Small Business Administration Loans Reviews

Its a loan provided by a bank that is guaranteed by the US. Lesser of a 100000 or b up to 100 of average monthly revenues.

Small Business Administration Sba Loans Immediately Available To Child Care Providers First Five Years Fund

5 hours agoThe US.

Small business administration loans reviews. Instead it guarantees and sets the guidelines for the loans its lending partners provide. The Small Business Administration offers several programs that provide funding for trucking companies. The salary is decent and very transparent its a government job and the benefits are good.

195 reviews from Small Business Administration employees about Small Business Administration culture salaries benefits work-life balance management job security and more. Small business loans that can be used for many many business purchases such as working capital business expansion and equipment inventory and real estate purchasing. SBA loan funds are flexible and can be used for a number of purposes including the purchase of equipment business.

Small Business Loan Resources. Finding the right loan is not a problem thanks to the rise of financial services providers and new companies that offer quick funding and straightforward approval processes. Small Business Administration Loans Review.

Make sure your business is eligible. Get 500 to 55 million to fund your business. This subpart defines the term SBA loan review decision as an official written decision by SBA after SBA completes a review of a PPP loan that finds a borrower 1 was ineligible for a PPP loan.

Small Business Administration 16 stars. Small business administration SBA loans are great for financing working capital commercial real estate lines of credit and disaster relief. 2 was ineligible for the PPP loan amount received or used the PPP loan proceeds for unauthorized uses.

With so many small business lending options available it can be hard to know which loan product makes the most sense for your small business. However they claim they have nothing to do with PPP They will hard check your credit score just to offer you the tiniest loan possible do. SMALL BUSINESS ADMINISTRATION 13 CFR Part 120 Docket Number SBA-2020-0033 RIN 3245-AH47 Business Loan Program Temporary Changes.

The pay is surprisingly great for contract work the work done is meaningful and can affect clients on a large and personal scale and the managers are surprisingly personal and affiable. Some loan programs set restrictions on how you can use the funds so check with an SBA-approved lender when requesting a loan. 17 reviews for US.

Paycheck Protection Program SBA Loan Review Procedures and Related Borrower and Lender Responsibilities AGENCY. The following information will help you understand your options for getting a small business loan make informed decisions and find responsible small business lenders. For small businesses.

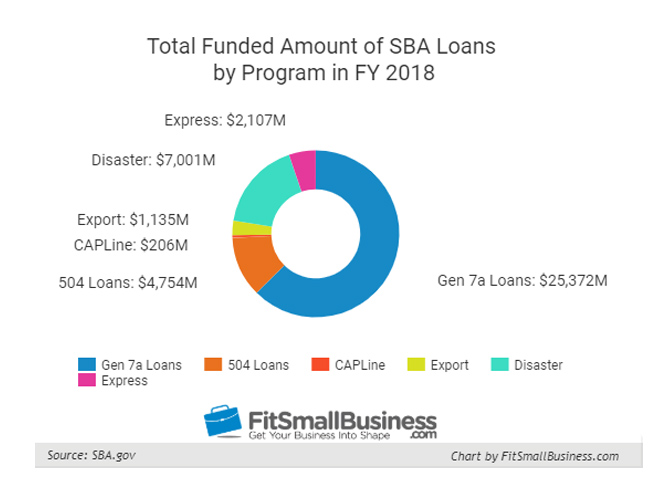

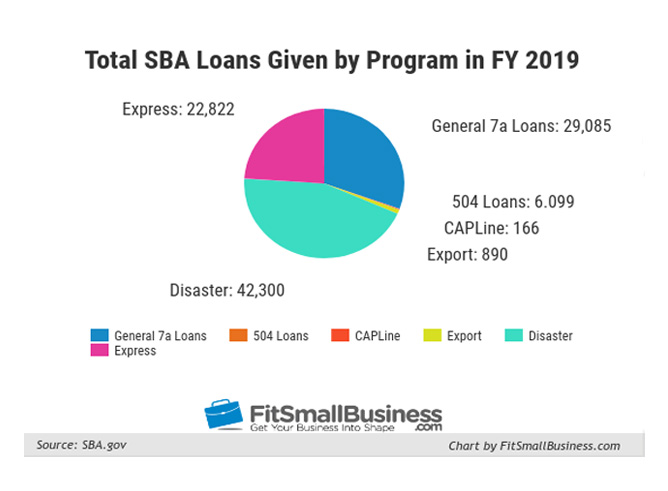

Unlike traditional loans extended to enterprise level companies small business loans are easier to access quicker to apply for and have friendlier terms for repayment. SBA LOANs 504 Loans. The Small Business Administration is a government agency dedicated to help small businesses with their legal financing and training needs.

Small loans with a maximum of 50000 which can be used for working capital inventory equipment or other business projects. SBA loans are backed by the government opening up new financing opportunities for small businesses that dont qualify for conventional business loans. Even though it was a 90-day appointment with the potential to be extended any LTE over 90 days gets health benefits though not dental or vision.

10 hours a day 6 days a week is a minimum for new loan officers. ICA is a designated Preferred Financial Service by. The PPP loan gets and SBA approval loan number.

Loans guaranteed by the SBA range from small to large and can be used for most business purposes including long-term fixed assets and operating capital. SBA loans are part of a federal program which vary based on your capital need and use of funds from 7a loans to 504 loans and others The SBAs 7a Loan Program tends to be the most applicable to franchise business owners. The SBA is not a direct lender.

SBA Small Business Administration was a very rewarding experience because it allowed me the ability to help borrowers with loans via FEMA for residents and business owners after natural disasters. Small Business Administration is taking steps to improve the first-draw Paycheck Protection Program loan review so that small businesses have as. New York Forward Loan Fund Loan Terms Small Businesses Working Capital loans can be up to 100000 on a fiveyear term- SMALL BUSINESSES Loan Amounts.

3 is ineligible for PPP loan forgiveness in the amount determined by the lender in its full or. To qualify for an SBA loan lenders typically like to. Small Business Administration SBA Loans.

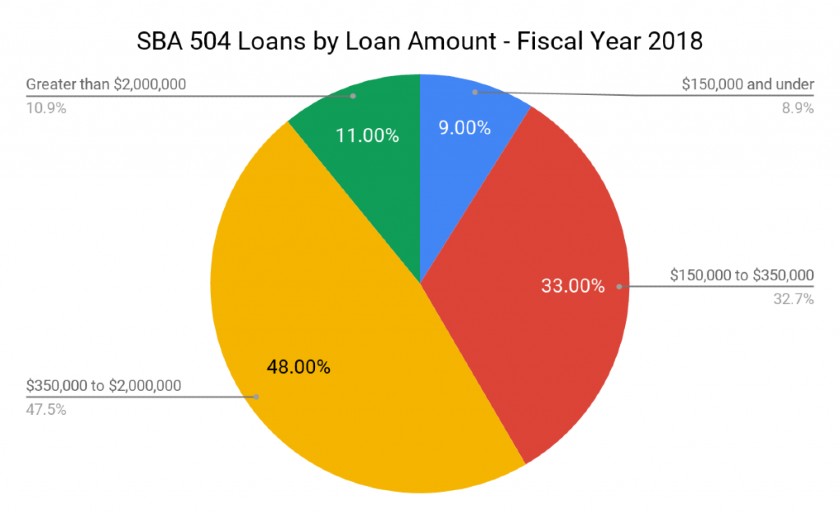

A business loan secured by collateral. The US Small Business Administration 504 Loan or Certified Development Company program is designed to provide financing for the purchase of fixed assets which usually means real estate buildings and machinery at below market rates. Generated by the SBA.

How Long Does It Take To Get An Sba Loan Approved

The 10 Best Sba Lenders For Small Businesses In 2021

Sba Loans For Business The Pros Cons Nav

Sba Loans Types Rates Requirements

Small Business Administration Sba Overview Loan Types Criteria

U S Small Business Administration Loans Reviews June 2021 Supermoney

How Do I Get An Sba 7 A Loan With Bad Credit Funding Circle

Small Business Entrepreneurship Council

Smartbiz Sba Loans Review 2021 Is Smartbiz A Good Lender

Top Ppp Loan Lenders Updated Approved Banks Providers

How To Get An Sba Disaster Loan Eidl Bench Accounting

10 Types Of Sba Loans Compared For Your Business Small Business Trends

Sba Eidl Loan Went Through Unlock Credit Files To Verify Ident

Sba Loans Types Rates Requirements

Sba Loans For Business The Pros Cons Nav

Sba 504 Loan Buy Commercial Real Estate With Sba Cdc Loans

Understanding The Sba Economic Injury Disaster Loan Application Process Startup Junkie

Beware Of Emerging Scams Cares Act Financial Scams And Fraud Targeting Small Businesses

Resources For Small Businesses In Response To The Covid 19 Pandemic Sba S Office Of Advocacy

Post a Comment for "Small Business Administration Loans Reviews"