Ohio Business Gateway Pay Sales Tax

Financial Institutions Tax FIT Gross Casino Revenue Tax. EASY PAYMENT VIA PHONE INTERNET OR THE OHIO BUSINESS GATEWAY.

Ohio Department Of Taxation S Casino Training Ppt Download

Register for a vendors license File and pay sales tax and use tax.

Ohio business gateway pay sales tax. The electronic payment options through the OBG are ACH Debit or credit card. File and pay sales tax and use tax. IT-941 Annual Reconciliation of Income Tax Withheld.

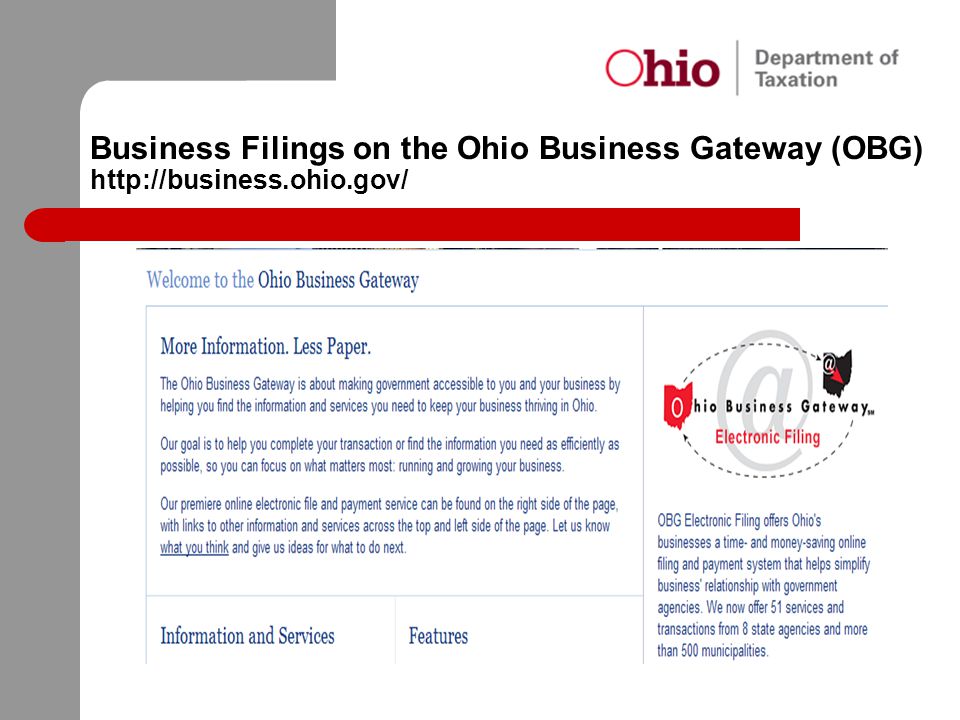

Ohio Business Gateway - Use the Ohio Business Gateway to register file and pay many types of taxes and other transactions including sales and use tax employer withholding commercial activity tax unclaimed funds and unemployment compensation tax. TeleFile is available for vendors who have a regular county vendors license license number which begins with 01 88 and are filing for a single county. If you have used the previous Gateway shown below but this is your first time visiting the modernized Gateway click the Cancel button and enter the username and password you have always used to access the Gateway.

File Unemployment Compensation Tax. Ohio Business Gateway Electronic payments can be made online through the Ohio Business Gateway located at businessohiogov. IT-942 Quarterly and 4th QuarterAnnual Reconciliation of Income Tax Withheld.

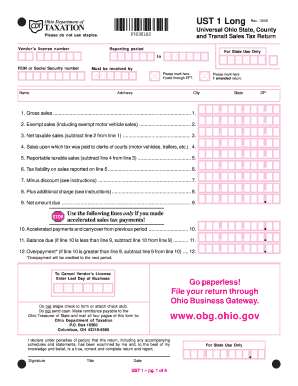

Ohio allows merchants to keep a small percentage of the sales tax they collect as a collection discount which serves as compensation for the work required to comply with the Ohio sales tax regulations The collection discount is 075 of the tax that is due. Two file upload options allow businesses with sales in multiple counties to file a single universal sales tax. The sales tax return UST-1 can be filed and paid at the same time through the.

Register for file and pay Commercial Activity Tax. Register for a vendors license File and pay sales tax and use tax Register for file and pay Commercial Activity Tax. To pay by credit card using a touch-tone telephone call the toll-free number 1-800-2PAY-TAX 1-800-272-9829.

You can file sales tax online Ohio Department of Taxation and also remit your payment through their online system. You have two options for filing and paying your Ohio sales tax. The Ohio sales and use tax applies to the retail sale lease and rental of tangible personal property as well as the sale of selected services in Ohio.

For KWHMCF Tax the 9th digit is assigned by the Department of Taxation. The Ohio Business Gateway allows all sales and use tax returns to be filed and paid electronically. Ohio Business Gateway - Use the Ohio Business Gateway to register file and pay many types of taxes and other transactions including sales and use tax employer withholding commercial activity tax unclaimed funds and unemployment compensation tax.

Your Ohio Sales Tax Filing Requirements. Ohio businesses can use the Ohio Business Gateway to access various services and submit transactions and payments with many state agencies such as. Heres a step-by-step guide on How to File an Ohio Sales Tax Return.

TeleFile is available for vendors who have a regular county vendors license license number which begins with 01 88 and are filing for a single county. School District Withholding Tax Returns. Nationally-recognized collaborative initiative of state and local government agencies and an important part of Ohios digital government strategy.

ACH Debit is available through the Ohio Business Gateway. IT-501 Payment of Income Tax Withheld. In transactions where sales tax was due but not collected by the vendor or seller a use tax of equal amount is due from the customer.

Each option is explained below. Income Municipal Income Tax for Electric Light Companies and Telephone Companies. By selecting Continue you will create a brand new account in the Ohio Business Gateway which only should be done if you have never accessed the Gateway in the past.

Electronic sales tax filing through the Ohio Business Gateway OBG is now much easier. Will I be subjected to penalties or interest if Im late paying my taxes via EFT. At a total sales tax rate of 725 the total cost is 37538 2538 sales tax.

Commercial Activity Tax CAT Corporation Franchise Tax No Longer in Effect Employer Withholding. Sales and use taxpayers have several options for remitting the tax collected from customers. Counties and regional transit authorities may levy additional sales and use taxes.

The Ohio Business Gateway allows all sales and use tax returns to be filed and paid electronically. Register for a vendors license. Can I remit my School District Income Taxes via EFT.

Yes but only on the Ohio Business Gateway website. This is also known as payment by electronic check Credit card The Department offers credit card payment options in cooperation with ACI Payments Inc. The state sales and use tax rate is 575 percent.

This can verified by calling the Ohio Department of Taxation at 1-888-405-4089. The Finder - This handy tool allows business owners to look up local income tax and sales tax rates for any address in the. Enter Ohios Business Tax Jurisdiction Code 6447 when.

A convenience fee is charged for credit card payments. Ohio businesses can use the Ohio Business Gateway to access various services and submit transactions and payments with many state agencies such as. Save time and money by filing taxes and other transactions with the State of Ohio online.

When calculating the sales tax for this purchase Steve applies the 575 state tax rate for Ohio plus 15 for Montgomery county. Credit card payments may be made via phone Internet or the Ohio Business Gateway. File online - The state of Ohio requires merchants to file sales tax online.

Http Www Ci Miamisburg Oh Us Index2 Php Option Com Docman Task Doc View Gid 489 Itemid 119

Useful Important Links Sbdc Small Business Development Center Akron Ohio Sbdc Small Business Development Center Akron Ohio

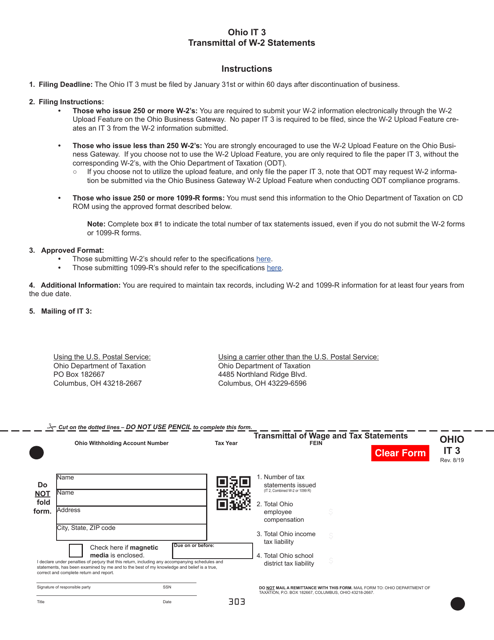

Form It3 Download Fillable Pdf Or Fill Online Transmittal Of Wage And Tax Statements Ohio Templateroller

Oh I Received A Sales Tax Delinquency Penalty For Over 3 000 For A Business That I Closed 18 Months Ago I Don T Understand Why This Happened And Could Really Use Some Help

Oh I Received A Sales Tax Delinquency Penalty For Over 3 000 For A Business That I Closed 18 Months Ago I Don T Understand Why This Happened And Could Really Use Some Help

Ohio Department Of Taxation S Casino Training Ppt Download

Ust 1 Form Ohio Fill Out And Sign Printable Pdf Template Signnow

Ohio Llc Steps To Form An Llc In Ohio

Https Equineaffaire Com Wp Content Uploads 2020 01 Ohio Sales Permit Pdf

How To File Sales Tax Department Of Taxation

Ohio What Is My Login And Passcode Taxjar Support

Ohio What Is My Login And Passcode Taxjar Support

Starting A Business In Ohio Financeviewer

Ohio Department Of Taxation Posts Facebook

Http Www Ohiolions Org Images Docs Procedures Info 20 20sales 20tax Pdf

Oh I Received A Sales Tax Delinquency Penalty For Over 3 000 For A Business That I Closed 18 Months Ago I Don T Understand Why This Happened And Could Really Use Some Help

How To File Sales Tax Department Of Taxation

Post a Comment for "Ohio Business Gateway Pay Sales Tax"