Ohio Business Gateway It 941

OBG Bulk Filing Implementation Guide Part B File Types and Formats 4 Change History Date Change 6302014 The scope of Phase I of the OBGODT Bulk Filing project included only the Ohio IT-501Phase II the current iteration will include the Ohio IT-941 Ohio IT-942 Quarterly and Ohio IT-942 4th QuarterAnnual return types. OBG and the Ohio Department of Job Family Services are not recognizing February 1st as a timely date for filing fourth quarter reports and is assessing forfeiture and interest inappropriately.

Http Www Zillionforms Com 2016 I668404991 Pdf

When in Ready for Checkout select.

Ohio business gateway it 941. It provides tools that make it easier for any business owner to file and pay sales tax commercial activity tax employer withholding unemployment compensation contributions workers compensation premiums and municipal income taxes for nearly. Learn more about the Gateway. Complete Ohio IT 1 Application for Registration as an Ohio Withholding Agent and mail it to the address shown on the.

The Ohio Business Gateway will be unavailable on Saturday October 17th 2020 from 800PM to approximately 1200AM Eastern Time for routine maintenance and updates. In addition to the. Gateway services offer Ohios businesses a time- and money-saving online filing and payment system that helps simplify business relationship with government.

If a due date falls on a weekend or holiday the due date is the next business dayFor example. The Ohio Business Gateway is excited to announce our latest feature. Your business is required to electronically file a final withholding annual reconciliation either Ohio form IT 941 or IT 942 and submit all W-2 information to the Department of Taxation within 15 days of closing the business or the merger.

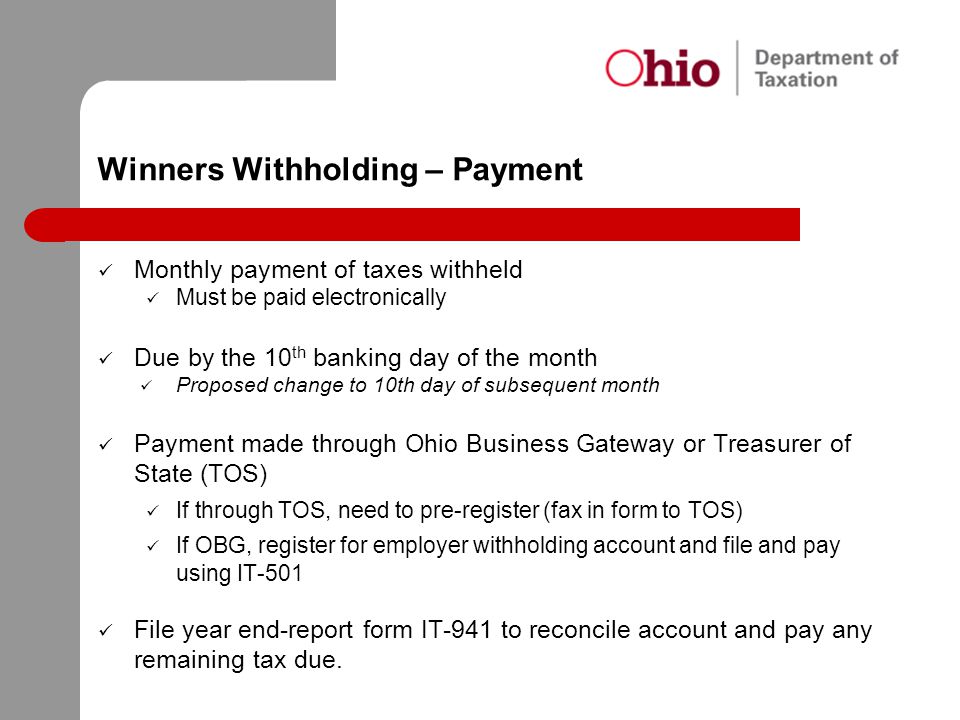

The April 2021 sales tax return which is normally due on May 23rd is due May 24th 2021 since the 23rd falls on Sunday. Employer Withholding tax payments Form IT 501 After selecting click on State Payments then select Ohio followed by Ohio Business Taxes then Form IT-501 Employer Withholding tax payments Form IT 941 After selecting click on State Payments then select Ohio. Return and Payment Due Dates.

Ohios one-stop online shop for business tax filing is designed to streamline the relationship between commerce and government. We apologize for any inconvenience this may cause. Call 1-888-405-4089 listen for the message and then press 2 to connect with an agent.

This system contains State of Ohio and United States government information and is restricted to authorized users ONLY. Bulk filing enables companies to submit large numbers of filings in a single file. Ohio requires two different filings in this regard and each has a different due date.

Unauthorized access use misuse or modification of this computer system or of the data contained herein or in transit to and from this system is strictly prohibited may be in violation of state and federal law and may be subject to administrative action civil and. Based on your feedback last summer this was the most requested feature to be implemented in future upgrades to the Gateway. Bulk filing is used primarily by payroll companies to submit employer withholding taxes to the Ohio Department of Taxation.

Ohio businesses can use the Gateway to access various services and electronically submit transactions and payments with many state agencies. Ohio Business Gateway Electronic Filing services offer Ohios businesses a time- and money-saving online filing and payment system that helps simplify business relationship with government agencies. By selecting Continue you will create a brand new account in the Ohio Business Gateway which only should be done if you have never accessed the Gateway in the past.

Employer Withholding tax payments Form IT 941 After selecting click on State Payments then select Ohio followed by Ohio Business Taxes then Form IT-941 Sales Use tax payments After selecting click on State Payments then select Ohio followed by Ohio Business Taxes then Sales and Use Tax. If you have used the previous Gateway shown below but this is your first time visiting the modernized Gateway click the Cancel button and enter the username and password you have always used to access the Gateway. Gateway services offer Ohios businesses a time- and money-saving online filing and payment system that helps simplify business relationship with government agencies.

First if you are on a monthly or quarterly payment schedule submit Form IT-941 Ohio Employers Annual Reconciliation of Income Tax Withheld. Starting June 30th 2019 you can save edit or delete your ACH or Credit Card information once with your account and it is readily available every time. Your business is required to electronically file a final withholding annual reconciliation either Ohio form IT 941 or IT 942 and submit all W-2 information to the Department of Taxation within 15 days of closing the business or the merger.

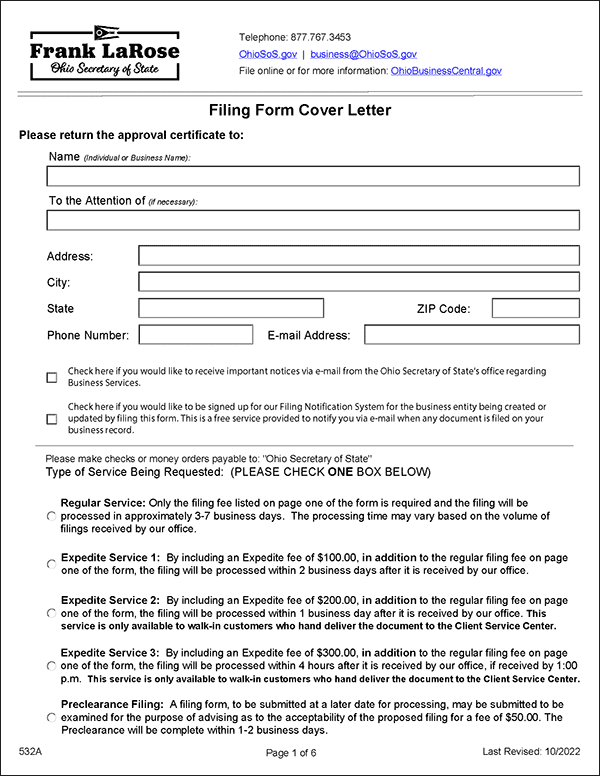

Register online through the Ohio Business Gateway OBG at businessohiogov and follow the instructions for Ohio Taxation New Account Registration. Reconciliation Ohio form IT 941 for the old account and you will need to obtain a new withholding account number. The Gateway is a nationally-recognized collaborative initiative of state and local government agencies and an important part of Ohios digital government strategy.

The Gateway is capable of receiving bulk filings for the following employer withholding services. These filings should include withholding liabilities and payments for any portion of the year employees earned compensation from your business. These filings should include withholding liabilities and payments for any portion of the year employees earned compensation from your business.

Employer Withholding Tax and Sales Use Tax are payable by credit card over the Internet at the ACI Payments Inc website. Save time and money by filing taxes and other transactions with the State of Ohio. The Ohio Business Gateway is a nationally-recognized collaborative initiative of state and local government agencies and an important part of Ohios digital government strategy.

You can obtain a new Ohio withholding account number by completing a registra-tion on the Ohio Business Gateway by calling our Registration Unit at 1-888-405-4089.

How To File Sales Tax Department Of Taxation

Llc Ohio How To Start An Llc In Ohio Truic

Ohio It 501 Fill Out And Sign Printable Pdf Template Signnow

Https Www Tax Ohio Gov Portals 0 Forms Employer Withholding 2014 Wth Wh1 Pdf

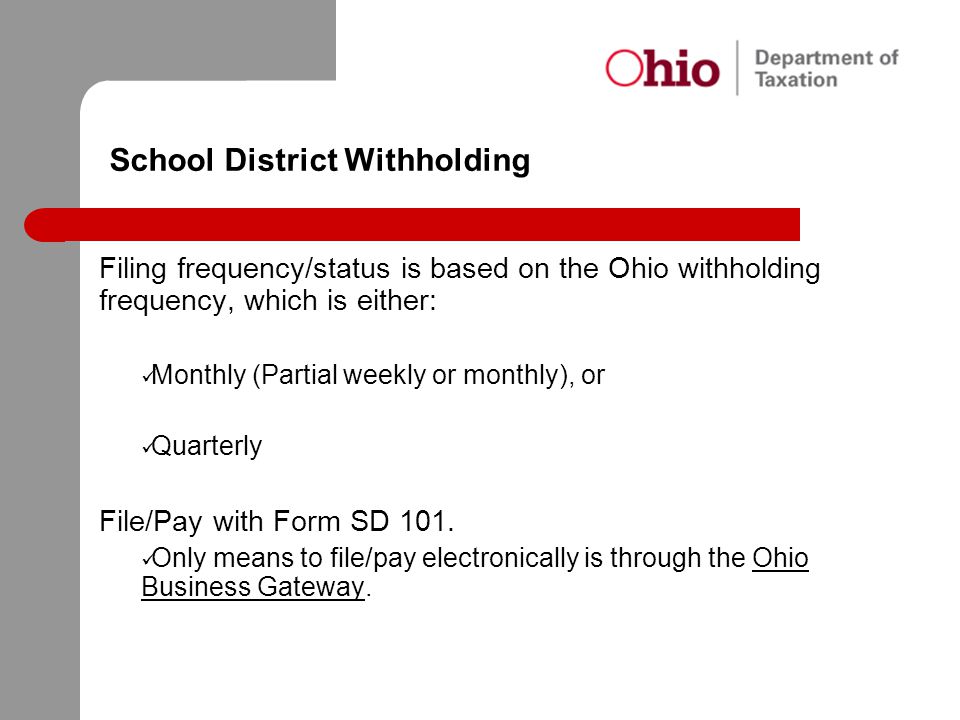

Https Tax Ohio Gov Portals 0 Research Vta Nov2017 Session2 Pdf

Https Tax Ohio Gov Portals 0 Employer Withholding General 20guidelines 2020 20ohio 20employer 20withholding 20and 20school 20district 20withholding 20tax 20filing 20guidelines 1 0 Pdf

Business Closing Department Of Taxation

Https Www Tax Ohio Gov Portals 0 Forms Employer Withholding 2019 Wth Instructions Pdf

Ohio Department Of Taxation S Casino Training Ppt Download

Ohio Department Of Taxation S Casino Training Ppt Download

How To Start A Business In Ohio Financeviewer

2012 Form Oh Ohif 1 Fill Online Printable Fillable Blank Pdffiller

Starting A Business In Ohio Financeviewer

Http Www Tax Ohio Gov Portals 0 Forms Employer Withholding 2014 Wth Instructions Pdf

Starting A Business In Ohio Financeviewer

Ohio Department Of Taxation S Casino Training Ppt Download

Ohio Department Of Taxation S Casino Training Ppt Download

Ohio Department Of Taxation S Casino Training Ppt Download

Ohio Department Of Taxation S Casino Training Ppt Download

Post a Comment for "Ohio Business Gateway It 941"