Business Valuation Industry Multiplier

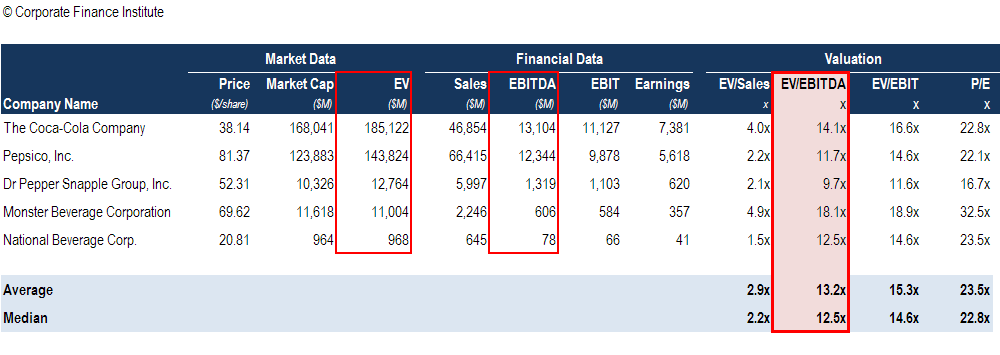

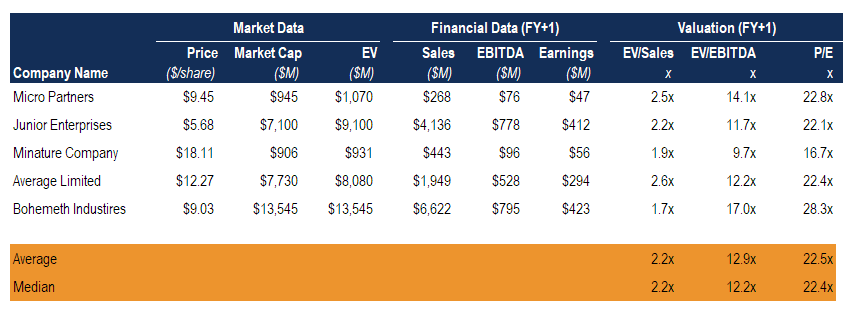

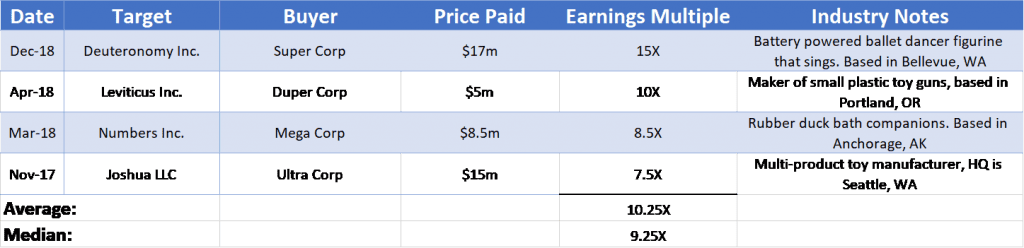

Take a simple measurement such as revenue or EBITDA earnings before interest tax depreciation and amortization. One way business appraisers evaluate a company is to look at how much others have paid for similar businesses relative to various earnings measures.

What S Your Business Worth Business Valuation Calculator

When it comes to calculating an exit valuation the most common and basic formula that is used is Valuation EBITDA x Multiple sometimes EBITDA or profit is substituted for revenue.

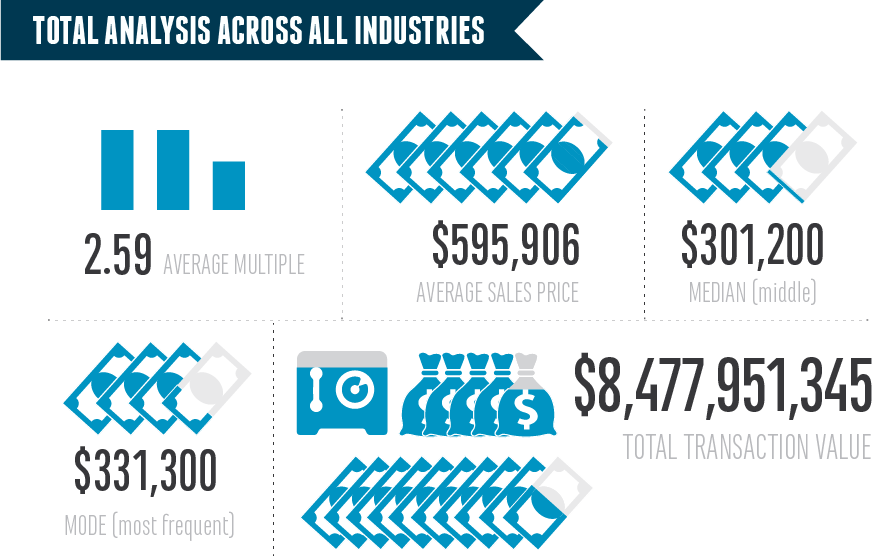

Business valuation industry multiplier. This is similar to the concept behind bonds or bank accounts. For example if your companys adjusted net profit is 100000 per year and you use a multiple like 4 then the value of the business will be calculated as 4 x 100000 400000. The average multiplier for all businesses with a value below one million dollars is between 23 and 27 depending on the database source.

98 rows These patterns industry specific multiples determine the current value of a company. Valuation multiples are used when a Future Maintainable Earnings valuation is conducted. Multipliers or Earnings Multipliers are used in business valuations as way of multiplying the earnings of a business to reflect the true value of a business.

In profit multiplier the value of the business is calculated by multiplying its profit. This multiplier is applied or multiplied against what is known as Owners Discretionary Earnings. Only positive EBITDA firms.

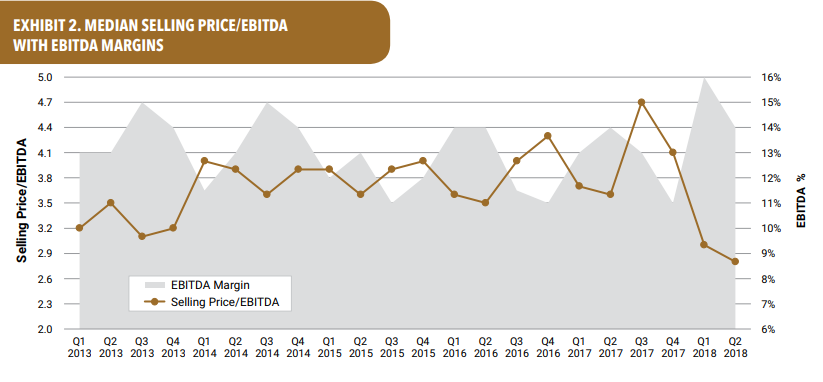

If a valuation is required where the business has incurred a recent loss or there are other complexities a discounted cash flow valuation technique may be more appropriate. Apply a multiplication factor based on industry sales or comparable companies in the sector. The industry of the business being valued can also have an effect on the choice of an appropriate multiple.

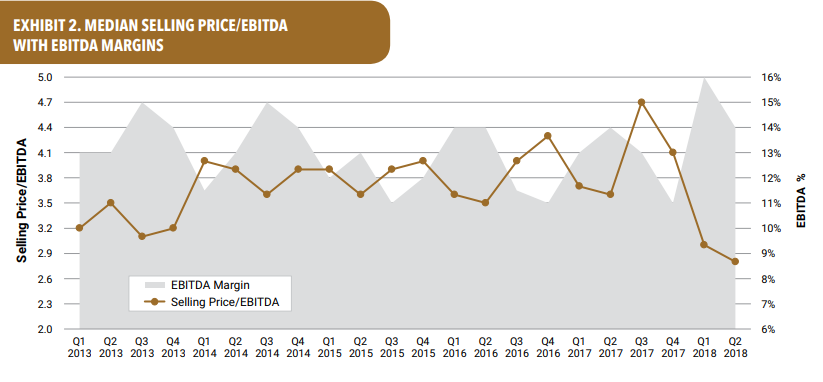

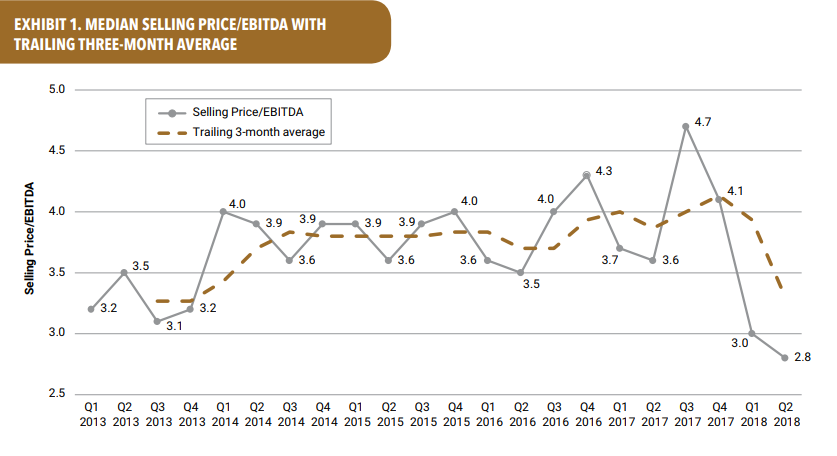

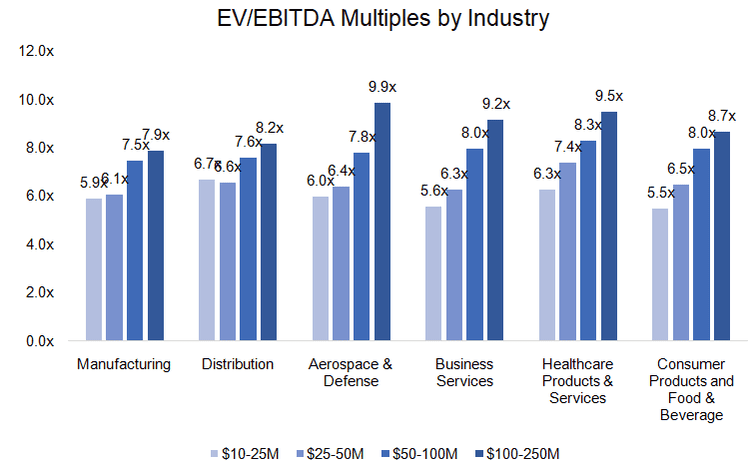

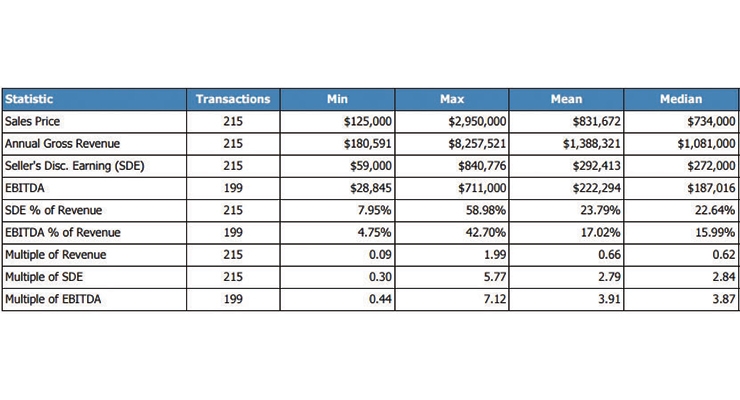

198 rows Valuation multiples by industry including EVRevenue and EVEBITDA multiples. Selling price divided by EBITDA earnings before interest taxes depreciation and amortization is a commonly used valuation multiple. The range of EBITDA multiples for EBITDA between 1000000 and 10000000 is 33x to 8x with the averages ranging from 45x to 65x.

221 rows For these industries a higher level business sector multiple is applied. This is a common valuation methodology when valuing micro and small to medium sized businesses. SDE multiples usually range from 10x to 40x.

Here we will focus on the multiples approach which follows two steps. Generally the multiplier is calculated by looking at risk and how the business will continue to generate cash flow for the new owner and the perceived desirability and growth prospects of the firm. Business Valuation Multiples by Industry Selling Tips Whether you are thinking of possibly selling your business and want to know how to maximize its value or if you just want to know how much your business is worth its important to understand that many different factors go into business valuations and that these factors vary.

Ebitda Multiple Formula Calculator And Use In Valuation

European Industry Market Multiples

Trading Multiples Definition Analysis Examples Of Trading Multiples

European Industry Market Multiples

Business Valuation Multiples By Industry Nash Advisory

Ebitda Multiples By Industry New Statistics On Private Company Selling Prices Business Valuation Resources

The Main Way To Value A Small Business Genesis Law Firm

Ebitda Multiples By Industry New Statistics On Private Company Selling Prices Business Valuation Resources

Multiples The Market Approach To Valuation Chinook Capital

What S The Value Of My Business The Ins And Outs Of Ebitda Multiples Cronkhite Capital

Ebitda Multiples By Industry Chart

Ebitda Multiples For Manufacturing Companies Microcap Co

What Factors Influence The Business Valuation Multiplier Multiples

Most Relevant Multiples Valuation Multiples By Industry Download Table

Business Sde Seller S Discretionary Earnings Business Brokers

What S The Value Of My Business The Ins And Outs Of Ebitda Multiples Cronkhite Capital

North American Industry Market Multiples Valuations Insights First Quarter 2019

How To Value A Business Based On Revenue Nash Advisory

Hey Rock What S The Multiple For The Label Industry Label And Narrow Web

Post a Comment for "Business Valuation Industry Multiplier"