Business Use Of Home Lacerte

Because the client can take depreciation the portion of the property used for business the sale is. For more information press F1 on this field.

Youtube Tax Software Fixed Asset Tax

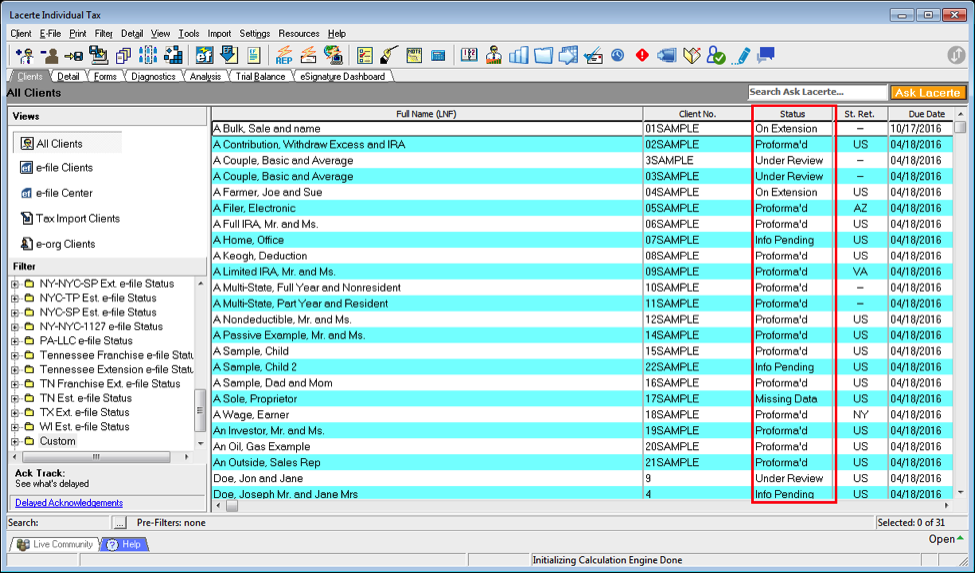

The information converted is captured in a way that converts to 2020 correctly once the file has been Proformad.

Business use of home lacerte. Allowable home-related itemized deductions claimed in full on Schedule A. Mortgage interest real estate taxes. Business Use of Home 8829 - The Lacerte conversion program nets the Carryovers of Unallowed Expenses reported on Form 8829 lines 41 and 42 with the carryovers reported on Home Office Wkst lines 39 and 40.

No home depreciation deduction or later recapture of depreciation for the years the simplified option is used. Divide the sum from Step 1 by 12. Tax law also provides that you can depreciate the portion of your property used for business purposes.

We will export financial data from QuickBooks to Lacerte tax for both a sole proprietorship and an S Corporation. Process to the 2019 Lacerte Tax program manually enter these items in your 2019 converted data files once the Proforma process of transferring from 2018 to 2019 is complete. 587 - Business Use of Your Home.

Suspended losses Passive Non-Passive from Schedules. For most businesses you simply divide the total square footage of your house by the square footage used for your business. Business Use of Home 8829 - The Lacerte conversion program nets the Carryovers of Unallowed Expenses reported on Form 8829 lines 41 and 42 with the carryovers reported on Home Office Wkst lines 39 and 40.

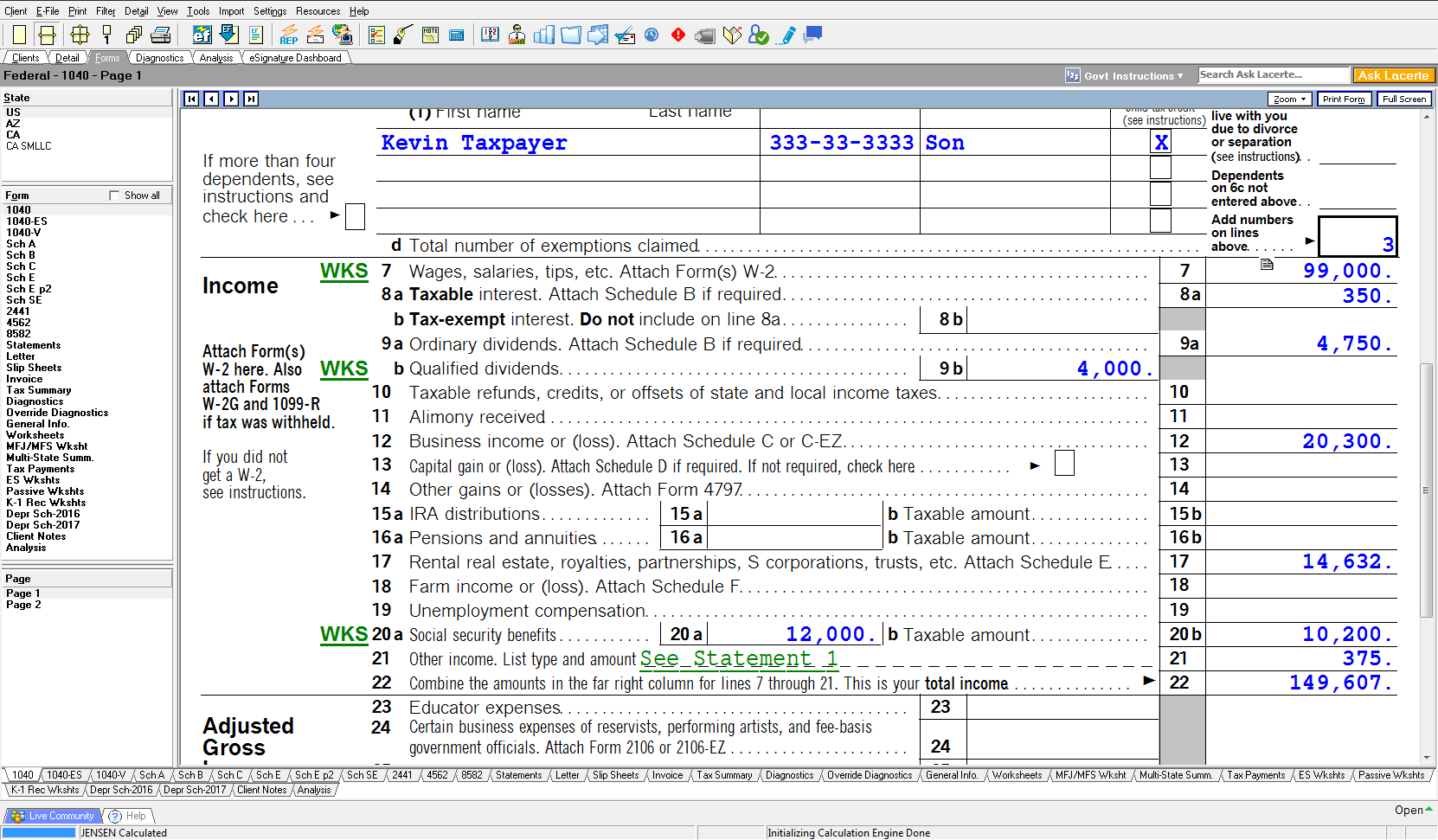

Up to 15 cash back Lacerte tax software is owned by Intuit and a 30-day free trial may be available to test out Lacerte tax software as well. Click on Business Use of Home 8829. In Lacerte go to Screen Business Use of Home.

If there is more than one Form 8829 or an additional Home Office Wkst. The standard mileage rate. If there is more than one Form 8829 or an additional Home Office Wkst.

On the left-side navigation menu select Deductions. If you file Schedule F Form 1040 enter this amount on line 32 Other expenses of Schedule F Form 1040 and enter Business Use of Home on the line beside the entry. Ft use that lower area Step 2.

However if the qualified business use is providing daycare services see the next FAQ. Prosystem FX to Lacerte The converted client file is not intended to duplicate or reproduce your 2019 return. Standard deduction of 5 per square foot of home used for business maximum 300 square feet.

If you run a daycare facility in your home in an area thats not exclusively used for the business youll have to make further adjustments. The prescribed rate is 500. Follow the forms instructions and you end up with the total allowable expenses for the business use of your home.

Go to Screen 29 Business use of Home. You can generally figure the amount of your deductible car expense by using one of two methods. If business use area is less than 300 sq.

Add 300 square feet for each month of business use. Follow these steps to enter business use of home information. How the simplified method works.

The allowable square footage is the smaller of the portion of a home used in a qualified business use of the home or 300 square feet. If you use your car only for business purposes you may deduct its entire cost of ownership and operation subject to limits discussed later. Enter a 2 in 1use actual expenses default 2elect to use simplified method.

400 07 280280 2000 14. The simplified method allows a standard deduction of 5 per square foot of home used for business with a maximum of 300 square. Line 34 is the total other than casualty losses allowable as a deduction for business use of your home.

The course will also demonstrate how to export financial data to Excel and create supporting tax worksheets. Scroll down to the Business Use of Home 8829 section. When you get to the Miscellaneous Supplemental Expenses screen enter the allowable expenses for the business use of your home from the worksheet you used from IRS Pub.

However if you use the car for both business and personal purposes you may deduct only the cost of its business use. Multiply the quotient from Step 2 by 5. For example you could depreciate 15 of your homes value if your office takes up 15 of your homes square footage.

Go to the Input Return tab. If your client sold a home that they also used for business the sale is considered a single transaction rather than separate sales of business and personal property. You list your total business income along with your deductible expenses.

Select the Form Click on arrow to select from list to link the home to. C E F K-1 Par K-1 Scorp K-1 Fid. Items to Note 1040 Individual.

The business percentage for home 2 is computed as follows. Locate the Business Use of Home 8829 section. The business use percentage for home 1 is computed as follows.

Youre effectively claiming a tax deduction equal to the cost of the portion your home dedicated to your office.

Lacerte Professional Tax Software Tax Software Software Tax

Lacerte Pricing For Pay Per Return Pay As You Go Intuit Accountants

Lacerte Dms Users Are Switching To Efilecabinet For 3 Major Reasons Cloud Storage Small Business Saving Money

Business Use Of Home Multiple Businesses One Home Intuit Accountants Community

Business Use Of Home Multiple Businesses One Home Intuit Accountants Community

Tax Preparer Resume Sample Job Resume Samples Resume Tax Preparation

Pin By Sagenext Infotech On Infographics Hosting Infographic Learning

Pin On Lacerte Tax Preparation Lacerte Tax Software

Lacerte Reviews And Pricing 2021

Publication 587 2013 Business Use Of Your Home Daycare Business Plan Small Business Advice Business

What Is The Main Difference Between Lacerte And Proseries

Lacerte And Proseries Enhancements For Tax Year 2018 Insightfulaccountant Com

Why You Should Take Lacerte To The Cloud This Tax Season Tax Software Tax Season Cloud Services

4 Tips And Tricks For Lacerte To Save You Time Tax Pro Center Intuit

Handling Multi State Returns In Lacerte Tax Pro Center Intuit

I Wanna Print Form Sch A Form 8829 And Form Stat Intuit Accountants Community

Quickbooks Accountant And Lacerte Help You Work Smarter

Get Greatest Advantages With Cloud Facilitated Lacerte Tax Software Http Www Hitech Cloud Com Lacerte Hosting Php Tax Software Tax Preparation Hosting

Post a Comment for "Business Use Of Home Lacerte"