021. 16 cents per mile was 17 cents in 2020 Charity. 59 per kilometre for the first 5000 kilometres driven 53 per kilometre driven after that In the Northwest Territories Yukon and Nunavut there is an additional 4 per kilometre allowed for travel.

Heres a breakdown of the current IRS mileage reimbursement rates for California as of January 2020. 17 cents per mile for medical purposes. 1 2019 the standard mileage rates for the use of a car also vans pickups or panel trucks will be.

56 cents per mile was 575 cents in 2020 Medical Moving. The federal standard mileage rate saw a slight decrease in 2020 from 58 to 575. As a result the current AMAP rates are 45p per mile for the first 10000 miles and 25p.

The advisory fuel rates from 1 December 2020 have been added and information on how the advisory fuel rates are calculated has been updated. Thats a drop of 05 cents from 2019. 575 cents per mile for business miles driven down from 58.

56 cents per mile for business miles this is a decrease of 15 cents from 2020 16 cents per mile for medical or moving expenses this is a decrease of 1 cent from 2020 14 cents per mile driven in service of charitable organizationsthis rate is set by law and hasnt changed from previous years 4. Over the span of nearly ten years we have seen fluctuation. In fact the last time AMAP rates changed was in April 2012 when the AMAP rate for the first 10000 car and van miles rose from 40p per mile to 45p per mile.

58 cents per mile driven for business use up 35 cents from the rate for 2018 20 cents per mile driven for medical or moving purposes up 2 cents from the rate for 2018 and. As we rely on third-party information that was delayed due to COVID-19 we were previously unable to provide these rates and advised businesses to use the kilometre rates for the 2018-2019 income year instead. The cost per mile is designated by state law.

Use the rates listed below to calculate the allowable expense for using your vehicle for business purposes for the 2019-2020 income year. Business standard mileage rate treated as depreciation is 24 cents per mile for 2016 25 cents per mile for 2017 25 cents per mile for 2018 26 cents per mile for 2019 and 27 cents per mile for 2020. The standard mileage rate for vehicles used for work medical and charitable purposes are as follows.

56 cents per mile driven for business use down 15 cents from the rate for 2020 16 cents per mile driven for medical or moving purposes for qualified active duty members of. Beginning January 1 2020 the standard mileage rates for the use of a car van pickup or panel truck will be. Business standard mileage rate treated as depreciation is 24 cents per mile for 2016 25 cents per mile for 2017 25 cents per mile for 2018 26 cents per mile for 2019 and 27 cents per mile for 2020.

The current IRS Business vehicle mileage rate for the year 2020 is. Employees will receive 575 cents per mile driven for business use the previous rate in 2019 was 58 cents per mile. Beginning on Jan.

The mileage rate released by the IRS also offers guidance on reimbursement for mobile workers. 575 cents per business mile. Theyre identical to the rates that applied during 2019-20.

14 rows The following table summarizes the optional standard mileage rates for employees self. The standard mileage rates for 2021 are as follows. 5p per passenger per business mile for carrying fellow employees in a car or van on journeys which are also work journeys for them.

14 cents per mile for people working on behalf of charities. Only payments specifically for carrying passengers count and. The IRS mileage rates for 2020 for business vehicle use are.

575 cents per mile for business miles driven down from 58 cents in 2019 17 cents per mile driven for medical or moving purposes down from 20 cents in 2019. What is the current federal mileage rate. 575 cents per mile of business use.

The automobile allowance rates for 2020 are. 26 August 2020 The advisory fuel rates from 1. Beginning on January 1 2021 the standard mileage rates for the use of a car also vans pickups or panel trucks will be.

Historical IRS rates chart. The federal mileage reimbursement rate of 2020 is 575 for business vehicles.

Free Mileage Log Templates Smartsheet

![]()

25 Printable Irs Mileage Tracking Templates Gofar

Free Mileage Log Templates Smartsheet

Free Mileage Reimbursement Form 2021 Irs Rates Word Pdf Eforms

Standard Mileage Rates For 2020 Dalby Wendland Co P C

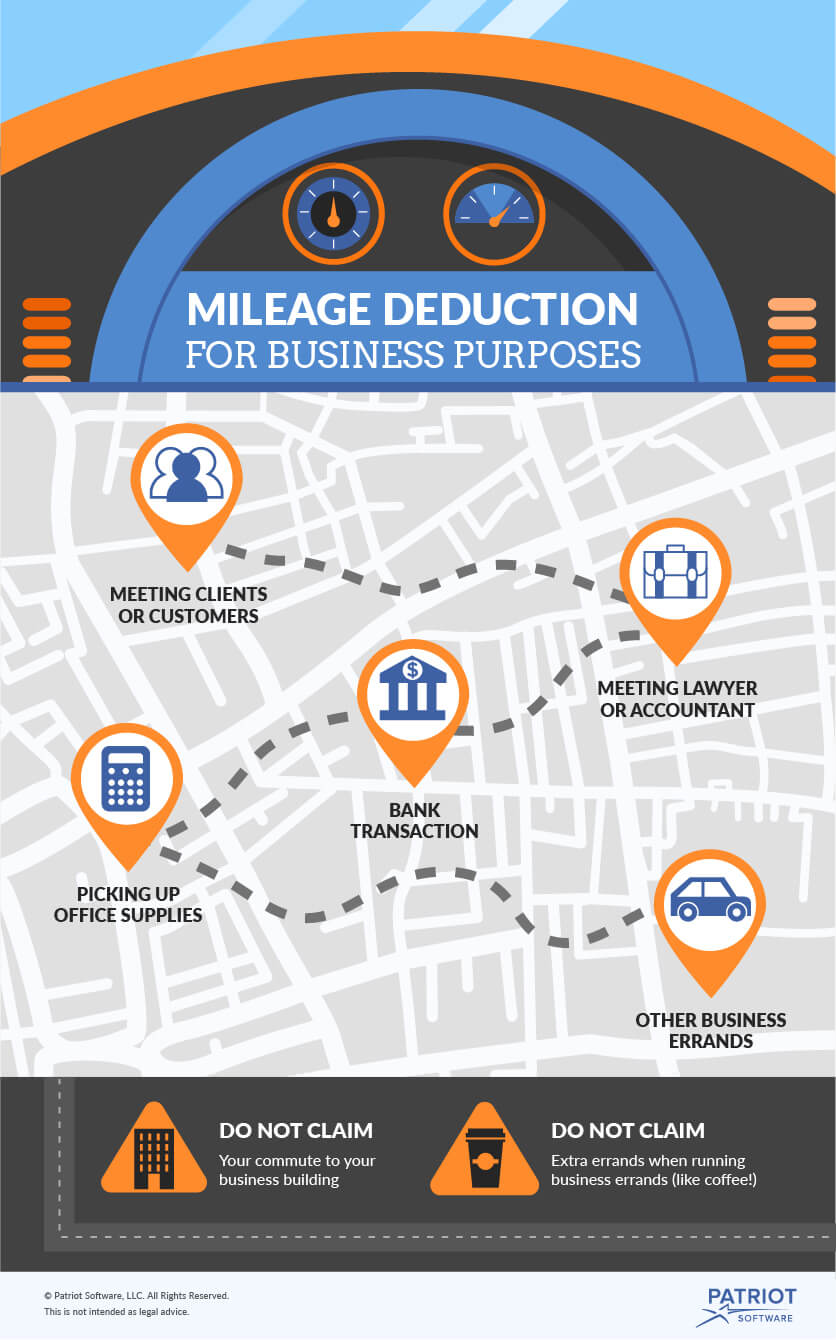

Business Mileage Deduction 101 How To Calculate Mileage For Taxes

New Quickbooks Features In 2020 Tech Tuesday Quickbooks Technology

Planner Fun Blog Business Plan Template Mileage Tracker Printable Mileage Tracker

New Mileage Rate For 2020 Mileage Expenses

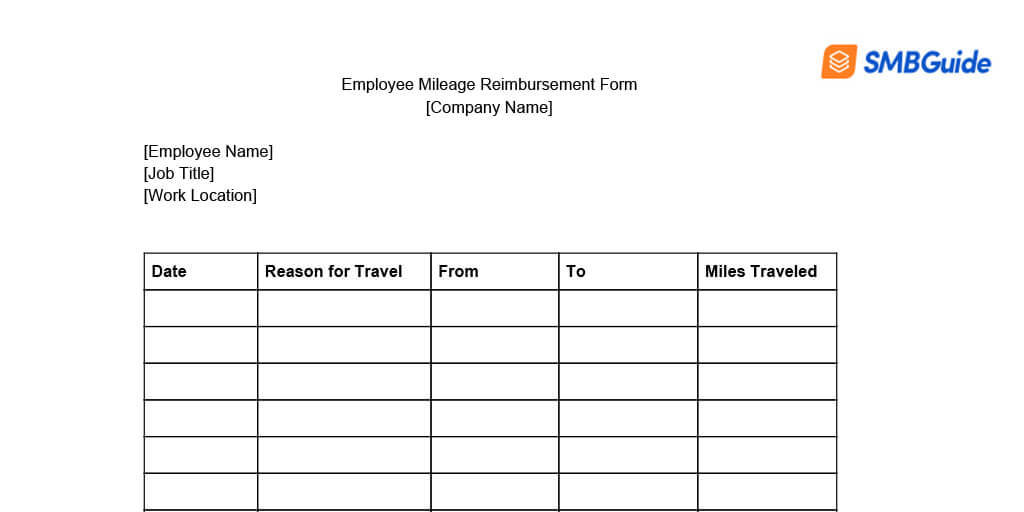

Mileage Reimbursement For Employees Info Free Download

What Do Most Companies Pay For Mileage Reimbursement

![]()

25 Printable Irs Mileage Tracking Templates Gofar

What Are The Irs Mileage Rates Updated 2021 Bench Accounting

![]()

Free Mileage Tracking Log And Mileage Reimbursement Form

![]()

25 Printable Irs Mileage Tracking Templates Gofar

Deducting Automobile Business Costs Strategic Finance

Https Mn Gov Mmb Assets 20200102 Tcm1059 414823 Pdf

Travel Expense Form Template Lovely Travel Reimbursement Form Template In 2020 Templates How To Memorize Things Formal Business Letter Format

Post a Comment for "Current Business Mileage Rate 2020"