Business Expenses Are Subject To Auditing By The

Sometimes it feels like hundreds. These expenses are required to be recorded by receipts made at the time the expense is incurred.

Irs Audit Letter 3572 Sample 4

The information contained herein is subject to change without notice and is not warranted to be error-free.

Business expenses are subject to auditing by the. When businesses file their taxes there will likely be a cursory check to see if they indeed did meet the payroll expense threshold or the deferral of expenses threshold. Government then the following notice is. In general professional expenses associated with defending this type of audit are deductible as a miscellaneous itemized deduction on Schedule A of a tax return.

This deduction is limited to the regular federal per diem rate for lodging meals and incidental expenses and the standard mileage rate for car expenses plus any parking fees ferry fees and tolls. Favorite areas that auditors like to explore are meals travel and. Further it can lead to an audit.

Claim these expenses on Form 2106 Employee Business Expenses and report them on Form 1040 or Form 1040-SR as an adjustment to income. Some examples are CPF contributions wages renovation advertising etc. SAP Concur is adding a new auditing capability to Concur Expense that checks all expense reports for potential issues and irregularities.

Ophthalmic Business. The auditing process isnt initially expected to be too difficult. Finding available resourcesmoney and timefor a new expense is difficult.

Business expenses may be deductible or non-deductible. As a business owner you juggle dozens of responsibilities. However every growing business must seriously consider investing the time and money required for an annual audit of the company financial statements.

Likewise interest expenses are not allowed as a tax expense if paid to a personal holding company that is more than 50 owned by a majority shareholder of the corporation. Dubbed Verify the tool uses artificial intelligence models based on more than 1 trillion in historical spending data within Concurs platform along with machine learning to automatically flag anomalies for review by human auditors according to the. On April 28 Treasury Secretary Steven Mnuchin stated that any business receiving more than 2 million in PPP loans would be fully audited and spot checks would be made for smaller loans.

The tax code requires some expenses to be documented at the same time the expense occurs such as. The IRS will provide contact information and instructions in the letter you receive. Government or anyone licensing it on behalf of the US.

Any non-business related expenses claimed as business expenses will raise a flag. Businesses conduct audits to establish the existence truth or validity of the evidence or the logic used in the report that was presented by the accountant. Business expenses are expenses you have paid to run the business.

All charitable contributions need receipts that accurately reflect the value of the contribution. Entertainment and recreation expenses of a business are subject to a limit of 05 and 1 of net revenue for taxpayers engaged in selling goods and services respectively. Any business that receives a PPP loan may be audited.

As part of the loan conditions you allowed the lender to share tax information with the SBA for loan compliance and SBA loan reviews. These numbers can be easily seen on the return. If we conduct your audit by mail our letter will request additional information about certain items shown on the tax return such as income expenses and itemized deductions.

More than 750000 reporting includes items such as general and administrative expenses and. If this is software or related documentation that is delivered to the US. When deductible they reduce your taxable income and the amount of tax you need to pay.

They will be subject to reporting and possibly auditing. There are easy steps small business owners can take with their internal controls to audit-proof their business books. If you have too many books or records to mail you can request a face-to-face audit.

If you find any errors please report them to us in writing. It is important to note that to benefit from this deduction the taxpayer must itemize his or her deductions and the amount of all such deductions must exceed 2 of the taxpayers adjusted gross income AGI.

Basic Income Tax Formula Income Tax Income Income Tax Return

6 Reasons Why Businesses Get Audited And How To Avoid Them

How To Prepare Your Biz For Tax Time The Freelance Cfo Tax Time Bookkeeping Business Business Finance

The Ultimate Business Finance Checklist Business Finance Bookkeeping Business Small Business Finance

Monthly Audit Report Templates Audit Report Template Internal Audit

Expense Report Audit Chapter 3 R20b

Five Irs Audit Triggers For Small Businesses

Irs Audit Letter 3572 Sample 2

Top Tax Planning Tips For 2019 Income Tax Audit Services Tax

Top 5 Benefits An Audit Provides

Mobile Device Management Policy Template Policy Template Device Management Mobile Device Management

What Are The Steps In A Fraud Investigation Investigations Forensic Accounting Fraud

Haseebjee I Will Do Bookkeeping Using Quickbooks Online Desktop And Excel For 25 On Fiverr Com In 2021 Accounting And Finance Quickbooks Online Financial Accounting

Irs Audit Letter 2205 A Sample 11

Credit Cards Photography The Awesome Corporate Functional Guide Template Regarding Company Credit C Corporate Credit Card Policy Template Credit Card Companies

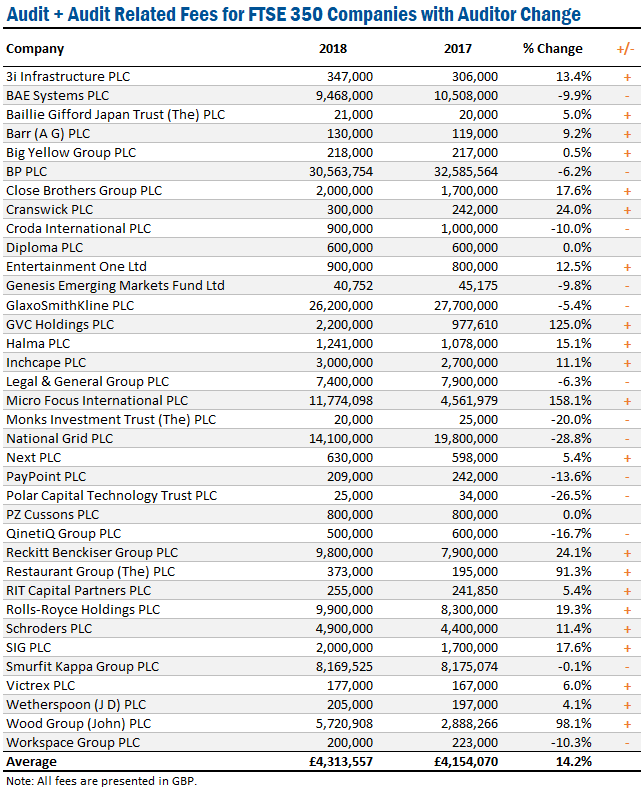

What Is The Cost To Do An Audit And How Much Time Does It Take To Complete An Audit

9 Different Types Of Audit Internal External Financial More

7 Small Business Tax Audit Triggers Owners Overlook Tri Merit

Post a Comment for "Business Expenses Are Subject To Auditing By The"