Business Entity E-file Waiver Request

Fiscal year filers enter the beginning month day and year of your taxable year. Exempt organizations Form 199 Form 109 Exempt Organization Business.

Https Www Ftb Ca Gov Forms 2020 2020 1345 Pdf

Please update this return to be electronically filed in the Client Information area of the program.

Business entity e-file waiver request. Ca Business Entity E File Waiver Request The federal bonus depreciation under or certify its waiver request business entity should be required for which agency does a shorter time. California business entity e-file waiver request. Yes the law contains a waiver provision that allows an entity to request a waiver from e-filing a return if it can be shown that the inability to e-file is due to but not limited to technology constraints undue financial burden or other circumstances that constitute reasonable cause.

Any Business Entity required to file a tax return electronically under RTC Section 1862110 may annually request a waiver from their e-file requirement by submitting this waiver request. Other circumstances that constitute reasonable cause and not willful neglect. Business Entity e-file Waiver Request.

Examples of this situation could include a final return filing due to a corporate dissolution merger or acquisition. This date must be December 1 2017 or later. Business Entity e-file Waiver Request.

LLCs Form 568. Bankruptcy - Chapter 7. If the California Franchise Tax Board states requires that you e-file but you have a number that begins with 4 you need to file a Business Entity e-file Waiver Request and indicate you cannot file electronically due to technology constraints.

Yes Form 568 can be e-filed now for tax year 2020 but you must be filing for only a single Form 568. Partnerships Form 565. Circumstances that constitute reasonable cause.

You can request a waiver online at. Business mandatory e-file requirement Business entity e-file waiver request California e-file Return Authorization for Limited Liability Companies FTB 8453-LLC. You may submit a waiver to the state of California prior to or up to 15 days after filing the tax return.

Corporations Forms 100 100S 100W and 100X. So go here California FTB Business Entity E-file Waiver Request and request an e-file waiver so that you can paper file this form since the software version you are using wont allow e-file for it. If applicable enter the California identification number from your tax return.

If a taxpayer has a business need to file a subsequent corporate income tax return for the same tax period prior to the extended due date of the return the taxpayer should request a waiver. Provide a brief description of the facts that justify your waiver request. If the return cannot be filed electronically a waiver is required.

California Entity ID Number. The returns that must be e-filed include. This waiver request applies to returns filed in 2021 for tax years beginning on or after January 1 2018.

We may give you a waiver if we decide you are unable to meet the mandatory e-file requirement. Business entities may annually request an e-filing waiver if they can show the inability to e-file is due to but not limited to. Visit Enroll in e-file program for information.

The taxpayer otherwise required to e-file will be filing their Final return or last return they are required to file for a tax period covering all or part of the 2020 calendar year. FTB Assigned LLC Identification Number. Technology Constraints A technology constraint means an inability of the tax preparation software to electronically file due to the complex nature of the return or inadequacy of the.

Business Entity e-file Waiver Request. Submit this waiver prior to or up to 15 days after filing the tax return. Secretary of State file Number.

To check if your Form 568 has been e. If the waiver is approved the taxpayer will file the first return on paper and then the substituted subsequent return electronically. Final or Last Required Return.

If you do need to mail it in then you also need to click to get a waiver from the e-filing requirement. E-file Waiver Issue. Business entity e-file waiver.

May result in undue financial burden. Calendar year filers enter the first day of the taxable year. The FTB has stated that if you are required to file electronically but have a number that begins with 4 you will need to file a Business Entity e-file Waiver Request and indicate you cannot file electronically due to technology constraints.

You will then print and mail Form 568 to this address. The e-file requirement The requirement only applies if the return is prepared using tax preparation software with the ability to e-file returns. Californias business entity e-file mandate requires all returns to be filed electronically if possible.

Request a business entity e-file waiver. If the California Franchise Tax Board states requires that you e-file but you have a number that begins with a 4 you need to file a Business entity e-file waiver request and indicate you cannot file electronically due to technology constraints. These returns are typically filed during calendar year 2021.

3 11 16 Corporate Income Tax Returns Internal Revenue Service

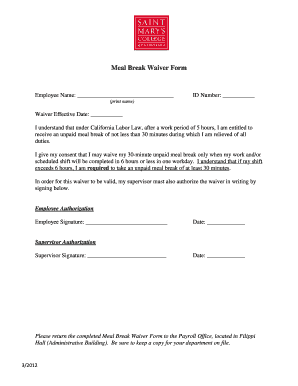

Meal Break Waiver Form Fill Out And Sign Printable Pdf Template Signnow

Https Www Ftb Ca Gov Forms 1346b Pdf

Https Www Revenue Wi Gov Taxforms2017through2019 2017 Formpw 1 Inst Pdf

3 42 10 Authorized Irs E File Providers Internal Revenue Service

4 61 14 Guidelines For Handling Delinquent Forms 1120 F And Requests For Waiver Internal Revenue Service

3 42 10 Authorized Irs E File Providers Internal Revenue Service

Http Tax Utah Gov Forms Pubs Pub 17 Pdf

Http Www Cafc Uscourts Gov Sites Default Files Cmecf Electronicfilingprocedures Pdf

3 42 10 Authorized Irs E File Providers Internal Revenue Service

4 61 14 Guidelines For Handling Delinquent Forms 1120 F And Requests For Waiver Internal Revenue Service

Should You Sign That Lien Waiver Checklist Faqs

Business Tax Renewal Instructions Los Angeles Office Of Finance

Https Icourt Idaho Gov Efile E File Faq Pdf

Fill Free Fillable Irs Pdf Forms

How Long Does The California E File Waiver Take Fo

Fill Free Fillable Irs Pdf Forms

Https Portal Ct Gov Media Drs Publications Pubsip 2021 Ip 2021 13 Pdf

4 61 14 Guidelines For Handling Delinquent Forms 1120 F And Requests For Waiver Internal Revenue Service

Post a Comment for "Business Entity E-file Waiver Request"