Business Attire Tax Deductible

Add all the deductions in this category togetherother deductions include work-related travel work tools and professional journalsand subtract two percent of your adjusted gross income. Uniforms which double as protective clothing required in a hazardous work environment are likely deductible.

Tax Deductible Work Clothes Yes For Lady Gaga But Not For You

And Uniforms with company logos or emblems may be not suitable for everyday use.

Business attire tax deductible. So if you spent 20 on the outfit and it qualifies under the IRS definition of work clothes then you may deduct the entire amount. This includes the cost of the clothing itself and the cost of adding your business logo to the item. As an example two common types of deductible clothing include purchases of work boots and hard hats in the construction industry and uniforms that you wear in a restaurant or other business.

If the clothes are suitable to wear outside of work then the dry cleaning expenses or business attire are not tax deductible. Clothing that promotes your business is deductible as a promotional expense. First it must be required for work.

The IRS excluded most but did allow for 200 of deductions. It makes no difference that your work requires you to be fashionably or expensively dressed. Work clothes are 100 percent deductible from your return.

Theyre nondeductible personal expenses. Yes some subscriptions are tax deductible. Does the IRS allow other work-related accessories and tools as tax deductions.

The IRS considers business attire a miscellaneous expense. It makes no difference that your work requires you to be fashionably or expensively dressed. Work clothes are among the miscellaneous deductions that are only deductible to the extent the total exceeds 2 percent of your adjusted gross income.

You can claim this promotional cost as a miscellaneous deduction on your tax. The IRS prohibits write-offs for clothing thats adaptable to general wear off the job. The IRS prohibits write-offs for clothing thats adaptable to general wear off the job.

A good rule of thumb is that if you can wear it anywhere else then you cannot deduct it. If your AGI is 100000 your miscellaneous. Generally clothing costs arent allowable as ordinary and necessary business expenses.

You must wear them as a condition of your employment. Basically if you can wear the clothing for something other than your business the IRS says it doesnt count as a business deduction. Second it must NOT be suitable for everyday use.

Clothing you buy for work is one of those grey areas that is often not tax-deductible unless its a required uniform or things like that. When Clothing Counts as a Deduction. Theyre nondeductible personal expenses.

Generally clothing costs arent allowable as ordinary and necessary business expenses. Its true that you can deduct the amount you spent on the purchase and upkeep of work clothes but your clothing must meet two requirements before you can claim the costs as an other expense on the Schedule C tax form where you report self-employment income and expenses. Business-expense deductions are not allowed for clothing described as professional or business attire such as business suits.

As such your expenses must add up to more than 2 percent of your adjusted gross income AGI. The more restrictions a small business places on the condition of a uniform and its exclusive use at work the more likely it is to be considered a deduction. As to the remaining clothes items we find that the majority of them are adaptable for general and personal wear and therefore are not a.

Each subscription must be directly related to your business to be claimed as a deduction. Promotional attire for your employees. Professional technical medical or trade journals or magazines related to your business.

If you own a business or are self-employed you can deduct the following types of subscriptions as a business expense. Clearly the underwear does not qualify as a business expense.

The Ultimate Guide To Writing Off Clothing Expenses

Small Business Tax Deductions Tax Deductible Business Expenses

Is Your Work Clothing Tax Deductible No Man Walks Alone

Are Work Clothes Tax Deductible For Self Employed The Turbotax Blog

Claiming Work Clothes As A Business Expense Mbp Advisors Accountants

Clothing For Work Can I Write It Off The Bottom Line Cpa

Can I Deduct My Work Clothes Sweetercpa

Can I Deduct Work Clothes On My Tax Returns

Can I Deduct My Clothing As A Business Expense Kpmg Spark

Write Your Clothes Off On Your Taxes Yes If You Meet This Irs Test

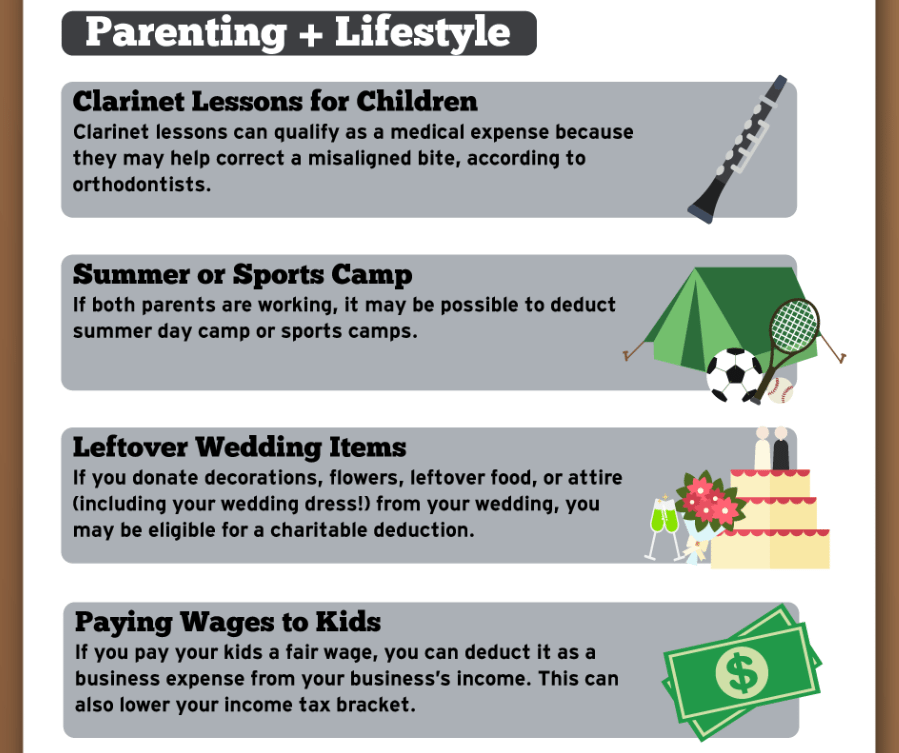

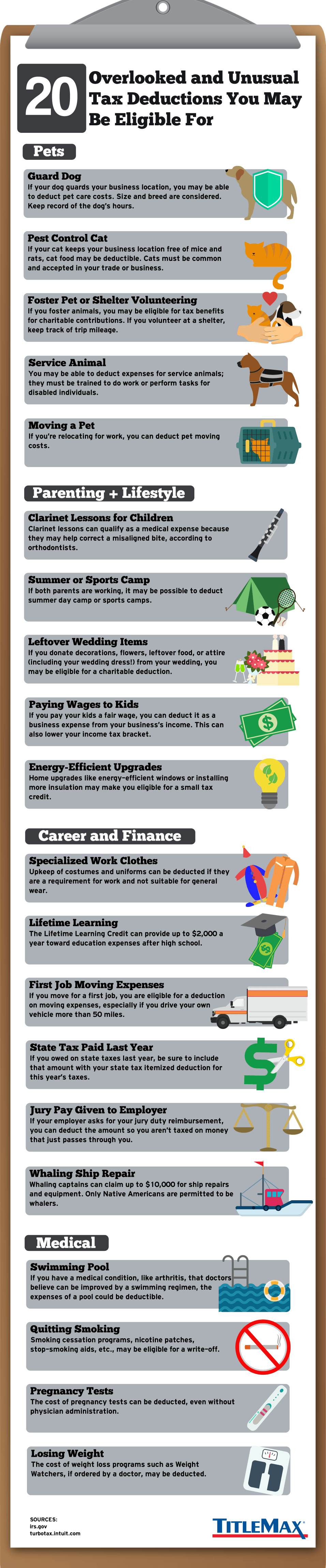

20 Overlooked And Unusual Tax Deductions You May Be Eligible For Titlemax

Small Business Tax Deductions Tax Deductible Business Expenses

Small Business Tax Deductions Tax Deductible Business Expenses

20 Overlooked And Unusual Tax Deductions You May Be Eligible For Titlemax

The Ultimate Guide To Writing Off Clothing Expenses

Can You Write Off Work Clothes Bench Accounting

Are Work Clothes Tax Deductible For Self Employed

Are Nursing Uniforms Tax Deductible Silver Lining Scrubs Silver Lining Scrubs

Small Business Tax Deductions Write Offs Wcg Cpas

Post a Comment for "Business Attire Tax Deductible"