Business Use Of Home Taxslayer

To claim expenses for business use of the home part of your home must be used regularly and exclusively as. 93 of TaxSlayer Pro respondents reported that they continue to use TaxSlayer Pro software after switching.

How To Input Schedule C For A Client S Tax Return Youtube

Or The space is regularly used as a storage facility or a day care center.

Business use of home taxslayer. Youll also need to fill out a Form 8829 Expenses for Business Use of Your Home. Your primary place of business on a regular basis. TaxSlayer Editorial Team May 11 2020 If your client is self-employed and uses part of their home for business purposes they may be eligible for a tax write-off on their federal income tax return.

Whether you are self-employed or an employee if you use a portion of your home for an office or business related activities you may be able to deduct the. Beginning with the 2018 tax year the business use of home deduction can be claimed within the Schedule C. This tax break also referred to as the home office deduction can be calculated using the standard method or the simplified method.

With TaxSlayer Pro customers generally wait an average of less than 60 seconds for in season support and enjoy the experience of using software built by tax preparers. Beginning in tax year 2018 with the implementation of the the Tax Cuts and Jobs Act the Business Use of Home Form can be used with your Schedule C business. Business Returns - Form 1120-H Homeowners Associations.

Subtract the business expenses not related to the use of the home from the gross income related to the business use of the home. Blog All the latest tax tips and news. The part of the home used exclusively for business is the primary place of business or The taxpayer meets with clients patients or customers there for business purposes.

Can you deduct the home officebusiness use of your home. What is the difference between Direct Expenses and Indirect Expenses. TaxSlayer Support What can we help you with today.

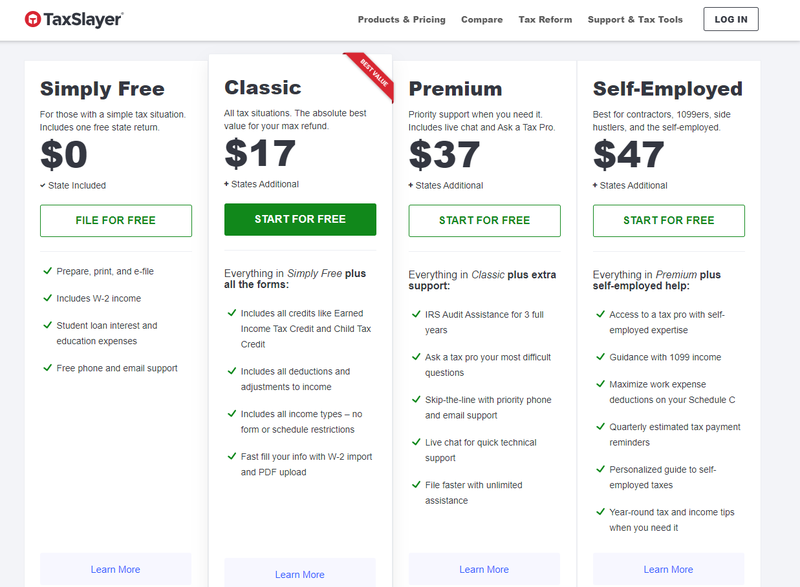

The taxslayer pro story TaxSlayer Pro makes tax filing simpler and less stressful for millions of Americans with exceptional easy-to-use technology. Start filing for 0 today. 300 square feet of the area used for business.

An authorized IRS e-file provider the company has been building tax software since 1989. The IRS understands this so they have special rules for deducting the business use of your home. Business Use of Your Home - What expenses can be deducted.

When you file your taxes with TaxSlayer youll be guided through the entire process. But there are a few inconveniences to be aware of. Line 34 is the total other than casualty losses allowable as a deduction for business use of your home.

1 TaxSlayer Pro through SurveyMonkey surveyed 757 users of TaxSlayer Pro online tax preparation software 4119 through 41719. Your business use must be for the convenience of your EMPLOYER You must not rent any part of your home to your employer. The Business Use of Home form in the Itemized Deductions section of the program is for state use only and will not be carried to the itemized deductions section of the federal return.

You can claim expenses related to the Business Use of Home if you use part of your home as. Can I take the home office deduction in addition to SALT. An authorized IRS e-file provider the company has been building tax software since 1989.

Getting Started The basics of filing your tax return online Get Started. If you file Schedule F Form 1040 enter this amount on line 32 Other expenses of Schedule F Form 1040 and enter Business Use of Home on the line beside the entry. As previously mentioned you must file a Schedule C on Form 1040 to be eligible for the home office deduction.

TaxSlayer is a top value pick for self-employed filers and a good budget option for anyone else. However for tax years prior to 2018 if you use a part of your home for business you may qualify for a deduction if you meet one of the above tests AND both of the following. TaxSlayer Pro does not support use of Form 8829 for a Qualified Joint Venture.

However it can no longer be claimed as an itemized deduction on your Schedule A. Business and Farm. Business Use of Home When do I qualify to take a deduction for the business use of my home.

Take a standard deduction of 5 per square foot max. 2 When clients receive their money in advance the funds are issued as a loan secured by and paid back with the clients own tax refund. When May I Deduct the Business Use of Home.

TaxSlayer Editorial Team August 28 2020 When you run an in-home daycare facility youre probably going to use the same areas for business and non-business activities.

What Do The Expense Entries On The Schedule C Mean Support

Taxslayer Review 2021 Features Pricing More The Blueprint

Do I Have A Business Or A Hobby The Official Blog Of Taxslayer Moving Moving House Moving Tips

The History Of Taxes In America Income Tax Taxslayer Us Tax

Taxslayer Login Free Tax Filing Taxslayer Filing Taxes

Installing The Business Program Support

Taxslayer Review 2020 Is It The Right Tax Software For You Club Thrifty In 2020 Tax Software Best Tax Software Taxslayer

Taxslayer Has Been Designed With Taking On Everything Your Tax Situation Has To Throw At You And It Has Been Nicely In 2020 Tax Software Online Taxes Best Tax Software

Blogger Tax Prep Tips Simply Clarke Tax Prep Business Blog Mom Encouragement

Survey Americans Reveal Biggest Tax Stressors

R Estimate Your 2016 Tax Refund Using Your Paycheck Prepare Yourself Use The Taxslayer Refund Calculator To Quickly Est Taxslayer Tax Refund Calculator App

Tax Tips 5 Things Newlyweds Should Do Newlyweds Taxslayer Married

Taxslayer Review 2021 Pros Cons Who Should Use It

Www Taxslayer Com Myaccount Register Aspx Utm Medium Social Utm Source Fb Utm Campaign Soc Soc Cpc Fb Dato Directtoform St Accounting Create Account Income Tax

Use Taxslayer To File Your Taxes In 2021 Filing Taxes Tax Refund Tax Prep

Everything You Need To Know About The Home Office Tax Deduction In 2021 The Official Blog Of Taxslayer

Tax Prep Checklist For The Small Business Owner The Official Blog Of Taxslayer

How To Get A Maximum Tax Refund In 2021 Tax Refund Filing Taxes Getting Things Done

Post a Comment for "Business Use Of Home Taxslayer"