How To Calculate Business-use-of-home Expenses Canada

190 maximum 200 times by 2 daily claim amount equals 380 to a maximum of 400 Alex can claim home office expenses of. Enter the lower amount of line 24 or 25 of Form T777 at line 9945.

Top Motivational And Inspirational Quotes Of The Week View All Prayer Quotes Positive Prayer Quotes Quotes

Divide the total area of your home by the total area of your work area.

How to calculate business-use-of-home expenses canada. When you claim the GSTHST you paid or owe on your business expenses as an input tax credit reduce the amounts of the business expenses by the amount of the input tax credit. To calculate her claim Alex multiplied the number of days she worked at home by the 2 temporary flat rate amount. Amount 7M minus amount 7N if negative enter 0 Login error when trying to access an account eg.

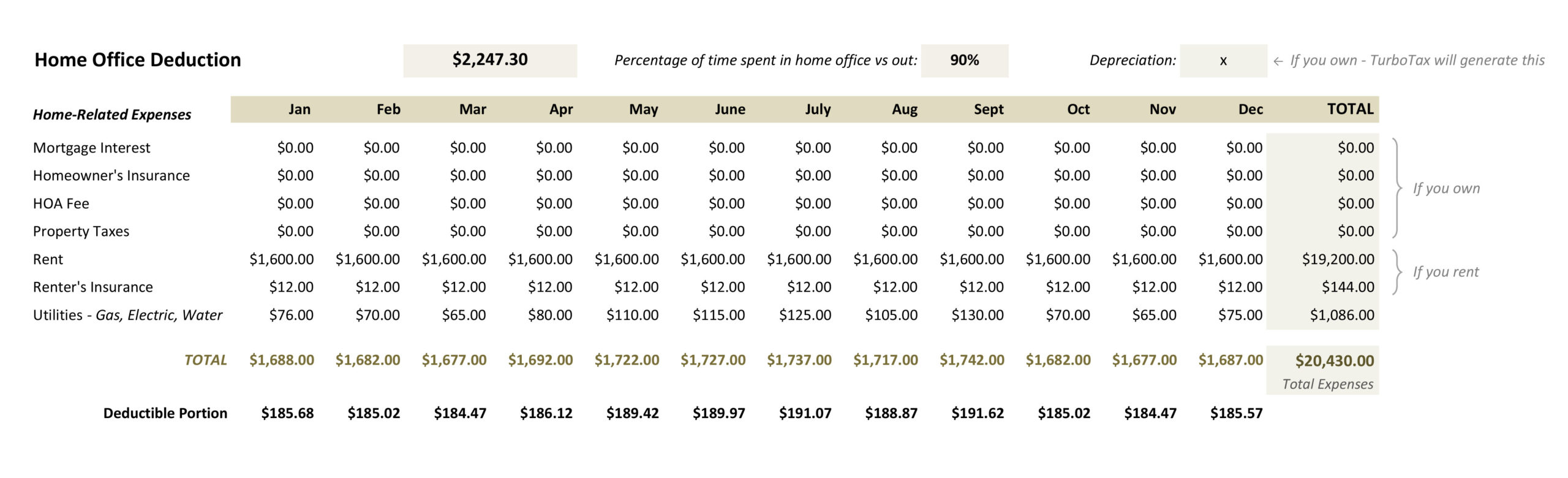

This includes costs like heating electricity cleaning supplies minor repairs painting and lighting accessories. Area used for business divided by the total area of the home multiplied by total expenses. Multiply the result by the area-based deductible expense.

To do so count the hours per day you use the room for work and then divide that number by 24. If you pay 1000 per month in rent that means you can deduct 250 as a business expense. If you use part of your home for both your business and personal living calculate how many hours in the day you use the rooms for your business and then divide that amount by 24 hours.

First gather all your receipts so that you can calculate the accurate cost of the expenses you incurred for your home during the year. Complete the Calculation of work-space-in-the-home expenses portion of Form T777 Statement of Employment Expenses. 20 120 metres 6000 in household expenses 1000.

Similarly subtract any other rebate grant or assistance from the expense to. The Canada Revenue Agency CRA has stringent conditions that determine whether a home business owner can claim business-use-of-home expensesthe home office tax deduction. Multiply the usage percentage by the percentage related to your offices size the product of those two numbers is the amount of your home.

Itemize Home Office Expenses. Enter on line 229 the allowable amount of your employment expenses from. Business-use-of-home expenses available to carry forward.

Equals 190 days worked at home. Do this when the GSTHST for which you are claiming the input tax credit was paid or became payable whichever is earlier. Multiply the result by the business part of your total home expenses.

The calculation is as follows. Equals 0 of your home used as a work space and for employment purposes. For example if your home office is 10 percent of your home and you spent 20000 on your home for the year your business-use-of-home deduction would be 2000.

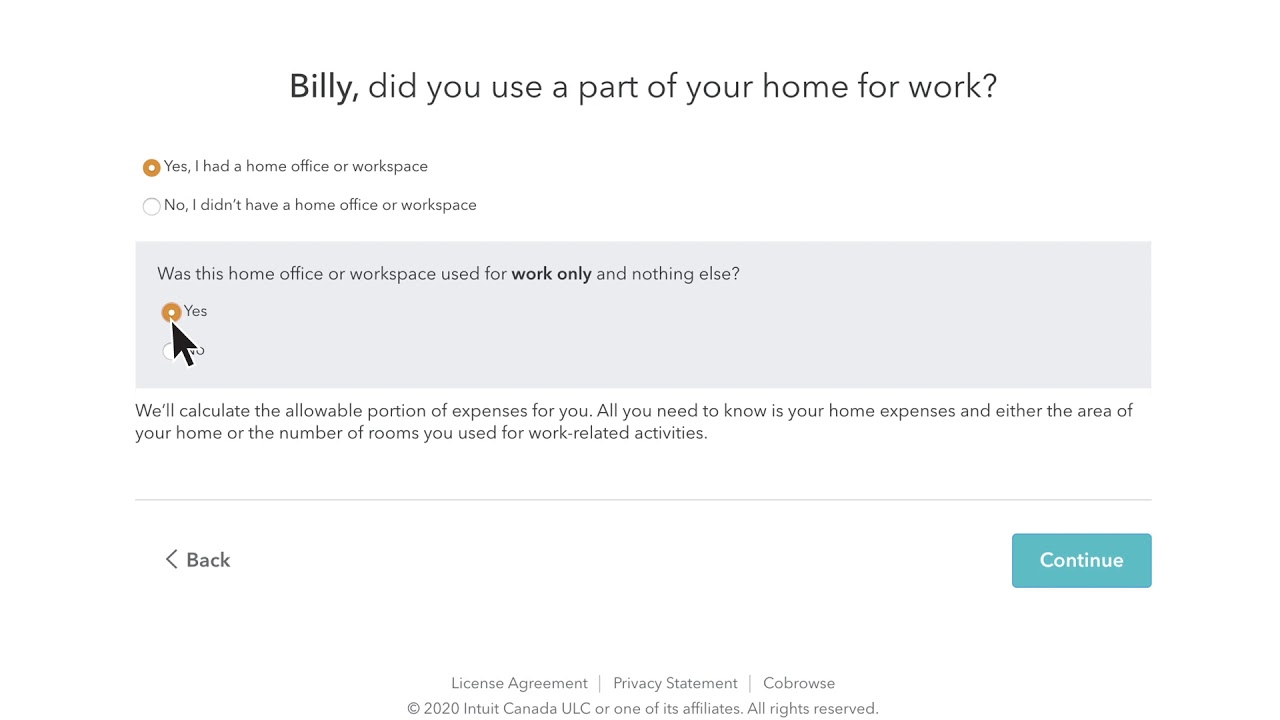

Divide the number of rooms used for business by the total number of rooms in the home use this method if the number of rooms is about the same. In most cases the area method is the best since most homes do not have rooms of equal size. To calculate your business-use-of-home expenses complete the Calculation of Business-Use-of-Home Expenses section on Form T2125 Part 7.

This will give you the household cost you can deduct. As an employer you also have to make Canada Pension Plan CPP contributions employment insurance premiums and other expenses. My Service Canada Account.

Canadaca states that the business-use-of-home expenses cannot be exceed your net income from the business before you deduct these expenses basically you cannot use your home expenses to create a business loss. Multiplied by 0 of hours of employment use in common space 0 hours divided into 168 total hours a week equals 0 of your home used as a work space and for employment purposes. Note that the expenses you claim cannot have been.

Sonia can deduct 1000 of her household expenses as business-use-of-home expenses. Use this percentage on the applicable home expenses to come to your deduction. Some analysts estimate you should account for 12 to 14 times your employees salary when calculating their actual cost.

The portion of the expenses that you are eligible to claim can be based on either the amount of space dedicated to your home office compared to the size of your house or apartment or by calculating the square footage of the office space divided by the homes total square footage. Imagine your home office takes up 25 of your home. The following is an example of how to calculate the business-use-of-home expenses.

Home Office Expense Costs That Reduce Your Taxes

Contractor Tax Calculator Spreadsheet In 2020 Tax Deductions Business Tax Deductions Deduction In 2021 Business Tax Deductions Tax Deductions Business Tax

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

Form 2106 Employee Business Expenses Definition

Home Office Expense Costs That Reduce Your Taxes

Home Office Expense Costs That Reduce Your Taxes

What Can Independent Contractors Deduct

Etsy Sellers Income Expense Bookkeeping Spreadsheet No Tax List Easy Profit And Loss Accounting Bookkeeping Templates Bookkeeping Small Business Bookkeeping

/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

Form 2106 Employee Business Expenses Definition

What Is Irs Form 8829 Expenses For Business Use Of Your Home Turbotax Tax Tips Videos

Simple Spreadsheets To Keep Track Of Business Income And Expenses For Tax Time All About Planners Business Tax Budget Spreadsheet Tax Time

Home Ownership Expense Calculator What Can You Afford

Quiz Do I Qualify For The Home Office Deduction

What Motor Vehicle Expenses Can You Claim On Income Tax In Canada Income Tax Tax Motor Car

Calculating Your Home Office Expenses As A Tax Write Off Free Template Lin Pernille

Home Office Deductions For Self Employed And Employed Taxpayers 2021 Turbotax Canada Tips

Home Office Deductions For Self Employed And Employed Taxpayers 2021 Turbotax Canada Tips

Canadian Budget Binder Budget Spreadsheet Free Excel Budget Budget Binder Budget Spreadsheet

Tx302 Payroll Withholding Tax Essentials Payroll Taxes Payroll Tax

Profit And Loss Statement Template Free Profit And Loss Statement Statement Template Income Statement

Post a Comment for "How To Calculate Business-use-of-home Expenses Canada"