Reimbursing Yourself For Business Expenses Quickbooks

Our users and the QuickBooks Desktop Mac team monitor this forum daily. Previously I talked about the accountable reimbursement plan as a way to reimburse yourself for business expenses bought with personal funds.

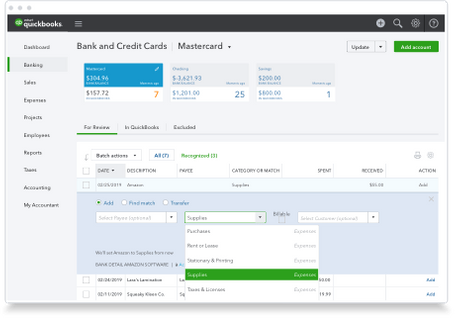

How To Create A Recurring Expense In Quickbooks Online Quickbooks Online Quickbooks Online Tutorials

I have some receipts entered into quickbooks that are expenses I paid for with a personal card before I had a business account setup.

Reimbursing yourself for business expenses quickbooks. Navigate to the Company tab and hit Make General Journal Entries. Id like to use the create expense feature to make a total of expenses and repay myself with one transaction. By Vickie Ayres How to decide to pay and reimburse yourself can be a difficult question especially when you first open your business.

If your Company Owes Me account has a positive number then your company owes you money. Yesterday Vickie Ayres The Countess of QuickBooks hosted our free monthly QuickBooks webinar and discussed the topic of how to pay and r. Business is Short on.

Almost all new businesses have to re-invest most of their profit back into the business. Write a business check for the money owed to yourself. When we pay business expenses out of our personal accounts I create a payable in quickbooks and actually pay it back.

Go to business then bills to pay. We help you get started with QuickBooks empower you to manage your bookkeeping and control your cash flow and provide technical support. Almost all new businesses have to re-invest most of their profit back into the business.

When you have expenses that you cover with your personal money simply fill out the form specifically the date what the expense was how much it was and then attach the receipt. The to section is yourself. Will you be reimbursing yourself for the expenses from your business accounts.

Then when it is time for you or your bookkeeper to do the books you can add this in as an expense and cut a check to reimburse you the money. Ive included the steps below to show you how. You can reimburse yourself in either of these two ways.

An accountable reimbursement plan is a method of reimbursing employees for business expenses paid with. The date is the date the purchase happened and the due date is when you will pay yourself back by. Paying Reimbursing Yourself in QuickBooks.

The easiest way to do this is to record the expense and then write a check to reimburse the money. We offer the following services to help do-it-yourself business owners manage their day-to-day operations using QuickBooks accounting software. If you fail to have your business reimburse you for these business expenses the only way you can take them as a tax deduction is to show them on your personal income tax return Form 1040 as Non-reimbursed Employee Business Expenses.

Paying and Reimbursing Yourself in QuickBooks. Thats followed by the self-employed health insurance deduction and the itemized deduction in that order. The other thing you need to account for is business expenses that you.

Record the business expense. By Vickie Ayres How to decide to pay and reimburse yourself can be a difficult question especially when you first open your business. Almost all new businesses have to re-invest most of their profit back into the business.

The easiest way to do this is to bill yourself. Enter your name in Pay to the Order of and the amount owed to you. In this article I delve more into the accountable reimbursement plan.

Never pay business expenses personally without reimbursing yourself or any other owners immediately. What is an accountable reimbursement plan. Article by Lori Yohe.

The other thing you need to account for is business expenses that you make with. Frequently business owners will pay for business expenses with personal funds. These expenses can be recorded in QuickBooks in one of several ways.

Deducting Medicare as a Business Expense. Spent a lot of it on materials and machines so I want to live off of the equity while the business checkingsavings grows to a comfortable amount. So if I pay a 300 utility bill with my personal card I would creat a general journal entry that is debit utility expense 300 and credit last.

Download the QuickBooks Desktop Mac 2021 Users Guide Post your question to our QuickBooks Desktop Mac community. Create a new bill. Paying Reimbursing Yourself in QuickBooks Yesterday Vickie Ayres The Countess of QuickBooks hosted our free monthly QuickBooks webinar and discussed the topic of how to pay and r.

Paying and Reimbursing Yourself in QuickBooks. How quickly the business will repay the expenses can determine the best way for the client to record the transactions. Im glad to assist you with reimbursing yourself for the expenses you paid for with personal funds.

How to decide to pay and reimburse yourself can be a difficult question especially when you first open your business. In the description put the expenses and where it was made eg Ikea purchase of new office bookcase. Paying and Reimbursing Yourself in QuickBooks.

Its always best to deduct Medicare premiums as a business expense if you qualify for it. The correct way to enter business expenses that you have paid for with your personal credit card debit card or cash in your companys QuickBooks will be based on whether you want to invest this money in your company or reimburse yourself for it as well as the type of business structure your company is setup as Sole proprietor Single. You can also search our Support Site for an article that may help you.

Chart Of Accounts Fixed Asset Accounting Restaurant Business Desktop Windows Amp Book. The business is making money but I am only cutting myself cash as Owners Equity Distribution I didnt get a loan to start the business just savings so everything started with my own money. QuickBooks Services Standard Custom Setup.

The other thing you need to account for is business expenses that you. Call our Customer Care team to talk to a specialist. The first the business deduction is the most financially advantageous.

How To Record Business Expenses Paid With Personal Funds In Quickbooks Youtube

Reimbursing Yourself For Business Expenses

Gbc Blog Quickbooks Tutorials App Reviews Business Tips Goshen Bookkeeping Co Quickbooks Tutorial Quickbooks Quickbooks Online

Track Expenses The Easy Way All In One Place Quickbooks Canada

How To Record Business Expenses Paid With Personal Funds In Quickbooks Youtube

How To Enter Personal Expenses Paying W Company Funds Quickbooks Online Tutorial Youtube

How Do I Reimburse Myself For Expenses Paid By Per

Solved Paid Business Expense With Personal Account

How To Create An Invoice In Quickbooks Online Quickbooks Online Quickbooks Create Invoice

Receipt Bank Quickbooks Online Best Practice Workflow Receipt Bank Presentation Creative Powerpoint Presentations Bookkeeping Software

Solved Pay For Business Expenses With Personal Funds On

How To Reimburse Expenses Incurred By The Company Owner Youtube

Hiring An Independent Contractor Tracking In Qbo Payroll Software Quickbooks Online Independent Contractor

Quickbooks Online Paying Business Expenses From Personal Accounts Youtube

Pay For Business Expenses With Personal Funds

Reimbursing Yourself For Business Expenses

Solved Paid Business Expense With Personal Account

Minutes Matter In The Loop Paying Amp Reimbursing Yourself In Quickbooks Chart Of Accounts Quickbooks Accounting

How To Record An Owner S Expense Reimbursement In Online Quickbooks

Post a Comment for "Reimbursing Yourself For Business Expenses Quickbooks"