Business Valuation Course Online Free

Free Course Equity to Enterprise Bridge Value Get a taste of The Valuer for free. This course is helpful for executives that need to value complete strategies and for all students interested in corporate finance and strategy.

For A Finance Student The Learning Curve Is Often A Steep One There Are Many Hurdles Along The Way In Order To Become A Successful Business Investor

Here you will learn the nuts and bolts of Corporate Valuation including DCF Modeling Relative Valuation Comparable Comps Financial Modeling and Valuations.

Business valuation course online free. Business Valuation Training 14 Courses 10 Projects This Business Valuation Course is a bundle of 14 courses with 70 hours of HD video tutorials and Lifetime Access. This course is an introduction to valuation and investing and aims to take the fear-factor out of stocks and shares by explaining the concepts behind valuing and investing in a clear and simple manner. Continuous Educational Programme CEP under clause e of sub-rule 2 of Rule 12 of the Companies Registered Valuers and Valuation Rules 2017 to be held on 27th May.

It will also delve into valuation approaches finance theory and practical applications to help managers understand key concepts that. Then Advanced Valuation and Strategy MA Private Equity and Venture Capital by Erasmus University Rotterdam is the right course for you. Next ON-LINE batch of the 50 Hours Educational Course under asset class Securities and Financial Asset by ICAI Registered Valuers Organisation from 27th May to 6th June 2021.

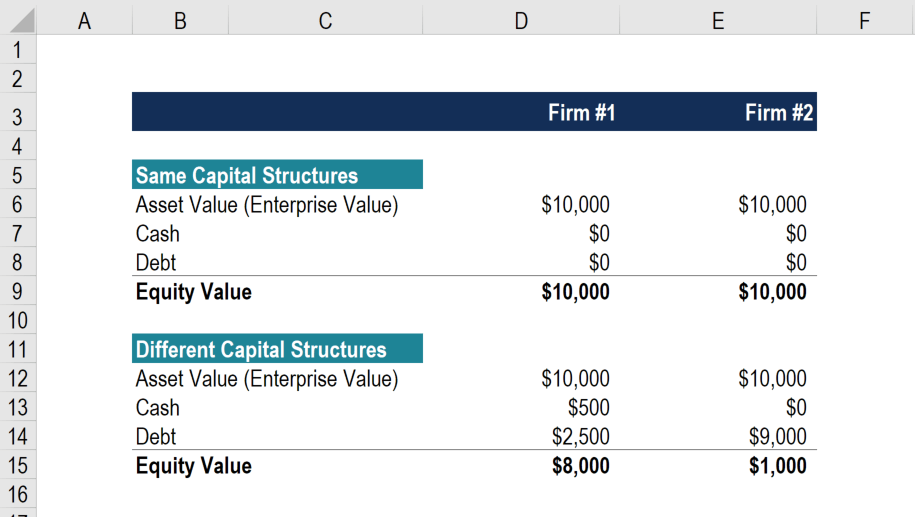

Erasmus University RotterdamFinance Quantitative Modeling for Analysts. Browse all free courses from CFI to advance your career as a world-class financial analyst. Sets up the foundations of intrinsic valuation with a contrast between valuing a business and valuing the equity in that business.

Understanding and applying the generally accepted business valuation methodologies and approaches and adhering to professional standards that govern the business valuation profession will put you in a stronger position to better. Build a DCF Valuation Model. This course will be of great interest to business and finance.

A Rawls College of Business student organization open to all RCOBA students interested in a career in Business Valuation Financial Statement Analysis or Investment Banking. Post-class test solution. Discover common multiples and the impact of leverage.

The Risk Free Rate. Learn how to build a Wall Street quality DCF valuation model. Freely browse and use OCW materials at your own pace.

The Business Valuation Certification and Training Center BVTC training teaches to the Core Body of Knowledge for the Certified Valuation Analyst CVA designation. Learn the differences between equity and enterprise value how theyre calculated and converted using the bridge. The Foundation has online and classroom versions of the real property USPAP Courses available for purchase.

Online Professional Certificate in Valuation. No enrollment or registration. Up to 15 cash back Top companies trust Udemy.

MIT Sloan shares a legacy of innovative thinking and collaboration with MIT and this relationship - unique among business schools - is one that provides tremendous opportunity for. Try Udemy for Business. Learn about the main drivers of free cash flow to the firm and business valuation in this course.

Explore materials for this course in the pages linked along the left. Get your team access to Udemys top 5500 courses. The MIT Sloan School of Management is a world-class business school long renowned for thought leadership and the ability to successfully partner theory and practice.

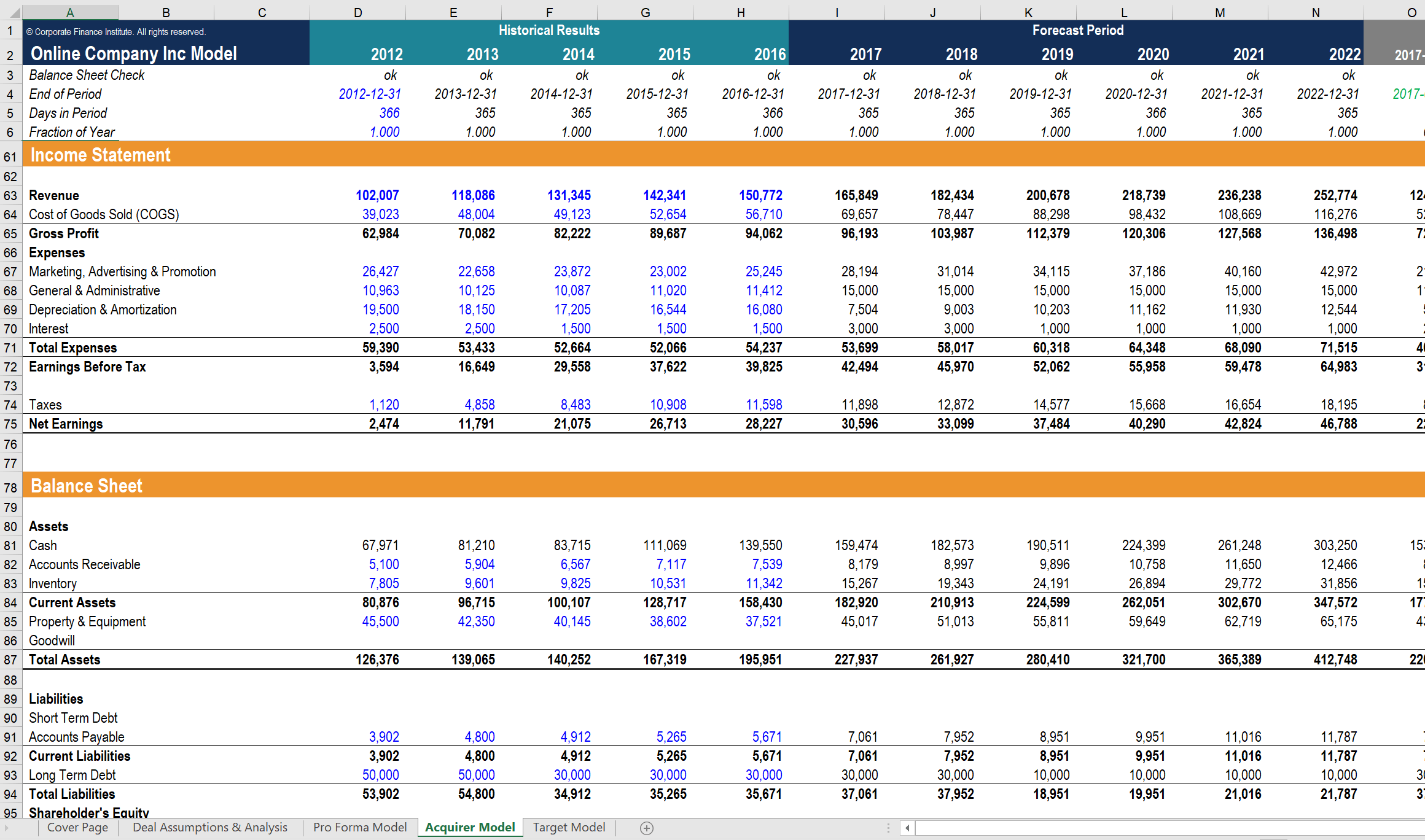

Explore the role of valuation in using concepts and principles from Corporate Finance Mergers and Acquisitions Business Valuation Financial Statement Analysis. With alumni excelling in careers all around the United States pursuing continued professional education through certifications offered through the American Society of. ROE Price-to-Earnings ratio depreciation amortization and many others.

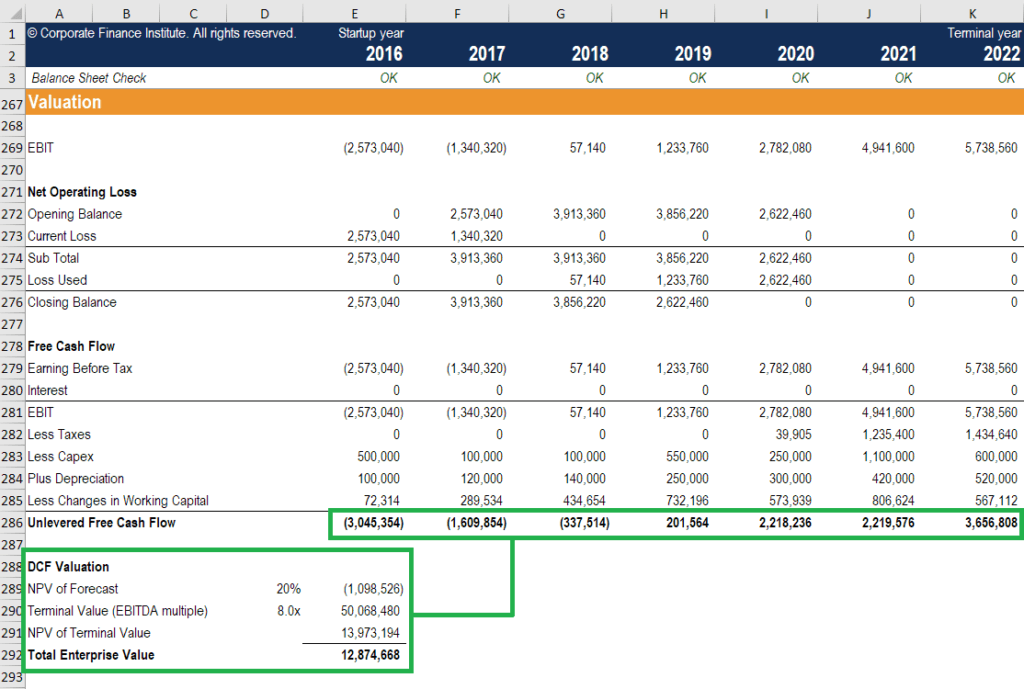

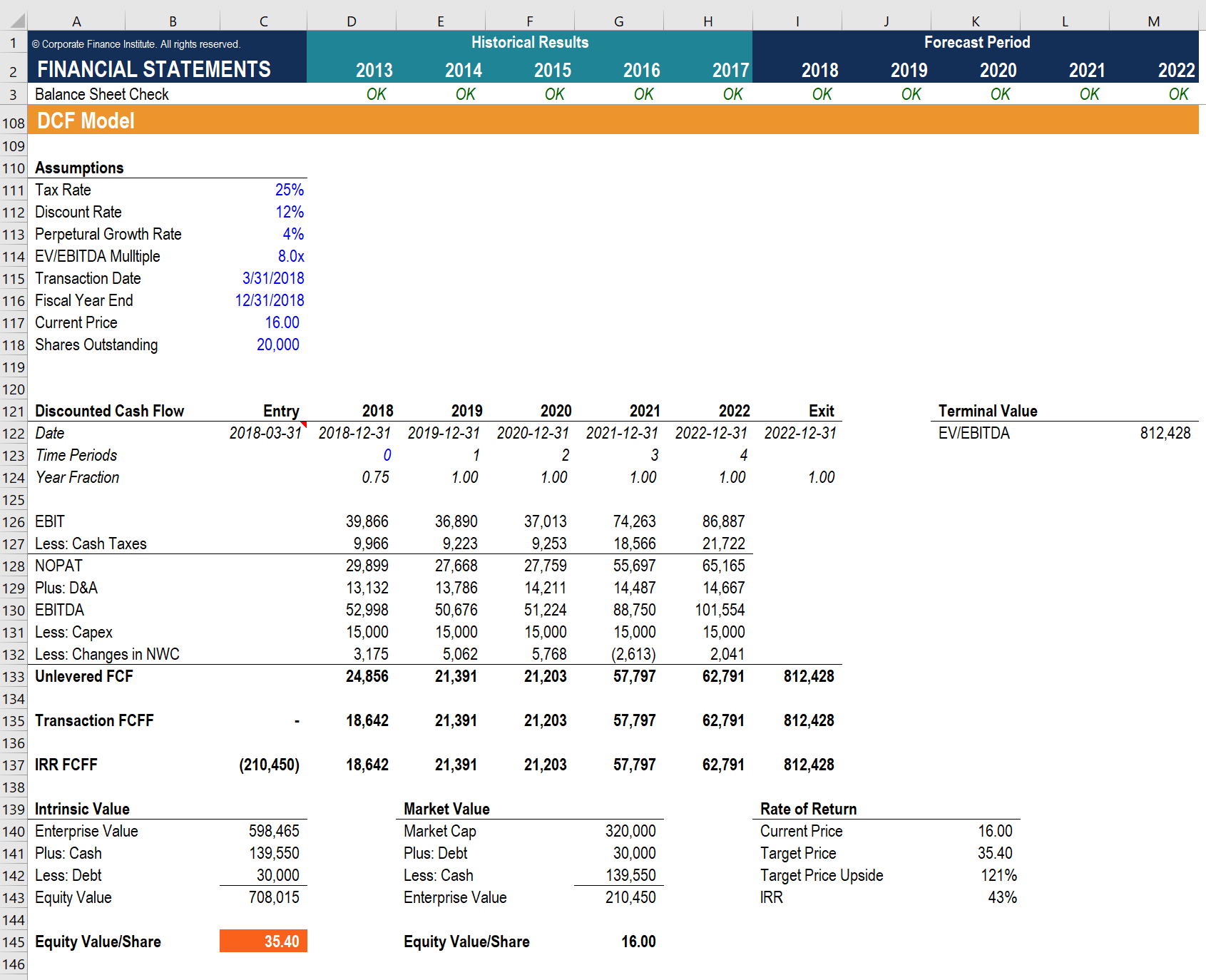

For a more personalized and in depth business valuation we provide a free business evaluation and consultation for local business owners who are thinking about selling their business. Discounted Cash Flow DCF Modeling In this corporate valuation course you will learn to build a DCF model from scratch building on the skills you developed from CFIs prior courses on building a 3 statement model. Includes a complete DCF.

Students will receive a solid grounding in Valuation. Learn How to Sell your Business How to Buy a Business How to Value a Business How to Choose a Business Broker Exit Strategy The Business Sellers Guide. 30 rows Course Description.

The Foundation and McKissock a leading developer of online education have partnered again to develop online versions of the real property version of the current 15-Hour National USPAP Course and 7-Hour National USPAP Update Course. From accounting to finance CFI has a wide range of free courses to help you start your career in corporate finance or move up the ladder in your field. In summary here are 10 of our most popular valuation courses.

This Valuation online course is designed for students and professionals who want to master their valuation skills. Sets up the requirements for a rate to be risk free and the estimation challenges in estimating that rate in different currencies. University of PennsylvaniaDiscounted Cash Flow.

This is one of over 2400 courses on OCW. Advanced Valuation and Strategy - MA Private Equity and Venture Capital. MIT OpenCourseWare is a free open publication of material from thousands of MIT courses covering the entire MIT curriculum.

Valuation is a key tool in almost every aspect of finance - corporate. Determine the Cash Flow of the business. See business valuation tool instructions for an explanation of the factors involved in the calculation.

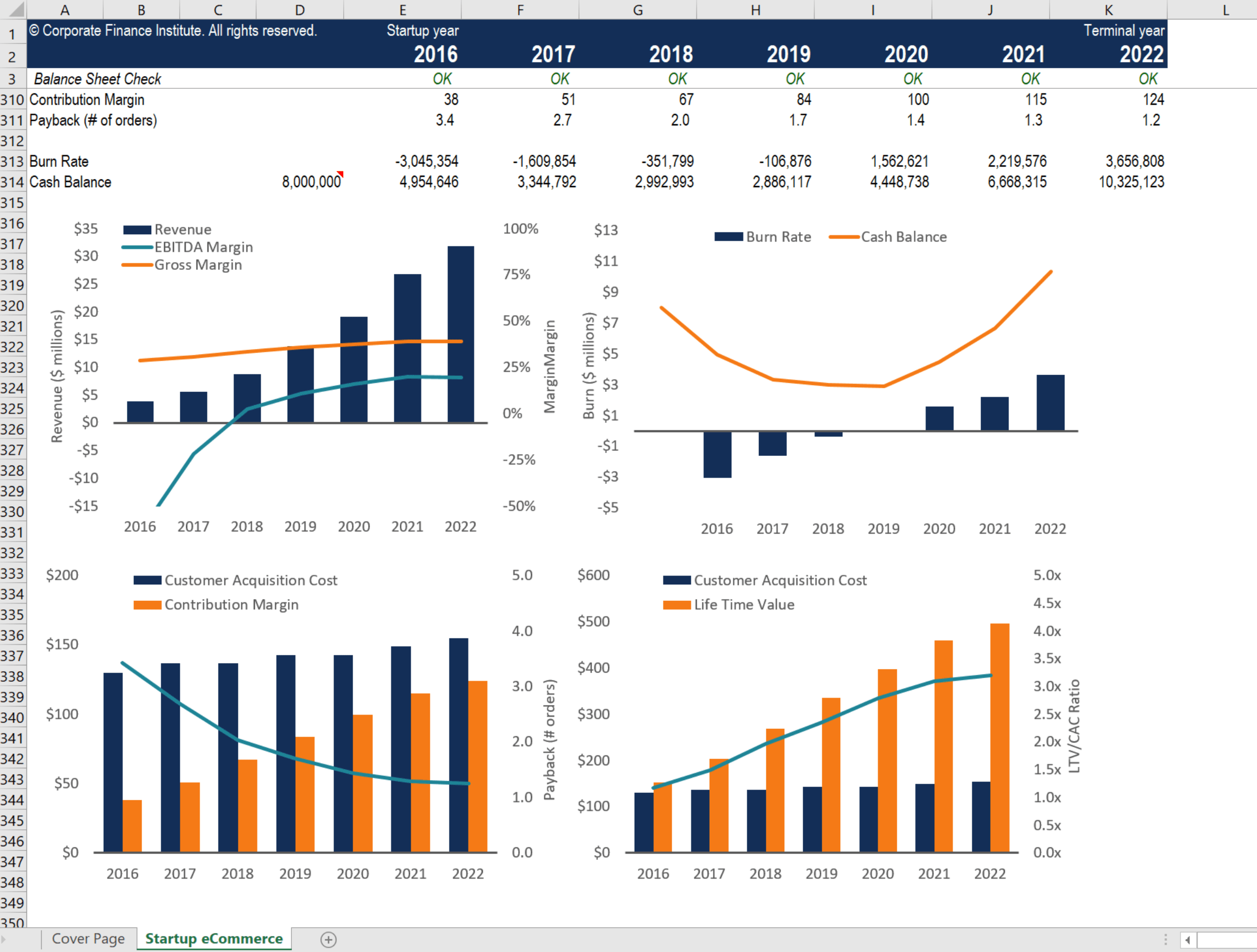

Forecast Free Cash Flow And Corporate Business Valuation Business Valuation Business Online Learning

Startup Valuation Metrics 17 Most Important Internet Metrics To Know

Dcf Model Training The Ultimate Free Guide To Dcf Models

Fcf Formula Formula For Free Cash Flow Examples And Guide

Enterprise Value Vs Equity Value Complete Guide And Examples

Stock Valuation With Comparable Companies Analysis

Valuation Modeling In Excel Learn The 3 Most Common Methods

Where Is Enterprise Value Used Enterprise Value Financial Modeling Business Valuation

Valuation And Financial Analysis For Startups Coursera

Pin By Greyhatmafia On Free Courses Wso Download Business Method Business Valuation Free Online Courses

Fmva Financial Modeling And Valuation Analyst Cfi

Business Valuation Calculating The Value Of A Company Video Lesson Transcript Study Com

Valuation Principles List Of Most Important Valuation Concepts

15 Best Financial Modeling Courses Classes Online 2021

Valuation Modeling In Excel Learn The 3 Most Common Methods

Dcf Model The Complete Guide To Building A Discounted Cash Flow Model

Startup Valuation Methods Coursera

Post a Comment for "Business Valuation Course Online Free"