Irs Business Mileage Depreciation Rate 2020

The business mileage rate declined half a cent for business travel driven and three cents for medical and certain moving expenses from the 2019 rates. Beginning January 1 2020.

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

Form 2106 Employee Business Expenses Definition

You must not operate five or more cars at the same time as in a fleet operation You must not.

Irs business mileage depreciation rate 2020. Yes if you used the Standard Mileage Rate in 2019 and use the Actual Expenses in 2020 you can switch back to the Standard Mileage Rate in the future. 14 cents per mile driven on behalf of charitable organizations. Standard mileage rate.

575 cents per mile driven for business use down one half of a cent from the rate for 2019 17 cents per mile driven for medical or moving. Depreciation limits on vehicles. The Internal Revenue Service IRS has announced the 2020 business mileage standard rate of 575 cents.

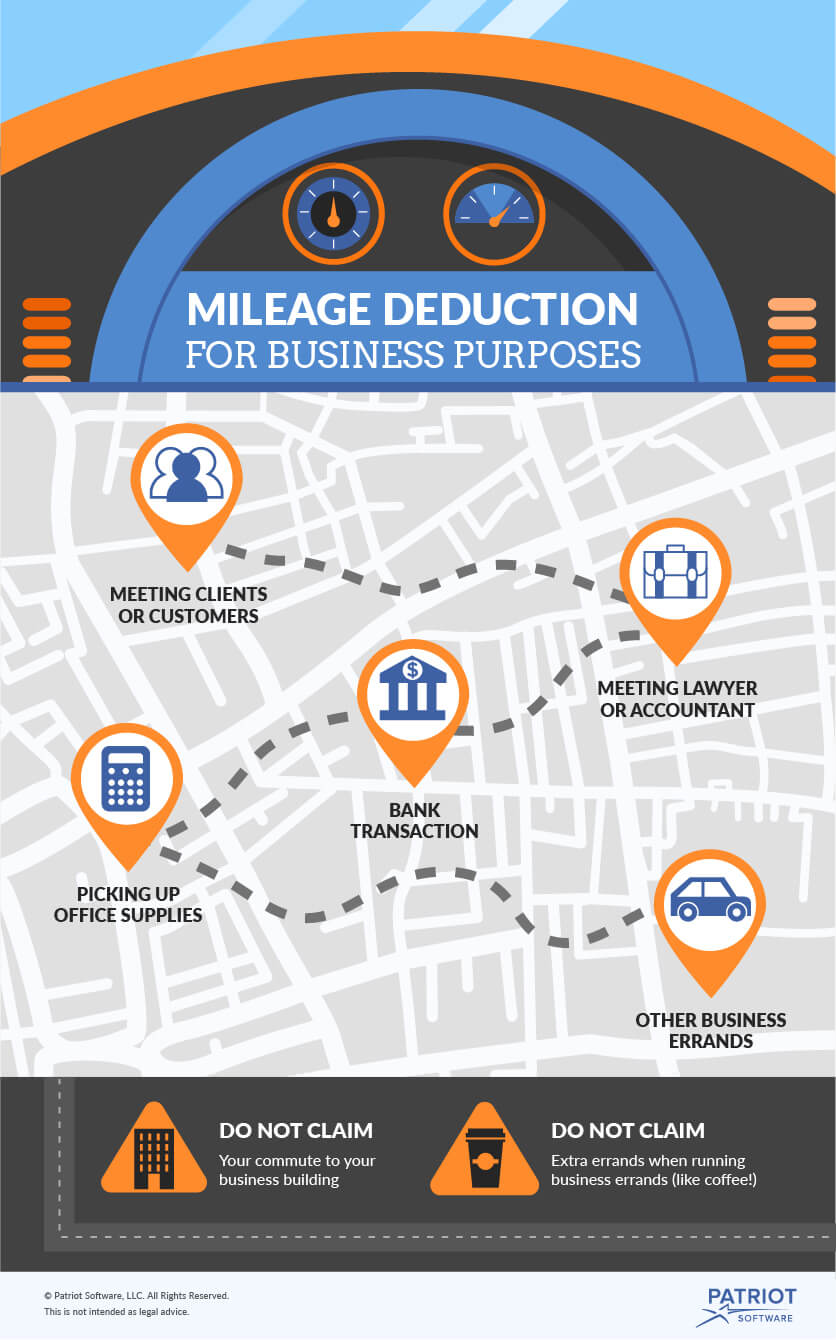

17 cents per mile driven for medical or moving purposes down three cents from the 2019 rate. The standard mileage rate for charitable purposes is 14. To use the standard mileage rate you must own or lease the car and.

The 2020 standard mileage rate for transportation expenses is 575 cents per mile for all miles driven for business purposes. For business use of a car van pickup truck or panel truck the rate for 2020 will be 575 cents per mile in 2020 down from 58 cents per mile last year after increasing from 545 cents per mile in 2018. Beginning on January 1 2020 the standard mileage rates for the use of a car also vans pickups or panel trucks will be.

575 cents per mile driven for business use down one half of a cent from the rate for 2019 17 cents per mile driven for medical or. For an automobile the taxpayer owns and uses for business purposes 26 cents of the 56 cents per mile rate in 2021 is attributable to depreciation expense down from 27 cents per mile for 2020. The current IRS standard mileage rate for 2020 is 575 The federal standard mileage rate is 575 per mile.

To learn more about depreciation click here to view a list of tax forms and find Form 4562. The 2020 rate for business use of your vehicle is 575 cents 0575 a mile. Taxpayers can use the optional standard mileage rates to calculate the deductible costs of operating an automobile.

1 2021 the standard mileage rate for the business use of cars vans pickup or panel trucks will be 56 cents per mile down 15 cents from 2020. The current business-standard mileage rate is 575 per mile. The reasons behind the decrease as in 2019 the standard mileage rate was 58 cents are.

The first-year limit on depreciation special depreciation. 1 2021 the optional standard mileage rate used in deducting the costs of operating an automobile for business will be 56 cents per mile down 15 cents from 2020 the irs announced dec. The additional first-year limit on depreciation for vehicles acquired before September 28 2017 is no longer allowed if placed in service after 2019.

Instead a portion of the rate is applied equaling 27 cents-per-mile for 2020. A taxpayer must use 27 cents per mile as the portion of the business standard mileage rate treated as depreciation. This applies to miles driven starting January 1 2020.

Use the irs mileage rate 2021 to see how much youre eligible to claim as part of the mileage deduction. 1 2020 the optional standard mileage rate used in deducting the costs of operating an automobile for business is 575 cents per mile down one-half cent from 2019 the IRS. To calculate your deduction you multiply the business standard mileage rate by the number of business miles traveled.

The business standard mileage rate is computed on a yearly basis and it is in lieu of deductions for your vehicles operating expenses and depreciation. The standard mileage rate allows you to claim a business expense of 575 cents per mile driven for your doordash and other deliveries for the 2020 tax year 56 cents per mile for the 2021 tax year. E ffective Jan.

54000 is maximum standard automobile cost that may be used in computing the allowance under a fixed and variable rate FAVR plan. 1 2020 the standard mileage rates for the use of a car also vans pickups or panel trucks will be. Business standard mileage rate treated as depreciation is 24 cents per mile for 2016 25 cents per mile for 2017 25 cents per mile for 2018 26 cents per mile for 2019 and 27 cents per mile for 2020.

575 cents per mile driven for business use down one half of a cent from the rate for 2019 17 cents per mile driven for medical or moving purposes down three cents from the rate for 2019 and. Beginning on Jan. Standard Mileage Rate - For the current standard mileage rate refer to Publication 463 Travel Entertainment Gift and Car Expenses or search standard mileage rates on IRSgov.

You cannot use the standard mileage rates if you claim vehicle depreciation.

Https Apps Irs Gov App Vita Content Globalmedia Teacher Schedule C Business Income 4012 Pdf

The Deductible Mileage Rate For Business Driving Decreases For 2020

/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

Form 2106 Employee Business Expenses Definition

Instructions For Form 2106 2020 Internal Revenue Service

Instructions For Form 8995 A 2020 Internal Revenue Service

Your Guide To 2020 Irs Mileage Rate I T E Policy I

Standard Mileage Rates For 2020 Dalby Wendland Co P C

Irs Issues Standard Mileage Rates For 2020 Mileage Irs Eureka

Section 3 Mileage Reimbursement For Self Employed Triplog Mileage

2021 Irs Business Mileage Rate Of 56 Cents Calculated Using Motus Data

What Is The 2020 Standard Mileage Rate And How Do I Use It In My Business

Home Business Tax Deductions Keep What You Earn Legal Book Nolo

Business Mileage Deduction 101 How To Calculate Mileage For Taxes

Publication 583 01 2021 Starting A Business And Keeping Records Internal Revenue Service

What Are The Irs Mileage Rates Updated 2021 Bench Accounting

Https Apps Irs Gov App Vita Content Globalmedia Teacher Schedule C Business Income 4012 Pdf

Irs Announces Standard Mileage Rates For 2014 Small Business Trends Irs Tax Deductions Small Business Trends

Https Apps Irs Gov App Vita Content Globalmedia Teacher Schedule C Business Income 4012 Pdf

Post a Comment for "Irs Business Mileage Depreciation Rate 2020"