When Does Irs Send A Certified Letter

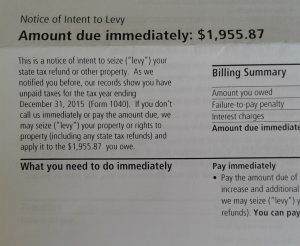

Below are some of the notices the government will send in order throughout the collections process. The government will give you 30 days to contact them to settle your delinquent tax debtThe longer you wait more letters will follow.

Why Use Certified Mail To Mail In Tax Forms Stamps Com Blog

If you determine the notice or letter is fraudulent please follow the IRS assistors guidance or visit our Report Phishing page for next steps.

When does irs send a certified letter. If when you search for your notice or letter using the Search on this page it doesnt return a result or you believe the notice or letter looks suspicious contact us at 800-829-1040. It also can happen before the IRS files a lien or assigns a Revenue Officer to visit you unannounced at your home or business. One last comment.

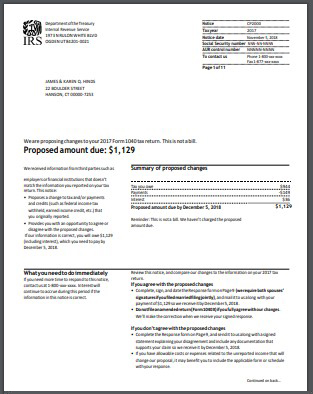

TaxPayer Rights By Artour Safarian November 8 2019. Nevertheless a notice from IRS is not always a warning that he or she is being audited. You are due a larger or smaller refund.

For example the first line of text might say We have selected your state or federal income tax return for the year shown above for examination. Never send more than one item other than a cover letter check and returnwhich is like one item in the same envelope. Generally when a person receives a letter from IRS he or she thinks that probably being audited.

An IRS audit letter is certified mail that will clearly identify your name taxpayer ID form number employee ID number and contact information. Received a Certified Letter From IRS. When they were lucky the IRS received all three and acted upon them individually.

IRS sends certified mail to tell you that your audit has ended up with you owing money and you have to either go to Tax Court within 90 days or your are going to get a bill OR you have a delinquent tax liability and if you dont promptly pay it or make other arrangement that are satisfactory to IRS it is going to collect the account by levy on your assets. The writer has known of people who claim to have sent two or more tax returns or other documents in the same envelope. Congress requires the IRS to send you a certified letter before they levy or garnish you.

This letter is typically an IRS Certified Letter sent by certified mail to the taxpayer. As it is mentioned before that IRS sends you a letter when you owe money. This Certified IRS Letter serves as a prelude to the Final Levy Notice.

2 days agoIRS officials announced on June 7 that it has started sending letters to more than 36 million American families who may be eligible to receive the monthly credits The actual payments will. The reason the irs certified mails this determination letter is because the irs is statutorily required to send it by registered or certified mail and after the date of mailing you have 90 days to protest this determination by filing a petition to tax court after which the irs. Collection Letters That Result in a Certified Letter from the IRS.

IRS has to send you a notice by certified mail prior to serving a levy to collect delinquent taxes. Generally speaking the IRS sent you certified mail to show it attempted to give you notice of whatever issue the IRS wants to address with you. The Internal Revenue Service will only contact taxpayers with form letters if they need to communicate something important to you such as.

668Y This is an official Notice of Tax Lien. The IRS sent you certified mail because the IRS wants to protect itself in case among other reasons you argue the IRS failed to give you notice. When Does IRS Send You A Letter.

This IRS letter also serves as the first notification that they plan to take funds from a bank account. If your are audited and cant come to an agreement with the auditor it has to send a Statutory Notice of Deficiency before assessing additional tax.

Why Would I Get A Certified Letter From The Irs

3 Ways To Write A Letter To The Irs Wikihow

Received A Notice From The Irs Or Department Of Revenue Here S What You Need To Do Sacco Tax

What To Do When You Received A Certified Mail Slip From The Irs Youtube

What To Do When You Receive An Irs Audit Letter Atlanta Tax Lawyers

Irs Certified Mail 7 Reasons You Might Be Receiving These Letters

Certified Mail Return Receipts

Get A Certified Letter From The Irs What It Means Reliance Tax Group

Understanding Common Irs Collection Letters National War Tax Resistance Coordinating Committee

Https Www Irs Gov Pub Irs Wd 1119035 Pdf

Certified Mail Has You Covered During Tax Time Stamps Com Blog

:max_bytes(150000):strip_icc()/GettyImages-922112390-cdd0402129f545b59838705169233d6d.jpg)

Fake Irs Letters How To Identify Them And Protect Yourself

Reasons For Certified Mail From Irs Top 5 Ex Irs Tax Blog Tax Attorney Newport Beach Ca Orange County Dwl Tax Law Daniel Layton

Irs Cp2000 Notice What It Means What To Do

How And Why To Mail Federal Tax Returns By Certified Mail Certified Mail Labels

8 Reasons Why You Should Use Certified Mail Labels Certified Mail Labels

Beware Fake Irs Letters Are Making The Rounds This Summer

Certified Letter From Irs Why Irs Sent Certified Mail

Certified Mail Return Receipts

Post a Comment for "When Does Irs Send A Certified Letter"