Business Use Of Home Gross Income

The square footage of the living room can be deducted as a business use of your home expense b. The deduction may not exceed business net income gross income derived from the qualified business use of the home minus business deductions.

:max_bytes(150000):strip_icc()/dotdash_Final_How_Do_Gross_Profit_and_Gross_Margin_Differ_Sep_2020-01-441a7bebdebb492a8ac3a1e3ea890ab9.jpg)

How Do Gross Profit And Gross Margin Differ

If however the gross income from that business is less than your total business expenses your deduction for certain expenses for the business use of your home is limited.

Business use of home gross income. As always please call us if you have any questions as were here to help and well be happy to run the calculations to determine your. Using the regular method qualifying taxpayers compute the business use of home deduction by dividing expenses of operating the home between personal and business use. If your gross income from the business use of your home equals or exceeds your total business expenses including depreciation you can deduct all your business expenses related to the use of your home.

They may deduct business use of their home expenses for the portion of the kitchen they use for business purposes. The deduction limit for the business use of your home is dependent on the gross income of the business primarily used in your home. The amount of the deduction computed using the simplified method cannot exceed the gross income derived from the qualified business use of the home for the taxable year reduced by the business deductions that are unrelated to the qualified business use of the home.

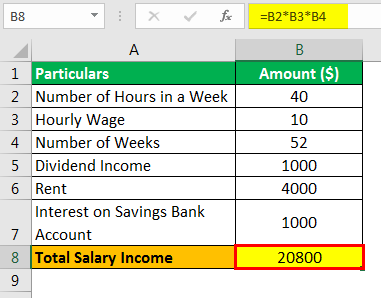

Revenue Procedure 2013-13 PDF allows qualifying taxpayers to use a prescribed rate of 5 per square foot of the portion of the home used for business up to a maximum of 300 square feet to compute the business use of home deduction. Your total home office expenses are 12000. Gross Business Income 10000.

Gross income limitation for the home office deduction on schedule C. The maximum deduction is 1500. If the calculated deductions exceed the yearly limit you can carryover the deductions to.

If your gross income from the business use of your home is less than your total business expenses your deduction for those indirect expenses deductible only from the business use of your home such as insurance utilities and depreciation with depreciation taken last is limited to the gross business income minus the sum of the following. 10 rows Standard deduction of 5 per square foot of home used for business. Your Gross Business Income is 10000.

As an employee you. Under the simplified method the standard home office deduction amount is 5 per square foot up to 300 square feet of the area used regularly and exclusively for business. I think that I have worked through the IRS speak in the instructions for schedule C but I would like some confirmation that I have got it right.

Using the simplified method 5 per square foot to calculate the part of the home that is used for business I come up with 500. You can only claim business-use-of-home expenses if your home is your principal place of business or you use a workspace in your home solely to earn your business income and use it regularly to meet with clients customers or patients. However business use is NOT considered to be for your employers convenience merely because it is appropriate and helpful.

An attorney uses the kitchen table in their home to write legal briefs and also to eat their meals. You are therefore subject to a deduction limit because your expenses are more than your income. Whether the business use of your home is for your employers convenience depends on all the facts and circumstances.

Under this safe harbor method depreciation is treated as zero and the taxpayer claims the deduction directly on Schedule C Form 1040 or 1040-SR. Once you have this final figure you can then Calculate Your Debt To Income DTI. Plus Business Use of Home Line 30 Qualifying Income.

The following is an example of how to use your income and expenses to determine your home office deduction limit. Your deduction of otherwise nondeductible expenses such as insurance utilities and depreciation with depreciation taken last is limited to the gross income from the business use of your home minus the sum of the following. If the taxpayer is an employee working at home for the convenience of the employer he or she first must determine the home-office-deduction limitation which is equal to the gross income from the business use of the home office.

See IRS Publication 587-Business Use of Your Home for more details. If your gross income from the business use of your home is less than your total business expenses your deduction for certain expenses for the business use of your home is limited. Self-employed taxpayers filing IRS Schedule C Profit or Loss from Business Sole Proprietorship first figure this deduction on Form 8829 Expenses for Business Use of Your Home.

If your gross income from the business operated or managed from your home equals or exceeds your total business expenses you can deduct all your business expenses. Line 29 is the tentative profit or loss after deducting all other.

/dotdash_Final_Gross_Profit_Operating_Profit_and_Net_Income_Oct_2020-01-55044f612e0649c481ff92a5ffff1b1b.jpg)

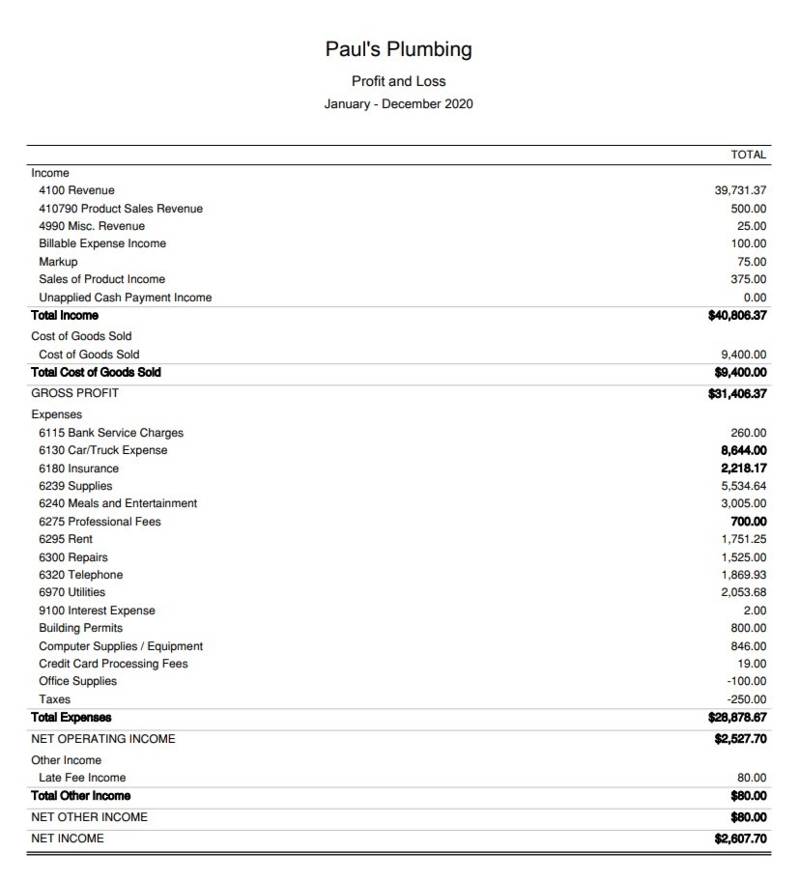

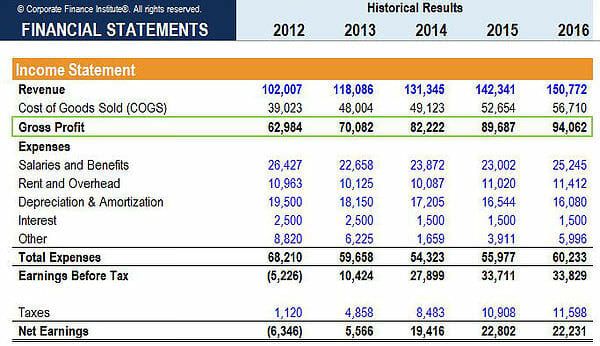

Gross Profit Operating Profit And Net Income

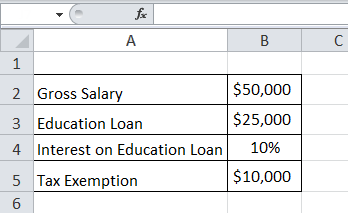

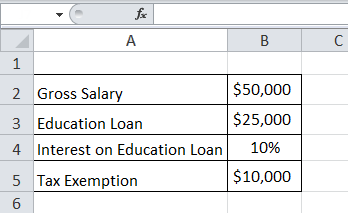

Gross Income Formula Step By Step Calculations

Step By Step Instructions To Fill Out Schedule C For 2020

Taxable Income Formula Examples How To Calculate Taxable Income

Sales Cost Of Goods Sold And Gross Profit

Irs Schedule C Instructions For 1099 Contractors Shared Economy Tax

Margins Measure Business Profitability And Reveal Leverage

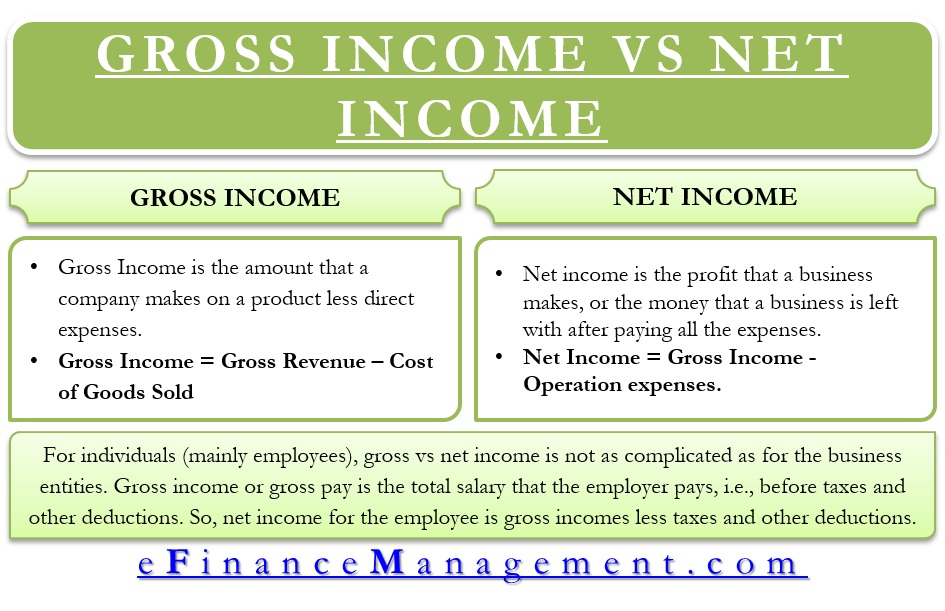

Difference Between Gross Income Vs Net Income Definitions Importance

What Is Gross Income For A Business

Gross Profit Margin Vs Net Profit Margin

Gross Profit Essentials You Need To Know About Gross Profit

Publication 583 01 2021 Starting A Business And Keeping Records Internal Revenue Service

Gross Profit Margin Vs Net Profit Margin

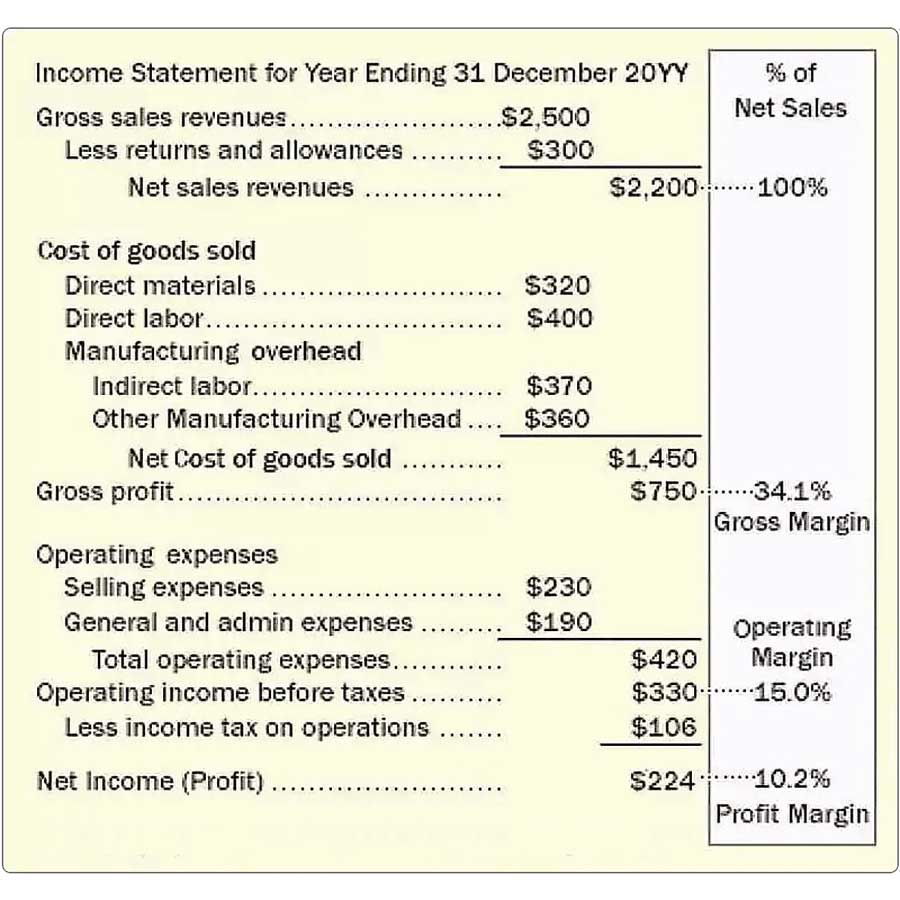

Calculating The Gross Margin Ratio For A Business For Dummies Income Statement Gross Margin Profit And Loss Statement

Home Business Worksheet Template Business Worksheet Business Tax Deductions Home Business

Schedule C Income Mortgagemark Com

Gross Income Definition How To Calculate Examples

What Is Gross Income For A Business

Post a Comment for "Business Use Of Home Gross Income"